The domestic base interest rate was raised by 0.50 percentage points in a single move, known as a ‘big step,’ signaling a shockwave to the housing market. In particular, concerns about stagnation are growing again in the commercial and office markets, which seemed to be recovering after the easing of COVID-19 social distancing measures. However, compared to the housing market, regulations are less stringent, and rent increases can be expected due to the interest rate hike, so the prevailing outlook is that polarization will intensify rather than an overall market contraction.

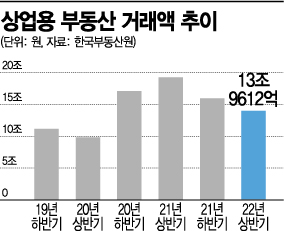

According to the Ministry of Land, Infrastructure and Transport’s real transaction price disclosure system on the 14th, the number of commercial and office real estate sales transactions in the first half of this year (January to June) was 7,420, down about 25% from the same period last year (9,835 transactions). The volume of transactions has steadily decreased in conjunction with the interest rate hikes that began in the second half of last year. As further interest rate hikes are expected within the year, the trend of transaction contraction is becoming a foregone conclusion for the time being.

Basically, the commercial market must cover loan interest and taxes with monthly rent income, so when interest costs increase due to high interest rates, profitability inevitably declines. According to the Korea Real Estate Board, the quarterly investment yield of office buildings (offices with six or more floors) in Gangnam-gu, Seoul, fell from 2.38% in Q4 2021 to 2.18% in Q1 this year. The quarterly investment yield of office buildings in central Seoul areas such as Gwanghwamun and Myeongdong also dropped from 1.85% in Q4 last year to 1.72% in Q1 this year. Kim Hyo-seon, Senior Real Estate Advisor at NH Nonghyup Bank, predicted, "As interest rate hikes lower the rental yields of commercial real estate, the burden on owners with high loan ratios will increase, and transactions are likely to decrease."

However, despite the decline in yields and concerns about economic activity stagnation due to the interest rate hikes, there is also an expectation that demand for prime locations will continue. Just as the housing market during interest rate hikes moves toward a ‘smart one-house’ and ‘polarization’ trend, a similar phenomenon is expected in commercial properties. In fact, although transaction volumes have decreased, real estate values are actually rising. The price per 3.3㎡ of office and commercial facilities in Gangnam-gu surpassed 100 million KRW for the first time in 2020, recording 114.27 million KRW. It rose to 146.86 million KRW last year and has continued upward to 161.07 million KRW as of June this year. As of Q1 this year, vacancy rates for large offices in downtown Seoul, Gangnam, Yeouido, and Mapo areas are approximately 9.4%, 6.4%, and 5.3%, respectively. Considering that the natural vacancy rate is 5%, it is difficult to find vacancies in major business districts.

Ko Jun-seok, CEO of J-Edu Investment Advisory, said, "It is true that the commercial market relies more heavily on loans compared to the housing market," but added, "The possibility of overall market contraction or long-term stagnation is low." He explained, "From an investor’s perspective, when interest rates rise, rents can also be raised to offset the interest burden," and predicted, "Especially since the commercial market is less regulated than housing, investment demand will remain centered on prime locations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.