Successful Evaluation of Future Food Market Expansion in the Electric Vehicle Business Sector

[Asia Economy Reporter Park Sun-mi] Samsung Electronics and LG Electronics are showcasing consecutive contract wins in the automotive electronics (electric and electronic equipment for vehicles) sector. It is being evaluated that they are successfully expanding their presence into the advanced automotive field, a future growth engine, without entering the complete vehicle market.

According to the industry on the 12th, Harman, an automotive electronics company acquired by Samsung Electronics in 2017, is set to supply 5th generation (5G) telematics equipment to Japan's Toyota for the first time. Although the main contract has not yet been finalized, it is expected to proceed at a scale of approximately 100 billion KRW. Harman's 5G telematics had already secured a supply contract for BMW electric vehicles last year, and this marks its first order from Toyota.

Harman provides innovative connected car (smart cars connected to communication networks) solutions to automakers, possessing technologies such as digital cockpit platforms, advanced driver assistance systems (ADAS), cybersecurity, and telematics. In particular, telematics equipped with 5G technology offers real-time information to drivers, including advance warnings of accidents ahead, making it a core technology for autonomous vehicles.

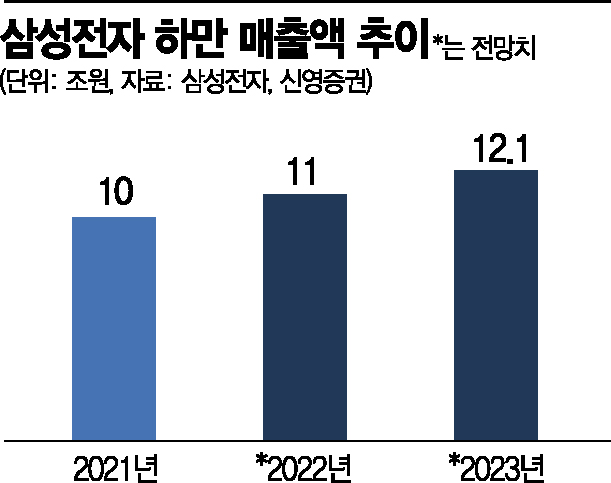

In the first year after Samsung Electronics acquired Harman in 2017, its sales and operating profit were only 7.1 trillion KRW and 57.4 billion KRW, respectively. However, last year, sales reached 10 trillion KRW, and operating profit surpassed 500 billion KRW for the first time. The securities market expects that if the current growth rate continues, Harman's sales will reach 11 to 12 trillion KRW this year and next. The operating profit margin, which was around 3.8% in the first quarter of this year, is also expected to rise to about 8% by the end of the year, making it possible to achieve an annual operating profit margin in the high 5% to low 6% range this year.

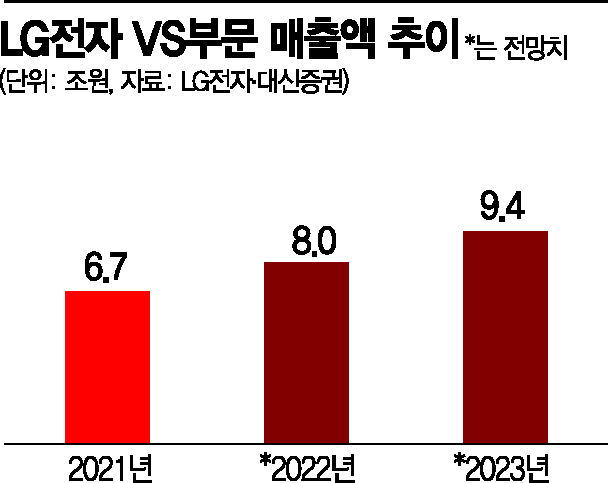

In the case of LG Electronics, its automotive electronics business turned profitable in the second quarter of this year, nine years after entering the sector, raising expectations for future growth. The VS Business Division, which includes the automotive electronics business, saw smoother-than-expected supply to customers due to eased vehicle semiconductor supply constraints, with second-quarter sales estimated to be around 2 trillion KRW, the highest quarterly performance.

Notably, LG Electronics secured new projects worth 8 trillion KRW in the automotive electronics sector in the first half of this year. It is widely expected that the total order backlog will exceed a record high of 65 trillion KRW by the end of the year. LG Electronics' automotive electronics business is composed of three main pillars: the vehicle infotainment system of the VS Business Division, the vehicle lighting system of its subsidiary ZKW, and the electric vehicle powertrain of the joint venture LG Magna e-Powertrain. Recently, these businesses have been showing balanced growth.

While global IT companies are continuously announcing their entry into the electric vehicle and autonomous vehicle markets, Samsung Electronics and LG Electronics are focusing solely on the automotive electronics business and have ruled out the possibility of entering the complete vehicle market. An industry insider explained, "The dominant analysis is that there is no need to take the risk of competing with existing customers by entering the complete vehicle market at a time when results are already emerging in the automotive electronics business by leveraging advanced IT technology."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.