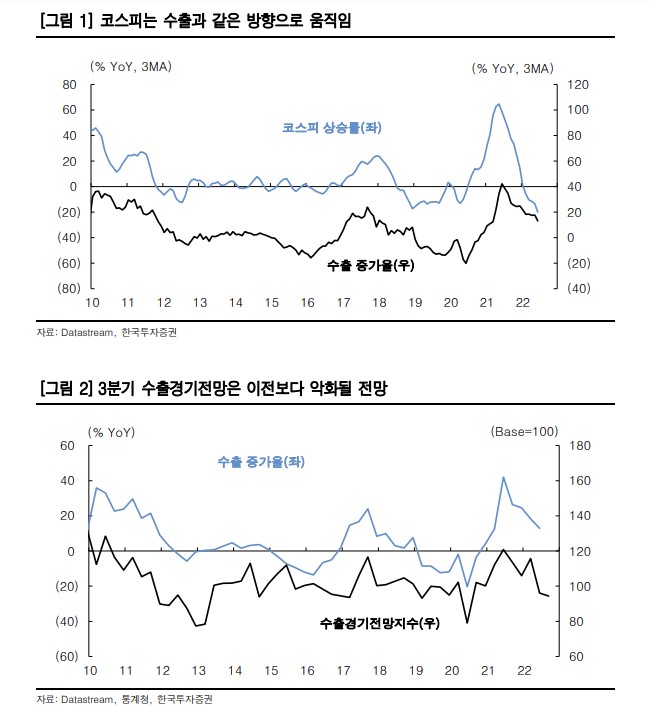

[Asia Economy Reporter Lee Seon-ae] The export environment in the second half of the year is expected to be challenging. Accordingly, while the stock market's momentum is likely to weaken, industries with increasing export contracts are expected to show relatively stable stock price trends.

On the 4th, Kim Dae-jun, a researcher at Korea Investment & Securities, stated, "According to the government's forecast and the recently released third-quarter export outlook survey, exports are expected to perform worse than now, which means the stock market's momentum will weaken further. Since the Korean economy is export-driven, stock prices inevitably move according to export results, which could cause considerable concerns from a market perspective."

On the 1st, the Ministry of Trade, Industry and Energy announced the export-import trends for June. Exports and imports increased by 5.4% and 19.4% respectively compared to the previous year. In particular, exports increased more than expected and imports decreased, resulting in a trade deficit of $24.7 billion, lower than the consensus of $43.1 billion. Such outward figures were sufficient to suggest that the performance was relatively good given the difficult environment. However, considering the detailed data and future outlook, the situation is not that favorable. The government's emergency economic ministers' meeting held on the 3rd is evidence of this. Chu Kyung-ho, Deputy Prime Minister for Economic Affairs leading the Korean economy, also emphasized that it is difficult to be optimistic about exports in the second half of the year and announced an expansion of trade finance for small and medium-sized export companies by more than 40 trillion won.

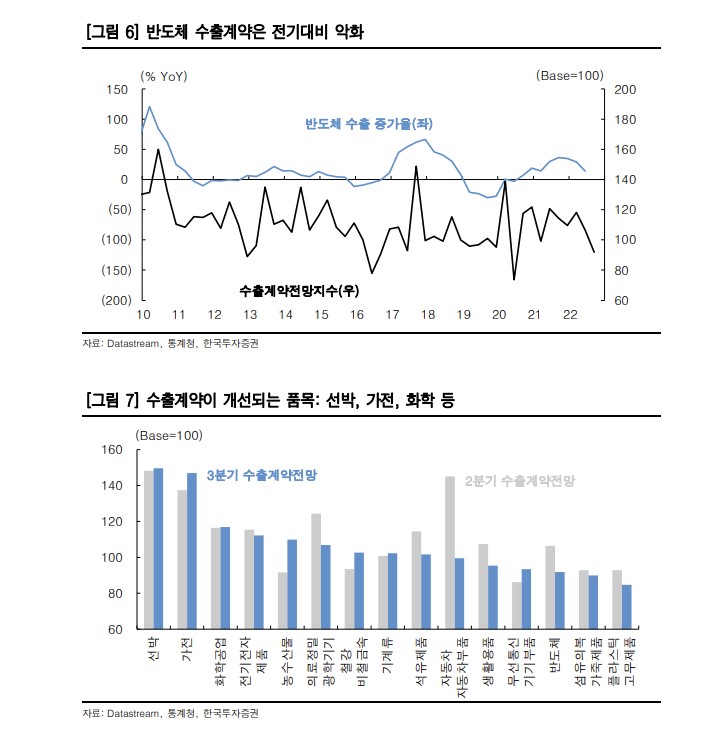

In particular, the monthly decline in the export growth rate of semiconductors, which account for about 21% of total exports, is a burden. So far, the export growth rate of individual items has shown a trend similar to export contracts among various items in the export outlook survey. Export contracts refer to the part where actual effects occur, not just inquiries about product contracts, so they are interpreted to have a greater impact on stock price trends. The problem is that semiconductor export contracts have been confirmed to have worsened compared to the previous quarter. This implies that exports may have an unfavorable impact on the sales of the semiconductor industry.

Researcher Kim said, "The export environment in the second half of this year will not be easy," and advised, "Just as you take shelter briefly when a sudden shower pours, it is necessary to step back temporarily from industries with unfavorable export prospects." He added, "On the other hand, industries expected to secure contracts well can show stable trends in stock prices. Currently, such industries include shipbuilding, home appliances, and chemicals."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)