Partner Company Notifies "Fuel Tank Supply Unavailable Until the 9th"

"Raw Material Price Increase and Electrification Shift Heighten Crisis Concerns"

[Asia Economy Reporter Kiho Sung] The resumption of some Kia vehicle production lines, which had been halted due to the suspension of parts delivery by first-tier suppliers, is expected to be delayed. This is because suppliers have announced additional suspension of deliveries. Kia temporarily stopped the operation of the production lines at factories where the affected parts are used. It is widely believed that this issue stems from dissatisfaction caused by first-tier suppliers being unable to receive raw materials from lower-tier suppliers due to the Cargo Solidarity Union strike, coupled with a refusal to raise delivery prices despite the sharp rise in raw material costs. There are also expectations that the ongoing debate over the delivery price linkage system, currently being promoted by the government and political circles, may reignite.

According to industry sources on the 4th, TIO Automotive, a first-tier supplier providing fuel tanks to Hyundai Motor and Kia, sent an additional official letter on the 1st, notifying Hyundai Motor and Kia that it would be unable to supply fuel tanks until the 9th. The company stated, "It is impossible to secure safety stock to stabilize supply due to supply disruptions." As a result, production for the afternoon shift at Kia’s Gwangmyeong Plant 1 was halted on the same day. Kia’s Gwangmyeong Plant 1 produces models such as the Carnival, Stinger, and K9.

TIO Automotive had sent a letter regarding production cuts on the 24th of last month, followed by a first official notice of supply suspension on the 29th. Consequently, starting from the 30th of last month, production disruptions have sequentially affected Kia’s Hwaseong Plant 1 Sorento production line, Gwangju Plant 2 Sportage, and Gwangmyeong Plant 1 Carnival. The fuel tanks affected by the supply shortage are three out of seven specifications, mainly parts installed in hybrid vehicles. The parts subject to supply suspension in the second official letter also pertain to the aforementioned vehicles.

Within the industry, it is believed that while the immediate causes of the production disruptions are the rise in raw material prices and the aftermath of the Cargo Solidarity Union strike, the fundamental reasons lie in suppliers’ anxieties over the delivery price linkage system and the transition to electric vehicles.

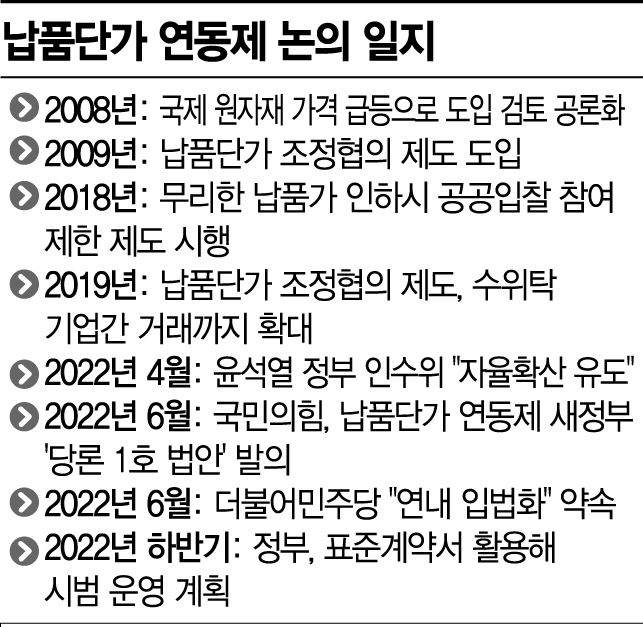

The delivery price linkage system is a mechanism that reflects raw material price increases in delivery payments. Discussions began in 2008 but did not achieve significant results. However, amid the recent COVID-19 spread, global supply chain instability, and the Ukraine war, raw material prices have soared, bringing the issue back to the forefront. With raw material prices reaching unprecedented highs, political circles have submitted related bills to the National Assembly and decided to promote them as party policies. The government also announced that it will pilot the delivery price linkage system using standard contracts for certain raw material items in the second half of the year.

However, the government’s pilot program is non-mandatory, and even if the linkage system is introduced, controversies are inevitable during the detailed design process. There are sharp disagreements between large corporations and small and medium enterprises regarding the industries to which the system applies, the scope of raw materials, reference prices, timing for raw material price increases and decreases, and linkage ratios. Debates also exist over whether to mandate the system and whether to provide incentives to companies that comply or impose penalties on those that do not.

The rapid transition to electrification is also cited as a factor increasing suppliers’ anxieties. The Korea Automotive Technology Institute estimates that the number of domestic internal combustion engine parts companies will decrease from 2,815 in 2019 to 1,970 in 2030, a reduction of 845 companies, due to vehicle electrification. The government also expects that if the share of electric and hydrogen vehicles rises from the current 2-3% to 33% by 2030, approximately 35,000 jobs will be lost.

An industry insider explained, "Parts suppliers find it difficult to develop technology independently, so transitioning from supplying internal combustion engine parts to electrified vehicle parts is not easy. Amid the rapid electrification of vehicles, current suppliers are overwhelmed by survival anxieties, feeling that ‘in the future, supplying will no longer be possible.’"

However, a Kia official stated that regardless of the government’s pilot program in the second half, Kia has long been implementing its own delivery price linkage system. The official said, "Kia has continuously operated a raw material price linkage system with its suppliers, including TIO Automotive, and recently reached an agreement on price increases. Therefore, the fuel tank supply issue appears unrelated to raw material prices or the delivery price linkage system."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)