Bio, Solutions, Aerospace & Robotics Industries Promising

US CPI, FOMC Schedule Important

Focus on Sectors with Foreign Net Buying

Also Pay Attention to Growth Potential Frontline Industries and Supply-Demand Stable Industries

[Asia Economy Reporter Hwang Yoon-joo] Kiwoom Securities' Innovation Growth Team has selected BioPlus, Baeksan, Suprema, and Platier as the top small- and mid-cap stocks for July.

On the 7th, Kim Hak-jun, a researcher at Kiwoom Securities, stated, "Promising categories are expected to be bio-related stocks, solution-related stocks, and aerospace and robotics-related stocks."

Researcher Kim explained, "Software solution companies are expected to continue growing as the government and corporations maintain their cloud transition and expand the scope of solution utilization. The bio sector has relatively stabilized supply and demand, and academic conferences and clinical results are scheduled for the second half of the year."

Regarding the aerospace and robotics sectors, he said, "Although there is a burden due to high valuations as new growth industries, they are entering an early stage of high growth," emphasizing, "Companies with high top-line growth (Intellian Tech, Rainbow Robotics) require continuous attention throughout this year."

Researcher Kim pointed out, "Recent concerns about inflation, recession, and the pace of interest rate hikes are causing anxiety, so rather than sector-specific issues, U.S. economic indicators and schedules (such as the U.S. June CPI and July FOMC) are important."

Therefore, he emphasized, "Currently, the focus should be on stabilizing the portfolio around front-end industries that can grow even in a recession, sectors with stable supply and demand, and sectors with net foreign buying, rather than individual issues."

◆ BioPlus, soaring earnings... Expansion into China = Looking closely at the stocks, BioPlus was highlighted for its record-breaking quarterly earnings and entry into the Chinese market as investment factors.

BioPlus posted sales of 12 billion KRW in Q1 2022, up 36.1% year-on-year, and operating profit increased by 13.3% to 5.6 billion KRW, showing continued growth in performance.

Researcher Kim said, "This year, sales are expected to increase by 58.7% year-on-year to 59.4 billion KRW, and operating profit is expected to rise by 58.9% to 29 billion KRW," explaining, "The recovery in demand for facial aesthetic procedures (Botox, fillers, etc.) in global countries, rapid sales growth of various product portfolios (adhesion prevention agents, joint synovial fluid, etc.), and additional sales expected from special import permits in the Hainan Special Zone in China and joint ventures (JV) are anticipated."

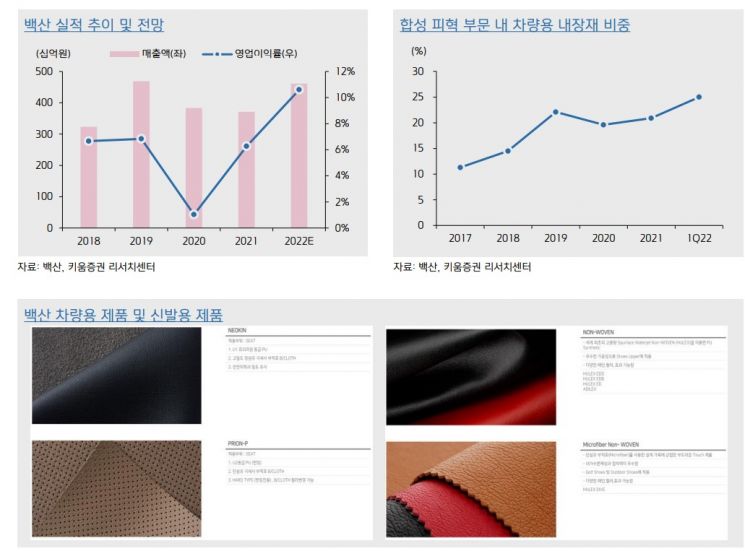

◆ Baeksan, focus on additional growth in automotive interior materials = For Baeksan, a synthetic leather manufacturer, additional growth through automotive interior materials is noteworthy.

Researcher Kim analyzed, "PU (polyurethane) synthetic leather products in automotive interiors are expanding the market by replacing traditional natural leather and PVC (polyvinyl chloride) synthetic leather," adding, "Especially with the full-scale launch of the electric vehicle market, eco-friendly demand for interior materials is increasing."

He further noted, "Not only expanding deliveries to existing domestic clients but also diversifying customers to global companies such as those in North America is possible," forecasting, "This year’s sales are expected to increase by 24% year-on-year to 461.4 billion KRW, and operating profit is projected to rise by 11% to 48.9 billion KRW."

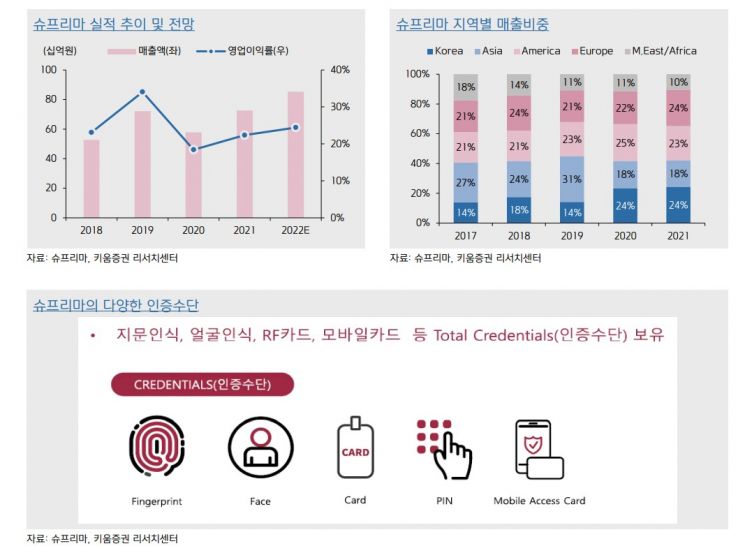

◆ Suprema, excessively undervalued phase = Researcher Kim evaluated Suprema as being excessively undervalued and advised paying attention to the recent rise in overseas sales, including in North America.

He stated, "With increasing demand for improved work efficiency, growth in biometric recognition products in the attendance management field is steep," and added, "The new product ‘BioStation 3,’ which enhances access methods diversity and recognition accuracy, is scheduled for release in the second half of the year."

Researcher Kim said, "Following the withdrawal of competitors and weakening competitiveness of companies in the Greater China region after COVID-19, benefits will be concentrated on the company," and forecasted, "This year’s sales are expected to increase by 18% year-on-year to 85.3 billion KRW, and operating profit is expected to rise by 28% to 20.8 billion KRW."

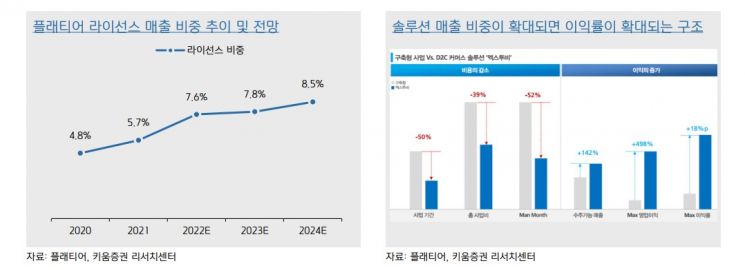

◆ Platier, entering a structural growth phase... rapid growth expected after 2023 = Researcher Kim diagnosed Platier as the biggest beneficiary in the domestic D2C (direct-to-consumer) market.

Researcher Kim said, "With the recent expansion of demand for direct commerce entry by large corporations (self-operated malls, platforms), Platier’s turnkey construction and product solution orders have rapidly increased," projecting, "This year, Platier’s sales are expected to increase by 22.2% year-on-year to 51.1 billion KRW, and operating profit is expected to rise by 39% to 5.8 billion KRW."

He analyzed, "The completion of the personalized marketing platform ‘Groovy’ and the D2C platform X2BEE is expected to be 3 to 4 cases this year, and from 2023, solution license sales will begin, expanding profit margins." Researcher Kim also anticipated overseas sales growth in 2023 when the SaaS conversion of Groovy and X2BEE solutions is completed.

However, a drawback is the shortage of quality developers needed for construction. Researcher Kim pointed out, "Since the number of personnel required for system construction is limited, a lag phenomenon occurs in securing additional orders after large contracts," adding, "If continuous acquisition of quality developers is achieved, more orders can be secured."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.