Transaction Volume Down 45% from January to May

Purchases by Non-Local Residents Rise

Seoul Yongsan-gu Highest at 39.3%

Concerns Over Regional Concentration in Second Half

[Asia Economy Reporter Hwang Seoyul] While the volume of housing market transactions has decreased this year, the proportion of transactions by non-local buyers in the first half of the year has increased. Furthermore, it is expected that in the second half of the year, as the market contraction intensifies due to interest rate hikes, regional differences in the proportion of non-local buyers will become more pronounced.

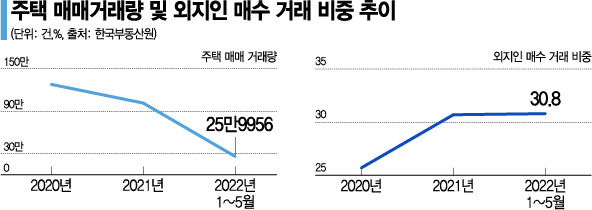

According to an analysis by KB Management Research Institute of the Korea Real Estate Agency’s ‘Housing Transaction Status by Buyer Residence,’ the volume of housing transactions from January to May this year (259,956 cases) decreased by about 45% compared to the same period last year (470,401 cases), but the proportion of non-local transactions slightly rose to 30.8% from the previous year. The proportion of non-local transactions has steadily increased, surpassing 30% in 2021 after 25.7% in 2020.

By region, among the Seoul metropolitan area, the proportion of non-local buyers steadily increased in Seoul and Incheon. The proportion of non-local buyers purchasing homes in Seoul rose from 15.9% in 2013 to 27.1% in 2021, and further increased to 29.6% in January-May this year. Notably, the district with the highest proportion of non-local transactions up to May this year was Yongsan-gu (39.3%). In 2019, Gyeonggi (25.8%) and Incheon (28.0%) recorded similar levels, but since then, Incheon’s increase has been significant, exceeding 40% last year and reaching 43.2% this year, the highest nationwide.

Among the five major metropolitan cities, all except Gwangju and Busan continued to show an increasing trend this year. Other provinces showed high volatility in the Gangwon region, with mixed rises and falls depending on the area, showing differences in direction.

KB Management Research Institute analyzed that the proportion of non-local transactions acts as one of the factors influencing housing price fluctuations. In fact, last year, when the nationwide housing price change rate soared to 15%, the proportion of non-local transactions increased by 4.7 percentage points. Especially in Incheon, where the housing price increase rate last year was a record high of 23.8%, the proportion of non-local transactions, which had been below 30% until just before, exceeded 40% during the same period.

It is expected that the proportion of non-local buyers in the second half of the year will show regional disparities despite an overall downward trend. Until last year, the proportion of non-local transactions increased in most regions nationwide, but recently, decreases have been observed in Gyeonggi, Busan, Gwangju, Gangwon, Chungnam, Gyeongbuk, and Gyeongnam. Due to market contraction caused by loan and tax regulations and interest rate hikes, the proportion of non-local transactions may further decrease.

Nevertheless, concerns have been raised about the possibility of concentration in specific regions. Jung Jonghoon, a researcher at the Real Estate Research Team of KB Management Research Institute, said, “Investors are hesitant to invest in other regions when housing prices are not rising,” adding, “Despite the overall decline, there is a possibility that non-local investment demand will concentrate in regions with specific issues.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)