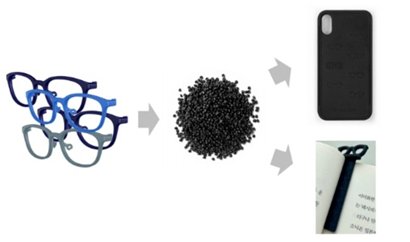

An example of the 3D custom glasses startup Brizm creating other products from the waste left after making glasses.

An example of the 3D custom glasses startup Brizm creating other products from the waste left after making glasses.

[Asia Economy Reporter Donghyun Choi] As ESG (Environmental, Social, and Governance) management rises globally and discussions on carbon reduction rapidly progress, interest in eco-friendly business among companies is increasing. In particular, the high growth potential of the waste industry is attracting attention, and there is a strong demand domestically and internationally for companies utilizing waste or by-products.

Rubicon, known as the "Uber of the waste industry" in the United States, is a software platform providing waste and recycling solutions to companies and governments worldwide. It is currently pursuing an IPO with a corporate valuation recognized at 2 trillion KRW this year. In February, Bill Gates, founder of Microsoft (MS), drew attention by purchasing approximately 150 billion KRW worth of shares in the U.S. waste management company Republic Services (RSG) through his investment firm Cascade Investment.

Domestic conglomerates are also responding swiftly to innovation in the waste industry. Hanwha Solutions announced on the 2nd of last month that it participated in a joint investment of about 27 billion KRW in the U.S. startup Novoloop. Novoloop does not merely recycle discarded plastics but upcycles them into high value-added products (activities that create added value through resource recycling).

Cases of directly establishing ESG funds are also increasing. SK Telecom formed an ESG startup fund worth 20 billion KRW with Kakao, and a 40 billion KRW ESG startup fund with KT and LG Uplus. Traditional manufacturers such as LG Chem and Lotte Chemical are also actively establishing ESG funds.

The domestic startup sector is no exception. Leading social venture investors in Korea, such as Impact Square, Bluepoint Partners, and Sopung Ventures, have actively led early investments in eco-friendly and waste-related startups. LK Technology Investment, launched by LIG Group in April, plans to focus on discovering startups with high growth potential in the domestic waste industry. As interest in the waste-related market heats up, ESG startups with innovative technologies and solutions are gaining attention.

Brism, a 3D custom eyewear startup, developed Korea’s first 3D printing personal eyewear production technology to create glasses reflecting consumer needs. Using a 3D scanner to scan the face, it precisely analyzes facial data such as face size, inter-pupillary distance, and nose bridge height, and based on this, produces personalized glasses with a 3D printer.

Brism’s made-to-order production system reduces the burden of eyewear inventory by producing according to order quantity. Over 50% of mass-produced glasses become deadstock and are discarded during distribution.

Only the necessary amount of material is used, resulting in less than 10% waste material during production. This is about 1/16th of the waste generated in the conventional eyewear manufacturing process, eliminating unnecessary resource waste. In the acetate horn-rimmed glasses production process, 90% of the acetate sheet, except for the frame shape (about 10%), is discarded. In contrast, Brism uses only the exact amount of raw material needed through 3D printing, and most leftover raw materials are recycled in the next production stage.

Brism also scraps all waste materials generated during product development and production to recycle them into Brism goods such as bookmarks and smartphone cases. Used glasses returned to stores by customers who no longer wear them are also recycled into goods.

Founded in 2020, the marine environment social venture Netspar produces recycled nylon by recycling marine waste such as discarded fishing nets. This recycled nylon is used to reproduce textile fibers for clothing, automotive parts, electronic components, and more. Founder Taeksu Jung, formerly of Hyundai Heavy Industries, and co-founder Donghak Song, from a textile testing institution, developed a solution to recycle marine waste into high value-added products.

Unlike the previous manual sorting of discarded fishing nets, Netspar has proprietary technology and automated facilities to perfectly sort nylon as a single material and extract it in large quantities. Netspar’s current nylon raw material production capacity is about 4,000 tons annually, and it plans to recycle 20,000 tons of discarded fishing nets annually through plant expansion in the future.

In Korea, food by-products generated from food processing approach 30 million tons annually. However, 70% of these are treated as waste after paying environmental fees, posing a significant environmental burden. Reharvest is Korea’s first food upcycling specialized company that upcycles by-products generated in food manufacturing processes to produce powders that replace flour for B2C and B2B food products. They developed ‘Renergy Powder,’ a substitute powder food made from beer and Sikhye by-products. This powder can replace flour, a main ingredient in various foods such as cereals, pizza, snacks, and bakery products. The powder features higher protein and dietary fiber content but lower calories compared to flour.

To maintain nutrition and quality, semiconductor technology is applied to the raw material processing. By-products are pre-treated with ultraviolet and far-infrared rays, sterilized with a dedicated cleaning solution, and dried while monitoring the nutritional status of the raw materials through feedback control. After cleaning and drying, the materials go through a grinding process to separate foreign substances and are ground as finely as possible. Reharvest has also filed four patents for its self-developed raw material processing technology.

Reharvest collaborates with OB Beer to produce Renergy Bars using beer by-products that were previously discarded. It also signed a business agreement with MP Daesan, operator of Mr. Pizza, to develop and manufacture Renergy Powder pizza dough upcycled from barley by-products, planning to distribute it. The Renergy Powder pizza dough is currently in the development stage and is expected to be commercialized in the second half of this year after production and manufacturing tests are completed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.