Under Aronamin's Solo Dominance

GC Green Cross Bimax's Fierce Pursuit

Daewoong Impactamin Forms a Triumvirate

Yuhan Yanghaeng and Chongkundang Also Show Growth

[Asia Economy Reporter Lee Gwan-joo] Amid growing interest in health management due to the COVID-19 pandemic, the domestic comprehensive vitamin market has entered a period of intense competition. As it became known that vitamin intake helps in various ways such as revitalization and immune system enhancement, vitamins have become household essentials, intensifying market competition. Currently, the domestic vitamin market is dominated by three major players: Ildong Pharmaceutical, GC Green Cross, and Daewoong Pharmaceutical, followed by Yuhan Corporation and Chong Kun Dang. New product launches are actively continuing among the leading vitamin brands of these traditional pharmaceutical giants.

No. 1 ‘Aronamin’ Stalls, Bimax Chases

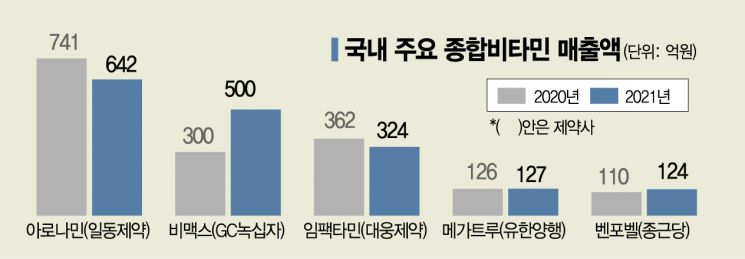

The top comprehensive vitamin product in Korea is Ildong Pharmaceutical’s Aronamin series. First launched in 1963, Aronamin has been synonymous with comprehensive vitamins for nearly 60 years. However, it has recently experienced some fluctuations. According to business reports, Aronamin’s sales last year totaled 64.2 billion KRW, maintaining its domestic No. 1 position, but this is about 10 billion KRW less than the 74.1 billion KRW recorded in 2020. Sales in the first quarter of this year were 14.2 billion KRW, down from 15.8 billion KRW in the same period last year. Despite this, industry experts say Aronamin’s brand power remains strong. Earlier in March, it ranked first for nine consecutive years in the comprehensive nutritional supplement category in the ‘2022 Korea Industry Brand Power’ survey conducted by the Korea Management Association Consulting (KMAC).

While Aronamin’s sales have stalled, GC Green Cross’s Bimax series has started to surge. Bimax’s sales exceeded 50 billion KRW last year, closing in on Aronamin. Since first reaching 10 billion KRW in sales in 2017, it has grown rapidly by about 50% annually. Its unique advertisements featuring famous celebrities have generated strong word-of-mouth and high marketing effectiveness. The Bimax series consists of seven products in total. The flagship product driving high growth is ‘Bimax Metavi,’ which combines activated vitamin B complex, over ten essential vitamins, and various minerals. ‘Bimax Metavi’ increases the content of ‘Bisbentiamine,’ which crosses the blood-brain barrier, enhancing brain energy metabolism activation. A GC Green Cross official explained, "Bimax’s excellent product quality and customized product lineup tailored by generation and gender are driving growth."

Daewoong Pharmaceutical’s Impactamin recorded sales of 32.4 billion KRW last year, falling to third place amid Bimax’s rapid growth, but it still holds a leading position in the comprehensive vitamin market. Sales in the first quarter of this year were 7.2 billion KRW, slightly down from 7.8 billion KRW in the same period last year. The Impactamin series emphasizes its inclusion of eight essential vitamin B types and high dosage as its strengths.

Daewoong Pharmaceutical Impactamin.

Daewoong Pharmaceutical Impactamin.

Yuhan Corporation and Chong Kun Dang Also Achieve 10 Billion KRW Sales

Yuhan Corporation and Chong Kun Dang also show formidable strength. Yuhan Corporation targets the comprehensive vitamin market with its 60-year-old brand Picom-C and Megatru. Megatru’s sales last year were 12.7 billion KRW, maintaining a level similar to the previous year’s 12.6 billion KRW. Sales in the first quarter of this year were 2.8 billion KRW, slightly down from 3.2 billion KRW in the same period last year. Picom-C is also regarded as a beloved long-standing brand with a solid customer base. Chong Kun Dang’s Benfobel growth is also noteworthy. Benfobel’s sales were 5.8 billion KRW in 2018 and surged to 11.7 billion KRW in 2019. Although sales decreased to 11 billion KRW in 2020 when the COVID-19 pandemic began, they rose again to 12.4 billion KRW last year.

Amid fierce competition, new product launches continue, heating up the vitamin market further. Kwangdong Pharmaceutical recently launched the activated vitamin ‘Mybejet Tablets’ and began full-scale market penetration. Mybejet contains 17 ingredients, including activated vitamin B complex, selenium, calcium, and magnesium. A Kwangdong Pharmaceutical official introduced, "We reduced the pill size to improve ease of intake."

Pharmaceutical industry interest in the vitamin market is expected to continue for the time being. An industry insider said, "Efforts to differentiate through antioxidant ingredients and immune-boosting components continue amid fierce competition," adding, "From the consumer’s perspective, as choices increase, they will be able to select products that best suit their needs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)