[Asia Economy Reporter Song Seung-seop] Banks are extending the benefits and sales period of interest rate cap-type mortgage loans. This is due to growing concerns over increased interest burdens on borrowers with variable-rate mortgage loans amid rising base interest rates.

According to the Financial Supervisory Service on the 14th, 11 domestic banks have decided to extend the sales period of interest rate cap-type mortgage loan products once again. Initially, banks planned to sell these products only until the 15th.

The interest rate cap-type mortgage loan is a product where the increase in loan interest rates is limited for a certain period. Even if market interest rates rise significantly, the interest rate applied to subscribers at the time of rate renewal is capped at a certain level. Borrowers currently using variable-rate mortgage loans or those applying for new loans can subscribe. Existing borrowers can add a special agreement to their current loan at the bank (no separate screening required). However, borrowers of jeonse deposit loans or group loans are excluded.

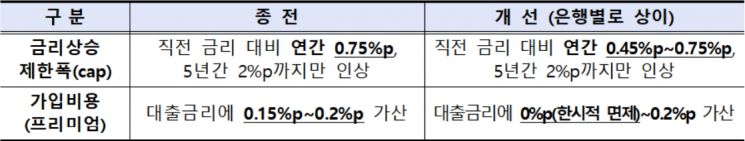

This time, considering the recent rapid rise in interest rates, conditions have been improved so that more borrowers can benefit from the subscription. This includes lowering the cap on interest rate increases or reducing or waiving the subscription fees borne by customers. Previously, the annual increase was limited to 0.75 percentage points compared to the previous rate (up to 2 percentage points over 5 years), but some banks now offer products limiting the increase to as low as 0.45 percentage points. Subscription fees, which were previously added at 0.15 to 0.20 percentage points, have been reduced to between 0 (temporarily waived) and 0.2 percentage points.

The banking sector plans to complete preparations such as changes to computer systems promptly to ensure smooth handling of the improved interest rate cap-type mortgage loans and implement them as soon as possible. Some banks are expected to implement immediately, while the rest plan to complete preparations by the end of July.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)