[Asia Economy (Suwon) = Reporter Lee Young-gyu] Gyeonggi Province is advancing the opening of applications for the 'Gyeonggi Ultra-Low Credit Loan' by one month and significantly expanding the number of application centers to 21 in response to the economic crisis caused by rising prices and other factors affecting people's livelihoods.

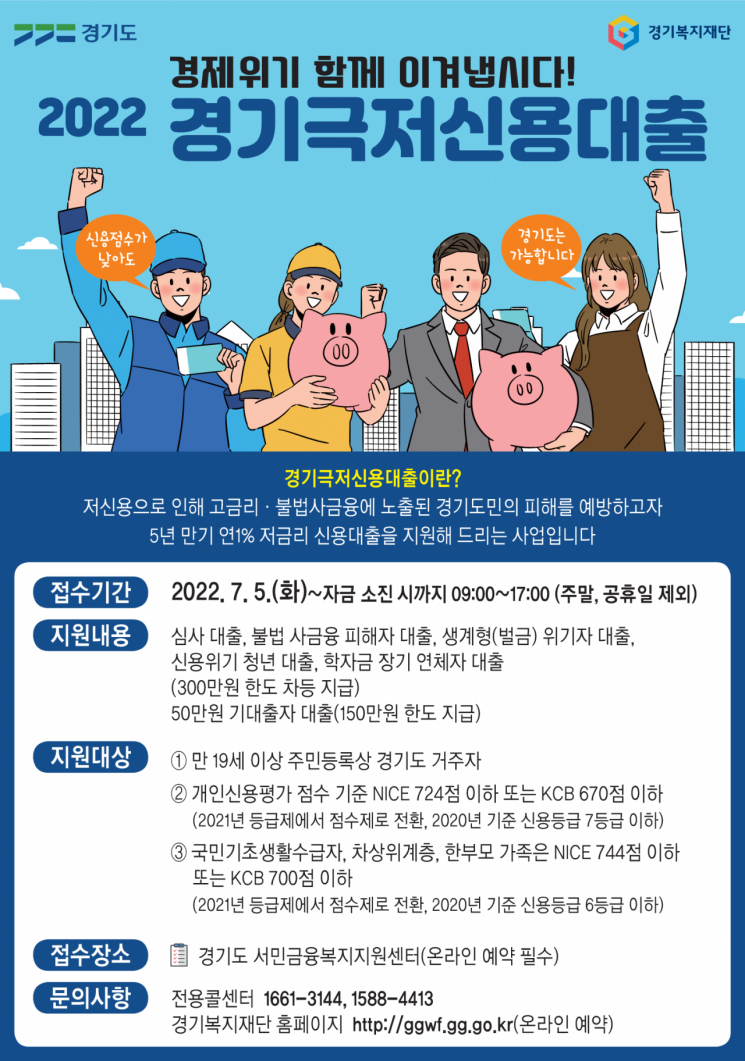

The Gyeonggi Ultra-Low Credit Loan is a program that provides loans of up to 3 million KRW at a low interest rate of 1% per annum with a 5-year maturity to low-credit residents aged 19 or older who need living expenses but have difficulty using formal financial institutions due to low credit ratings.

The province announced on the 4th that it will start the Gyeonggi Ultra-Low Credit Loan from the 5th of this month, one month earlier than originally planned, and will increase the number of loan application centers to 21 by opening additional temporary base centers.

The types of ultra-low credit loan support include ▲screening loans ▲loans for victims of illegal private loans ▲loans for livelihood crisis (fine) victims ▲credit crisis youth loans ▲and loans for those who received a 500,000 KRW emergency loan in 2020.

The screening loan support targets residents of Gyeonggi Province as of the application date who are aged 19 or older with a NICE Information Service credit score of 724 or below, or a KCB credit score of 670 or below.

Loans for victims of illegal private loans are provided to those who have suffered from illegal debt collection, following consultation after reporting to the Gyeonggi Province Illegal Private Loan Center.

Loans for livelihood crisis victims target low-income residents who have been sentenced to simple fines but are unable to pay due to financial difficulties.

Credit crisis youth loans are for young people under 39 years old who have been in long-term arrears on student loans with the Korea Student Aid Foundation for six months or more, or have had debt adjustment with the Credit Counseling and Recovery Service for six months or more.

Loans for those who received a 500,000 KRW emergency loan target borrowers who received a temporary small emergency living expense loan (500,000 KRW) in 2020.

From the loan amount (up to 1.5 million KRW), the principal and interest of the existing 500,000 KRW loan will be repaid simultaneously, and the difference will be paid out.

Additionally, to strengthen borrowers' credit and financial management capabilities and to prevent credit problems in advance, credit education will be mandatory, and online education will be conducted before loan execution from the second application onward.

Those wishing to apply for the loan can make a reservation in advance on the Gyeonggi Welfare Foundation website starting from the 5th, and then apply after financial counseling at the Gyeonggi Province Low-Income Financial Welfare Center.

To facilitate prompt loan applications, the province has opened two additional temporary application base centers in addition to the existing 19 Low-Income Financial Welfare Centers.

For detailed information on advance reservations and loan application methods, please check the dedicated 'Gyeonggi Ultra-Low Credit Loan' call centers (1661-3144, 1588-4413) or the Gyeonggi Welfare Foundation website.

In the first half of this year, the Gyeonggi Ultra-Low Credit Loan, now in its third year, supported 8,218 people with loans totaling 15.666 billion KRW. The province plans to continue operating post-management programs such as financial counseling, financial education, and linkage to jobs and welfare services to help residents in need of financial welfare achieve practical recovery.

Lee Jong-don, Director of the Welfare Bureau of the province, said, "The recent rapid rise in prices has worsened the economic situation for low-income groups. To respond to this emergency economic situation, we have advanced the support period for the Ultra-Low Credit Loan. We hope this will help strengthen the social safety net and support economic recovery for financially vulnerable groups who are in the blind spots of the financial system."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)