Downward Rigidity in Inflation May Keep Prices High Despite Stabilized Commodity Prices and Exchange Rates

[Asia Economy Reporter Park Sun-mi] It is forecasted that the expansion of the trade deficit caused by fluctuations in raw material prices and the rise in the won-dollar exchange rate, as well as the slowdown in economic growth, will gradually stabilize by early next year.

According to the report titled "Factors Affecting International Raw Material Prices and Won Exchange Rates and Their Impact on the Korean Economy," released on the 15th by the Korea International Trade Association's International Trade and Commerce Research Institute, international energy raw material prices and grain prices have risen significantly compared to last year.

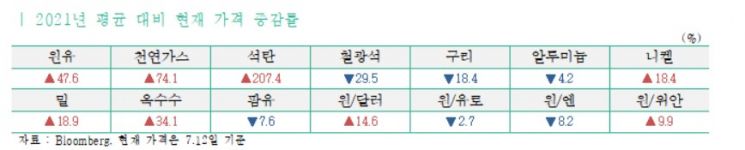

Based on the 2021 average price, as of July 12, crude oil has increased by 47.6%, natural gas by 74.1%, and coal by 207.4%. Prices of wheat (18.9%) and corn (34.1%) surged sharply following the outbreak of the Russia-Ukraine war at the beginning of the year and have since stabilized but remain high. Recently, the won-dollar exchange rate surpassed the 1,300 won level for the first time since the 2008 financial crisis and is currently trading at 1,312.4 won, a 14.6% increase compared to the 2021 average.

The International Trade and Commerce Research Institute analyzed the impact of raw material price and exchange rate fluctuations on exports and imports, finding that a 10% increase results in only a 0.03% rise in exports (by value), whereas imports increase by 3.6%. This indicates that the import increase effect outweighs the export increase effect caused by rising raw material prices and exchange rates, suggesting that the trade deficit will persist for the time being.

Regarding production costs, considering this year's rise in raw material prices and exchange rates, it is estimated that the average production cost across all industries increased by 8.8% compared to 2021. The report explains, "Although prices of metals such as iron ore and copper slightly declined compared to the previous year, the rise in international energy prices and exchange rates drove the increase in production costs." By sector, the manufacturing industry's production cost increase (11.4%) was more than twice that of the service industry (4.4%).

Meanwhile, it was found that it takes about five months for fluctuations in raw material prices and exchange rates to be reflected in the final goods production costs. The impact of shocks from rising raw material prices and exchange rates on the economic growth rate is greatest immediately after the shock, then fluctuates and mostly dissipates after about ten months.

Researcher Do Won-bin of the Trade Association stated, "The trade deficit and economic growth slowdown caused by the concentrated rise in raw material prices and exchange rates during March and April this year are expected to ease from early next year due to improvements in external conditions." However, he added, "Although raw material prices have recently shown some stabilization amid concerns about a global economic recession, inflation fundamentally exhibits strong downward rigidity and is likely to remain at a high level in the medium to long term, so government-level inflation management is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.