Changes in Asset Share of Top 5 Groups Among Top 30 Groups

2012: 51.7% → 2016: 59.4%

→ 2017: 60.5% → Last Year: 59.7%

[Asia Economy Reporter Jeong Dong-hoon] It has been revealed that the asset concentration phenomenon of the top 5 conglomerates (Samsung, SK, Hyundai Motor, LG, Lotte) has intensified over the past decade.

According to Leaders Index, a corporate analysis research institute, which analyzed the assets (fair assets), sales, and employment numbers of the top 30 conglomerates based on the Fair Trade Commission's data from 2012 to 2021, this was reported on the 5th.

Top 5 Groups' Assets Reach 1,322 Trillion KRW... Up 38.2% in 10 Years

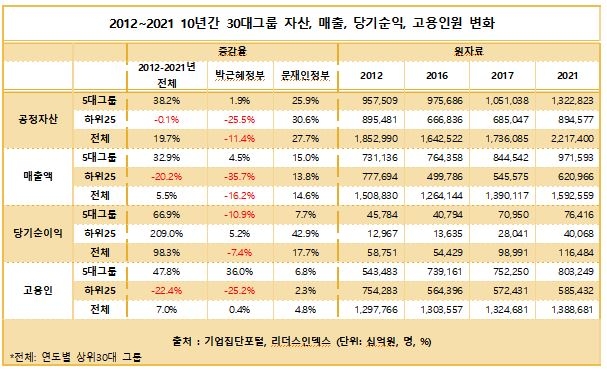

The fair assets of the top 5 groups increased by 38.2%, from 957.509 trillion KRW in 2012 to 1,322.823 trillion KRW last year. Fair assets refer to the total assets of general affiliates of large business groups plus the total capital of financial affiliates. As of last year, the fair assets of the top 30 groups amounted to 2,217.4 trillion KRW, which is a 19.7% increase from 1,852.99 trillion KRW in 2012.

The asset concentration of the top 5 groups increased further during the Park Geun-hye administration. The asset share of the top 5 groups among the entire top 30 groups rose from 51.7% in 2012 to 59.4% in 2016, the end of the Park Geun-hye government, an increase of 7.7 percentage points. This share slightly decreased from 60.5% in 2017, when the Moon Jae-in administration began, to 59.7% last year.

Among the top 30 groups, the asset trends of the top 5 groups and the bottom 25 groups diverged. Looking at asset changes, the assets of the bottom 25 groups decreased by 25.5%, from 895.481 trillion KRW in 2012 to 666.836 trillion KRW in 2016, whereas the assets of the top 5 groups increased by 1.9%, from 957.509 trillion KRW to 975.686 trillion KRW.

Afterwards, the assets of the top 5 groups increased by 25.8%, from 1,051.038 trillion KRW in 2017 to 1,322.823 trillion KRW last year. During the same period, the assets of the bottom 25 groups also rose by 30.5%, from 685.047 trillion KRW to 894.577 trillion KRW. This indicates that during the Moon Jae-in administration, the asset growth rate of the lower groups was relatively higher than that of the top groups.

Asset Increase Over 10 Years: Samsung 177 Trillion, SK 151 Trillion, Hyundai Motor 91 Trillion, etc.

Since 2012, the group with the largest asset increase was Samsung Group. Its assets rose from 306.092 trillion KRW in 2012 to 483.919 trillion KRW last year, an increase of 177.827 trillion KRW (58.1%). SK Group followed with an increase of 151.348 trillion KRW (from 140.621 trillion KRW to 291.969 trillion KRW), Hyundai Motor Group with 91.151 trillion KRW (from 166.694 trillion KRW to 257.845 trillion KRW), LG Group with 65.141 trillion KRW (from 102.36 trillion KRW to 167.051 trillion KRW), and Lotte Group with 34.066 trillion KRW (from 87.523 trillion KRW to 121.589 trillion KRW).

The highest asset growth rate was recorded by Shinsegae Group at 166.8% (an increase of 38.174 trillion KRW), followed by Mirae Asset Group at 134.4% (11.599 trillion KRW), Hanwha Group at 123.6% (44.444 trillion KRW), and Kyobo Life Insurance Group at 119.5% (7.521 trillion KRW).

The concentration of the top 5 groups was even more pronounced in sales. The total sales of the top 30 groups increased by 5.5%, from 1,508.83 trillion KRW in 2012 to 1,592.559 trillion KRW last year. During the same period, the sales of the top 5 groups rose by 32.9%, from 731.136 trillion KRW to 971.593 trillion KRW. Meanwhile, the sales of the bottom 25 groups decreased by 20.2%, from 777.694 trillion KRW to 620.966 trillion KRW.

The employment numbers of the top 30 groups increased by 7.0%, from 1,297,766 in 2012 to 1,388,681 last year. During the Park Geun-hye administration (2012?2016), employment increased by 0.4%, and during the Moon Jae-in administration (2017?2021), it increased by 4.8%. The employment share of the top 5 groups within the top 30 groups rose by 15.9 percentage points, from 41.9% in 2012 to 57.8% last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.