[Asia Economy Sejong=Reporter Son Seon-hee] As the ruling and opposition parties competitively propose bills to expand the flexible fuel tax rate (currently up to 30%), the government finds itself in a dilemma over controlling fuel prices. There are concerns that if domestic fuel prices briefly drop due to a fuel tax cut amid soaring international oil prices, increased demand could lead to price hikes again.

According to the National Assembly Legislative Information System on the 4th, bills have been proposed to reduce the fuel tax by up to 50% (Rep. Bae Jun-young of the People Power Party), 70% (Rep. Kim Min-seok of the Democratic Party), or even completely exempt it by 100% (Rep. Seo Byung-soo of the People Power Party). If discussions proceed in the National Assembly, pressure for further fuel tax cuts on the government is expected to intensify.

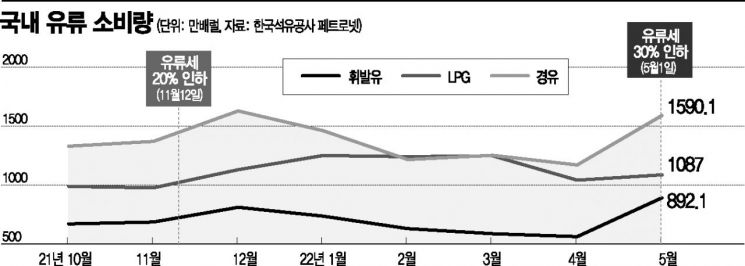

The government has already lowered the fuel tax to the maximum legal limit. The problem is that fuel consumption has surged accordingly. According to the Korea National Oil Corporation’s Petronet, domestic gasoline consumption in May reached a record high of 8.921 million barrels. This is a 60% increase compared to the previous month (5.639 million barrels). Compared to the same period last year, consumption rose by 25%. Diesel consumption (15.901 million barrels) also jumped 36% from the previous month.

When the government first implemented a 20% fuel tax cut on November 12 last year, consumption trends showed a similar pattern. In December last year, when the fuel tax cut was fully reflected, consumption of gasoline, diesel, and liquefied petroleum gas (LPG) all increased simultaneously. This year, as international oil prices rose to levels offsetting the previous fuel tax cuts, fuel consumption somewhat slowed down, but when the government expanded the tax cut last month, consumption surged as if waiting for it. A representative from the Korea Petroleum Association explained, "The biggest factor is the pent-up demand caused by the fuel tax cut. Since the government announced the fuel tax cut would take effect on May 1, gas stations likely delayed ordering fuel to avoid inventory losses and purchased it in early May."

Basically, market prices rise when supply decreases or demand increases. There are criticisms that the fuel tax cut, implemented to respond to rising oil prices, ultimately stimulates demand and leads to price increases, making it an ineffective fundamental oil price policy. The International Monetary Fund (IMF) recently advised restraint on artificial price control policies like fuel tax cuts, stating they "encourage consumption and put more pressure on energy prices." The Organisation for Economic Co-operation and Development (OECD) is also expected to soon issue recommendations pointing out that "fuel tax cut policies run counter to climate goals and lead to overconsumption in the long term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.