In the first half of this year, global orders for liquefied natural gas (LNG) carriers increased by more than 400% compared to the first half of last year, with Korea securing orders for 7 out of every 10 LNG carriers.

According to Clarkson Research, a UK-based shipbuilding and shipping market analysis firm, the total global LNG carrier orders in the first half of this year amounted to 7,678,585 CGT (Compensated Gross Tonnage, equivalent to 89 vessels). This represents a 416% increase compared to the 1,486,795 CGT (18 vessels) ordered in the first half of last year. Among these, Korean shipbuilders such as Korea Shipbuilding & Offshore Engineering, Samsung Heavy Industries, and Daewoo Shipbuilding & Marine Engineering secured orders for 7 out of every 10 LNG carriers ordered worldwide. In the first half of this year, Korea won orders totaling 5,444,931 CGT (63 vessels), accounting for 71% of the global LNG carrier orders, which is about a 280% increase compared to last year's first half orders of 1,433,562 CGT (17 vessels).

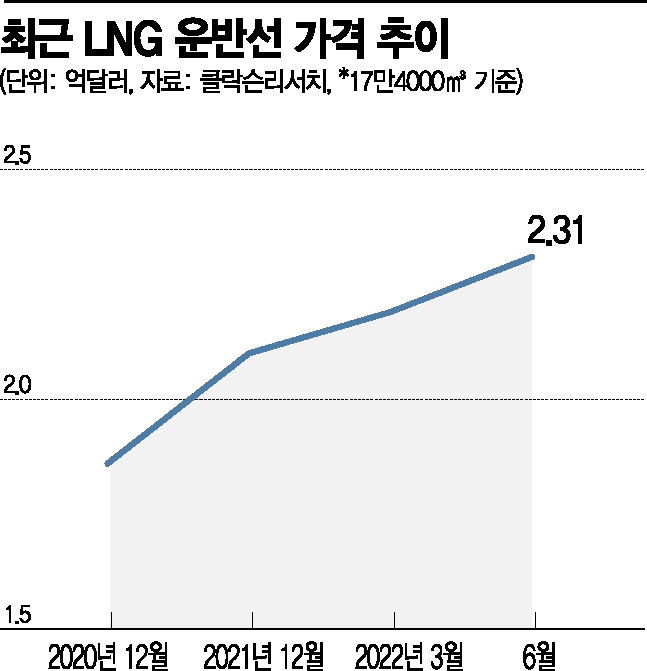

Global LNG carrier prices are also rising, which could positively impact the profitability of domestic shipbuilders. The price of an LNG carrier (based on 174,000 cubic meters) was $186 million (approximately 241.3 billion KRW) two years ago, but as of the end of last month, it rose by about 24% to $231 million (approximately 299.7 billion KRW). The demand for energy supply via LNG carriers increased due to Russia's invasion of Ukraine, and with Qatar's LNG carrier orders ramping up, LNG carrier prices are expected to remain strong for the time being.

Korea's ability to secure a large number of LNG carrier orders is attributed to its unparalleled technological expertise. LNG carriers transport LNG stored in cryogenic tanks at minus 163 degrees Celsius. If LNG leaks from these cryogenic tanks, the steel weakens, potentially causing the ship to break apart. Given the risk of a major maritime explosion, shipping companies prefer Korean shipyards with advanced technology for safety reasons.

However, the soaring price of steel plates poses a negative factor. Typically, steel plates account for about 20% of shipbuilding costs. Steel plate prices have increased three consecutive times from the first half of last year through the second half and into the first half of this year. Currently, prices have surged to 1.2 million KRW per ton, double last year's level. The impact of steel plate prices is significant, leaving the improvement of shipbuilders' profitability uncertain. The chronic labor shortage in the shipbuilding industry is also a hindrance. According to the Korea Shipbuilding & Offshore Plant Association, the workforce at domestic shipyards, including in-house subcontractors, decreased by 54% over seven years, from 203,441 workers at the end of 2014 to 92,687 at the end of last year. Furthermore, due to increased orders, as of September this year, 47,000 production workers (excluding subcontractors) are needed on shipbuilding sites, but the current workforce remains at around 38,000, resulting in a shortage of 9,500 workers.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)