<13il Geumtongwi 'Mulga Useon' Tonghwajeongchaek Jeonmang>

[Asia Economy Reporter Seo So-jung] As the Bank of Korea's Monetary Policy Committee meeting to decide the base interest rate approaches on the 13th, expectations for a big step (0.50 percentage point hike) are spreading. This is because the consumer price inflation rate, which surged to the 6% range, is likely to continue in the second half of the year, and if the interest rate inversion between Korea and the U.S. intensifies due to the U.S.'s consecutive giant steps (0.75 percentage point hikes) this month, capital outflows cannot be prevented. If the Bank of Korea takes a big step at the July Monetary Policy Committee meeting as expected, it will be the first-ever big step and will set a record for 'three consecutive rate hikes.'

According to the financial industry on the 10th, expectations that the Bank of Korea's Monetary Policy Committee will take a big step on the 13th are gradually spreading. The committee raised the base interest rate by 0.25 percentage points each in April and May, bringing it to 1.75%. If it raises the rate by an additional 0.50 percentage points this month, it will be the first time for three consecutive hikes, and the base interest rate will reach 2.25%.

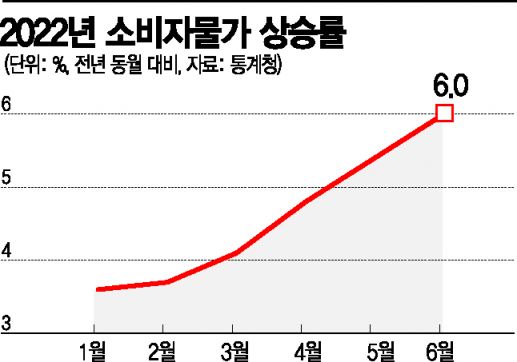

The pace of interest rate hikes has become steeper than expected due to worsening inflationary pressures. The consumer price index in June rose 6.0% compared to the same month last year, influenced by rising international raw material and grain prices. This is the highest increase in 23 years and 7 months since November 1998 (6.8%) during the Asian financial crisis. The consumer price inflation rate was in the 3% range from October last year to February this year, then rose to the 4% range in March and April, jumped to the 5% range in May, and surged to the 6% range in June. This year, prices have risen by 0.6?0.7% month-on-month; assuming a 0.7% monthly increase continues throughout the year, the annualized inflation rate would reach 8.2%.

The problem is that this upward trend has not yet peaked. Livestock product prices continue to rise in double digits, and even agricultural products, which had shown relatively stable trends, have turned upward after five months, pushing up food prices. This month, electricity and gas rates have also been further increased, affecting inflation. Eo Un-seon, a senior official at Statistics Korea, said that inflation could rise to 7?8%, adding, "If the current high rate of increase is maintained, we cannot rule out that possibility."

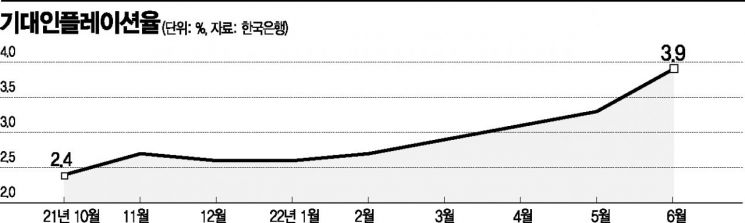

Economic agents' inflation expectations are also growing. The expected inflation rate (general public) for the next year rose from 3.3% last month to 3.9%. The 0.6 percentage point increase is the largest since related statistics began in 2008.

Kim Jeong-sik, Emeritus Professor of Economics at Yonsei University, said, "Inflation causes wage increases, which in turn raise inflation again, creating a wage-inflation vicious cycle that the economy falls into," emphasizing, "To prevent the economy from falling into this vicious cycle and stabilize prices, it is important to lower inflation expectations through interest rate hikes." Kim Sang-bong, Professor of Economics at Hansung University, noted, "If owner-occupied housing costs, which are not reflected in Korea's statistics, are included, Korea's inflation rate approaches the 8% range seen in the U.S.," adding, "Normalizing the real estate asset price surge, which was the starting point of inflation, is a priority."

However, amid growing concerns about an economic recession and increased interest burdens due to rapid rate hikes, some view that the Monetary Policy Committee will be cautious about taking a big step. Park Jung-woo, economist at Nomura Securities, said, "Korea's recession will begin in the third quarter of this year and continue with three consecutive quarters of negative growth until the first quarter of next year," predicting, "Instead of a big step, the Bank of Korea will raise rates by 0.25 percentage points in July and August."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.