Counterpoint Research Announcement

Decline for 2 Consecutive Months... 10% Decrease Compared to Previous Year

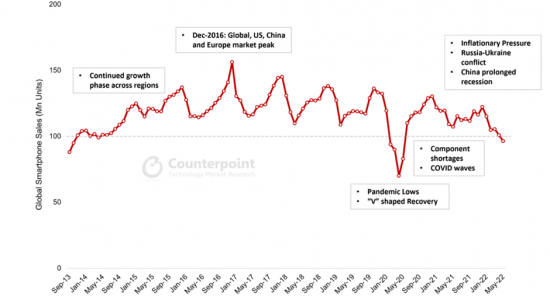

[Asia Economy Reporter Cha Min-young] As the global smartphone market contracts, total sales in May fell below 100 million units. With demand expected to continue declining through the second quarter, a similar trend is anticipated next month.

According to global market research firm Counterpoint Research on the 5th, global smartphone sales in May recorded 96 million units, down 4% from the previous month and 10% from the same period last year. Smartphone sales have decreased month-over-month for two consecutive months and year-over-year for eleven consecutive months.

The smartphone market showed a V-shaped recovery after the first COVID-19 wave in 2020 but has yet to reach pre-pandemic levels. Last year, the smartphone market continued to face supply constraints and the impact of COVID-19. Since the beginning of this year, although component shortages have not been fully resolved, the market has stabilized; however, inflation, China's economic slowdown, and the Ukraine crisis have dampened smartphone demand.

Tarun Pathak, Research Director, stated, "In developed countries, replacement demand drives the market, but inflation has led consumers to postpone unnecessary purchases, including smartphones, resulting in pessimistic consumer sentiment worldwide. The strong US dollar is also impacting emerging markets, and some consumers are likely to wait for seasonal promotions due to cost concerns."

Analyst Varun Mishra commented on the Chinese market and the Ukraine crisis, saying, "China's lockdowns and prolonged economic downturn have not only hurt domestic demand but also weakened the global supply chain. In May, the Chinese smartphone market slightly recovered month-over-month as lockdowns eased but remained 17% lower than May 2021."

He added, "Uncertainty in China's smartphone market remains, and combined with the Russia-Ukraine crisis, it is impacting demand in Eastern Europe. Smartphone manufacturers are unlikely to avoid the negative effects of these situations." An analysis also suggests that the vicious cycle of 'demand decline → inventory buildup → shipment reduction → order decrease' will have the greatest impact in the second quarter.

Counterpoint Research expects this situation to continue through the summer but anticipates gradual improvement in the second half of the year. The normalization of the Chinese market, improved supply-demand balance in the technology supply chain, and macroeconomic recovery are expected to drive improvement in the latter half. Positive factors include major events such as China's 6·18 and August back-to-school promotions, India's Diwali, and Christmas and New Year sales. New products like Samsung's Galaxy Fold series and Apple's iPhone 14 series are also expected to boost demand.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)