Oil Corporation Sells 'Prime North Sea Oil Fields' to Improve Financial Structure

Already in 'Complete Capital Erosion' State... Debt Increased by 1.3 Trillion Won in One Year

Gas Corporation Plans Sale of Indonesia's Krung Mane... Debt Ratio at 378%

Overseas Asset Sales Continue... KEPCO Also Considering Disposal of Largest Overseas Project

Concerns Over 'Fire Sale'... Critics Say Supply Chain Instability May Cause More Harm Than Good

[Asia Economy Sejong=Reporter Lee Jun-hyung] Korea National Oil Corporation's push to sell assets held by its UK subsidiary, Dana Petroleum, stems from the urgent need for restructuring to normalize management. Since entering an emergency management system in 2018, the financial structure of the Oil Corporation has already exceeded its limits several years ago. The debt ratio, an indicator of the company's financial soundness, soared nearly fivefold in just two years, from 719% in 2017 to 3415% in 2019. The Oil Corporation has been in a state of complete capital erosion since 2020. This contrasts sharply with the average debt ratio of public enterprises, which stands at around 150%.

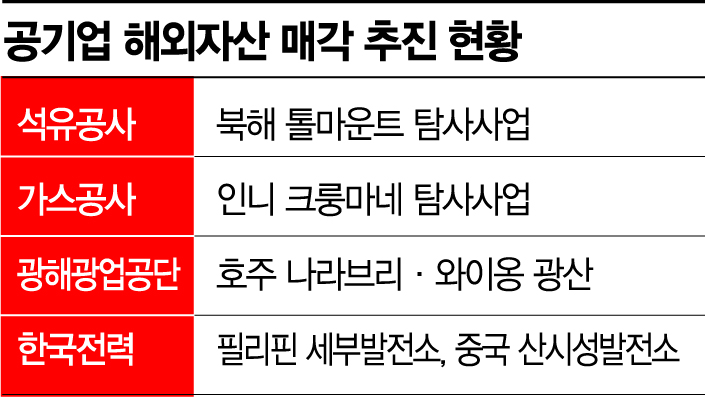

The reason the Oil Corporation has initiated the sale process of the Canadian oil company Harvest, which it acquired in 2009, is also due to the debt ratio. Recently, the Oil Corporation selected Canadian private resource development company A as the preferred negotiation partner and has begun formal sale negotiations. To secure liquidity, the Oil Corporation plans to complete the sale of both its 10% stake in Tolmount and Harvest within this year.

The Oil Corporation is not the only one embarking on a trend of selling overseas assets. Korea Gas Corporation decided at its board meeting in May to sell its entire stake in the Krung Mane project in Indonesia. This is a measure to reduce its debt ratio, which reached 378% as of last year. The Krung Mane project is a gas field development located offshore in northwest Indonesia. In 2007, Korea Gas Corporation purchased a 15% stake in Krung Mane from the Italian oil development company Eni.

Korea Mine Rehabilitation and Mineral Resources Corporation, which is in a state of complete capital erosion, is accelerating the sale of the Narabri mine in Australia. The corporation selected a lead sales agent and legal advisor in March and May respectively, formalizing the sale process. The Narabri mine is capable of producing 6 million tons annually of high-quality coal (thermal coal). The corporation is also pursuing the sale of the Wyang mine in Australia, which has thermal coal reserves of approximately 1.38 billion tons.

Korea Electric Power Corporation (KEPCO), which is also mired in deficits, is taking similar steps. In May, KEPCO formed an emergency countermeasure committee with its power group companies and decided to sell the Cebu power plant in the Philippines and the Boulder 3 solar power plant in the United States within this year. KEPCO is also considering selling the Shanxi coal-fired power plant in China, its largest overseas project with a capacity of 8,350 MW. Originally, KEPCO planned to operate the Shanxi coal-fired power plant, which it co-invested in 2007, until 2057.

This is being evaluated as the start of a 'relay sale' of overseas assets by public enterprises. Disposing of overseas assets worth trillions of won is inevitable to improve the worsening financial structure. There is also speculation that additional sales of overseas assets by public enterprises may follow, as the government recently designated 14 public enterprises, including the Oil Corporation, as financially at-risk institutions and announced high-intensity reforms. The government has already demanded that these financially at-risk institutions submit a 'five-year financial soundness plan' by the end of this month.

Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho is delivering a keynote speech at the '3rd Emergency Economic Ministers' Meeting' held at the Government Seoul Office in Jongno-gu, Seoul, on the 3rd. Photo by Kang Jin-hyung aymsdream@

Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho is delivering a keynote speech at the '3rd Emergency Economic Ministers' Meeting' held at the Government Seoul Office in Jongno-gu, Seoul, on the 3rd. Photo by Kang Jin-hyung aymsdream@

Within the industry, concerns have been raised that the disposal of overseas assets could lead to 'hasty sales.' Since the sales are rushed to reduce debt, it may be difficult to receive fair value. In fact, the current value of the 15% stake in the Krung Mane project, in which Korea Gas Corporation invested a total of 47.98 million USD (approximately 62.3 billion KRW), is reported to be around 350,000 USD (approximately 450 million KRW).

Another issue is that it could exacerbate supply chain instability. Selling large-scale overseas resources inevitably increases dependence on energy imports, making the country vulnerable to fluctuations in international energy prices. A Ministry of Trade, Industry and Energy official stated, "(Energy import costs) are acting as a core factor in the trade deficit," adding, "The increase in imports of the three major energy sources this year has exceeded the monthly trade deficit amount."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.