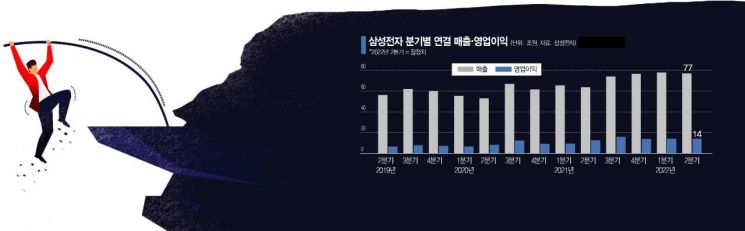

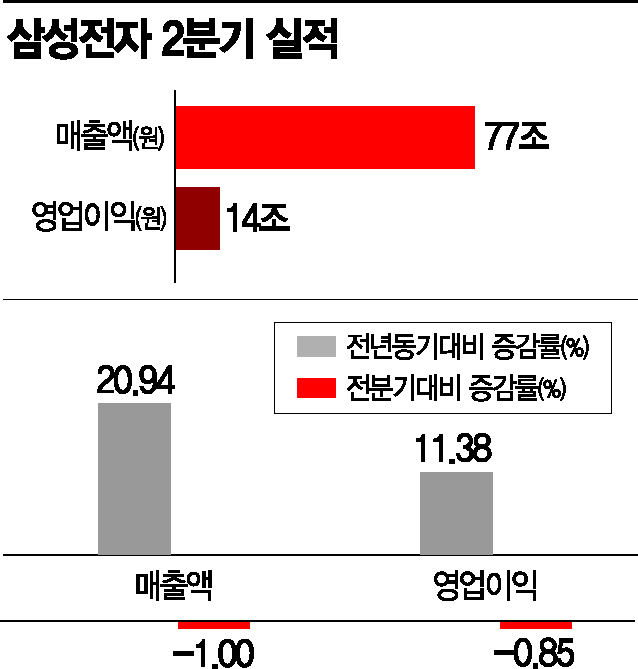

Samsung Electronics Q2 Revenue 77 Trillion KRW, Operating Profit 14 Trillion KRW

Decline Compared to Q1

[Asia Economy Reporters Sunmi Park and Hyesun Lim] The halt in Samsung Electronics' record-breaking quarterly sales is attributed to a slowdown in product demand caused by global inflation. Amid unstable economic conditions such as high inflation, high interest rates, and high exchange rates, consumer sentiment has been hit, leading to a decline in the performance of sets (finished products) such as smartphones and home appliances. Thanks to a strong performance in the semiconductor sector, sales were prevented from falling below 77 trillion won, but the outlook for the second half of the year is not optimistic. It is expected that the price decline of memory semiconductors such as DRAM and NAND flash will accelerate in the second half, raising concerns that market expectations for the overall performance this year will continue to be revised downward.

◆Weak demand for smartphones and home appliances... halted record-breaking streak= On the 7th, Samsung Electronics announced preliminary results for the second quarter with sales of 77 trillion won and operating profit of 14 trillion won. It is highly likely that sales and operating profit declined across all sectors except semiconductors compared to the previous quarter. In particular, the set sector, including smartphones and home appliances, which are highly sensitive to economic conditions, experienced significant performance deterioration.

Despite the rise in the won-dollar exchange rate, the industry expects that sales in the MX (Mobile Experience) and Network sectors fell to around 26 trillion won, lower than the 32 trillion won recorded in the first quarter due to a decrease in smartphone shipments. Samsung Electronics' smartphone shipments in the second quarter are estimated to be around 61 million units, down by more than 10 million units from 73 million units in the previous quarter.

While the overall consumption decline is a factor, consumers have turned away from Samsung products due to issues such as the GOS controversy. Inventory turnover days (the time it takes for inventory to be converted into sales) are also increasing. According to market research firm Display Supply Chain Consultants (DSCC) and others, Samsung Electronics' average inventory turnover days in the second quarter of this year reached a record high of 94 days. At this rate, it is difficult to guarantee 270 million units for the year (double the 135 million units in the first half), and there are even voices suggesting the possibility of a further decrease from the 272 million units, which had significantly declined last year due to supply chain issues.

In the second quarter, sales in the video display (VD) and home appliance sectors, including TVs, are also expected to have shrunk from 15.5 trillion won in the first quarter to around 13 trillion won in the second quarter. Samsung Electronics is focusing on selling premium products with high profit margins to secure profitability amid declining sales, but it is likely that operating profit also decreased by about 200 billion won compared to the first quarter due to rising raw material prices and logistics costs.

On the other hand, the semiconductor sector led the second quarter's performance. Although memory prices declined in the second quarter, semiconductor purchases by customers proceeded normally, and shipment volumes increased. Due to the nature of transactions being based on the dollar, the strong dollar exchange rate also had a positive effect. It is estimated that out of Samsung Electronics' total operating profit of 14 trillion won, about 10 trillion won came from semiconductors.

◆Lowered expectations amid gloomy outlook for the second half= There is still hope that Samsung Electronics can achieve record-high annual performance this year.

Samsung Electronics' current annual performance forecast, based on consensus (average of estimates over the past three months), is sales of 320.4434 trillion won and operating profit of 58.988 trillion won, both record highs. Sales surpass last year's 279.6 trillion won, and operating profit exceeds the 58.89 trillion won recorded in 2018. Since Samsung Electronics will hold an unveiling event (Unpacked) for the 'Galaxy Z Fold4' and 'Galaxy Z Flip4' on the 10th of next month, if the new foldable phone effect is realized in the third quarter, MX sector sales in the third quarter could improve compared to the second quarter.

However, as pessimistic economic forecasts deepen over time, expectations for Samsung Electronics' annual performance are also being lowered. Samsung Electronics was expected to achieve an operating profit exceeding 60 trillion won for the first time this year, but recent forecasts have been revised downward by 6.83% compared to a month ago (63.3102 trillion won). Reflecting the recent inventory reduction movement in distribution channels and conservatively estimating set business performance, there are opinions that operating profit this year could shrink to around 51 trillion won, potentially failing to set a new record.

Yangjae Kim of Daol Investment & Securities said, "The trend of declining quarterly earnings is expected to continue until the first half of next year," adding, "Due to weakening front-end demand, smartphone and TV sales are expected to be sluggish, and with increasing inventory, the semiconductor sector is also expected to see an expanded price decline in DRAM and NAND in the second half."

Meanwhile, after announcing the preliminary second-quarter results, Samsung Electronics paid business unit-specific Target Achievement Incentives (TAI) to employees. The performance bonuses paid in the first half of this year clearly reflect the performance of each business unit. The DS division, responsible for the semiconductor business, including the memory semiconductor business unit, foundry business unit, and system LSI business unit, all received 100% of the base salary (bonus base). In contrast, the home appliance business unit, responsible for products such as refrigerators and washing machines, was notified of the lowest payout rate among all company divisions at 62.5%. This is reportedly due to less-than-expected profitability caused by recent rises in raw material prices, logistics costs, and demand contraction.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.