[Asia Economy Reporter Changhwan Lee] Although cyberattacks have increased globally since COVID-19, there is a lack of cyber insurance in South Korea to prepare for these threats, prompting calls to discuss measures to activate the market.

According to the Insurance Research Institute's report titled "Increase in Cyberattacks and Trends in Domestic and International Cyber Insurance Markets" on the 10th, the spread of non-face-to-face culture due to COVID-19 has accelerated digital transformation in companies worldwide, leading to a rise in cyberattacks globally and increased corporate demand for cyber insurance.

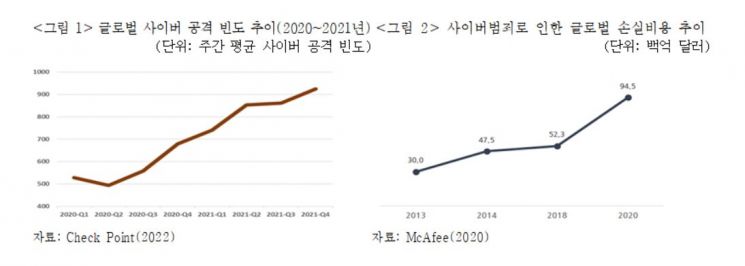

According to cybersecurity solution company Check Point Software, the frequency of global cyberattacks has been on the rise since mid-2020, when COVID-19 began to spread widely. The weekly average number of cyberattacks per institution, which was around 500 in the first half of 2020, surged to 925 in the fourth quarter of 2021.

The report pointed out that although an increase in cyberattacks has recently been observed in South Korea, cyber insurance?which is a representative means for companies to transfer cyber risks?is not yet active.

According to the Korea Internet & Security Agency, the number of ransomware reports increased more than threefold from 39 cases in 2019 to 127 cases in 2020. The Ministry of Science and ICT also raised the cyber crisis alert level for the private sector from "interest" to "caution" in March.

Recently, South Korean non-life insurance companies have also been launching cyber insurance policies that comprehensively cover cyber risks. In 2020, Company A collaborated with insurtech firms and cybersecurity companies to launch cyber insurance covering data damage, loss, and theft caused by ransomware.

In 2022, Company E launched insurance that comprehensively covers investigation costs of incident causes, data recovery costs, losses due to business interruption, and costs related to resolving cyber extortion.

However, the report analyzed that most domestic non-life insurers’ cyber insurance products tend to focus on liability coverage related to information leakage rather than comprehensive coverage of various risks occurring in cyberspace.

The report speculates that the reason cyber insurance is not active in South Korea is due to the difficulty in measuring cyber risks and the uncertainty of loss ratio fluctuations.

Accordingly, the report explains that major foreign countries are discussing ways to activate the cyber insurance market, such as expanding cyber risk underwriting capacity through capital markets by utilizing Insurance-Linked Securities (ILS).

Kim Sejung, a research fellow at the Insurance Research Institute, emphasized, "Since South Korea has a high ICT penetration rate and competitiveness (ranked first worldwide as of 2019), the risks and damages from increasing cyberattacks may be greater than in other countries," adding, "The domestic insurance industry needs to consider measures to activate the cyber insurance market and address coverage gaps."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)