Mid-Interest Rate Innovation Corporation Obtains Final Approval from Financial Services Commission

Plans to Begin Full-Scale Operations After Renaming to Korea Credit Information

[Asia Economy Reporter Minwoo Lee] The first company in Korea dedicated exclusively to credit evaluation (CB) for individual business owners is emerging.

'Data-Based Mid-Interest Market Innovation Preparation Corporation' (hereinafter referred to as Mid-Interest Innovation Corporation) announced on the 7th that it has obtained a full license for individual business owner credit evaluation (CB) from the Financial Services Commission. While financial companies such as credit card companies have previously been licensed for concurrent business, this is the first time a company specializing solely in credit evaluation for individual business owners has received approval.

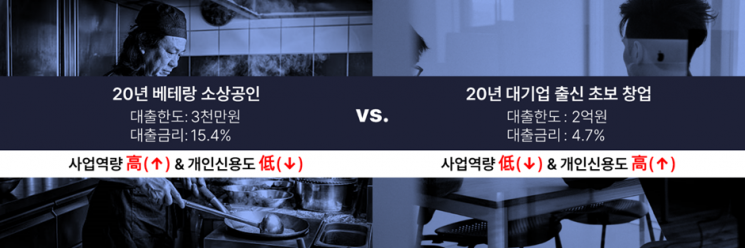

The Mid-Interest Innovation Corporation plans to comprehensively assess the business capabilities of individual business owners by utilizing credit card payment data and Hometax information. Until now, operational information of individual business owners' workplaces has not been significantly utilized in credit evaluations. This is because reliable sources of information on individual business owners' management situations are scarce, and the collection cycle ranges from six months to a year, resulting in a lack of timeliness.

However, credit card payment data can be collected almost in real-time, allowing for an understanding of management conditions. The Mid-Interest Innovation Corporation has developed a credit evaluation model that combines this with Hometax information to comprehensively assess the business capabilities of individual business owners. It is explained that this will also aid in the execution of policy funds.

The Mid-Interest Innovation Corporation's first and second largest shareholders are Korea Credit Data, a management service provider, and KakaoBank, an internet-only bank, respectively. SGI Seoul Guarantee, KB Kookmin Bank, Hyundai Capital, Jeonbuk Bank, and Welcome Savings Bank also participated in the investment. After a shareholders' meeting, the company plans to change its name to 'Korea Credit Service (KCS)' and commence full-scale operations.

Kim Sangwoo, CEO of the Mid-Interest Innovation Corporation, said, "Since many individual business owners have been struggling with financing after COVID-19, we will strive to have as many financial institutions as possible adopt improved loan screening methods." He added, "Our goal is to secure more than 30 financial institutions as clients by next year so that many individual business owners can use more reasonable financial services."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.