Next Quarter Revenue Guidance at $7.2 Billion

Below Market Expectations... DRAM Cycle Turns Down

Expresses Willingness to Defend Prices Amid Reduced Capex

[Asia Economy Reporter Minji Lee] Amid growing market uncertainty, Micron Technology's stock price decline is accelerating. Concerns over the remaining quarterly earnings have increased, and the announcement of a weak industry outlook guidance is dampening market sentiment.

On the 3rd, Micron Technology's stock price stood at $53.65. The company's stock price has fallen 23.29% over the past month, reflecting concerns about declining earnings, including the downturn in the DRAM cycle.

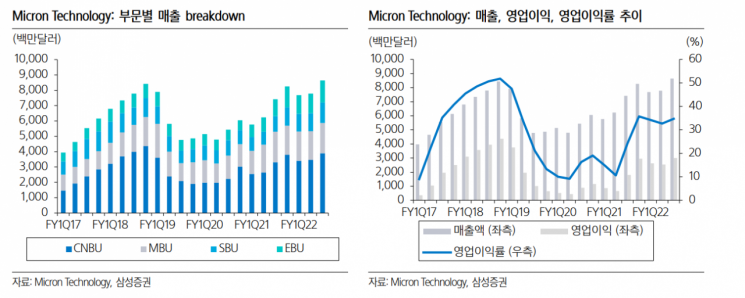

Micron Technology reported Q3 (March-May) revenue of $8.6 billion, exceeding market expectations. The DRAM and NAND segments rose by the low teens and high teens percentages respectively compared to the previous quarter. Most notably, strong performance in the Auto, Industrial, Networking, and Data Center sectors drove NAND segment to record-high earnings. By business segment, Computing & Networking (13%), Mobile (5%), Embedded (12%), and Storage (15%) all grew compared to the previous quarter. Inventory stood at about 109 days, down 4 days from the previous quarter.

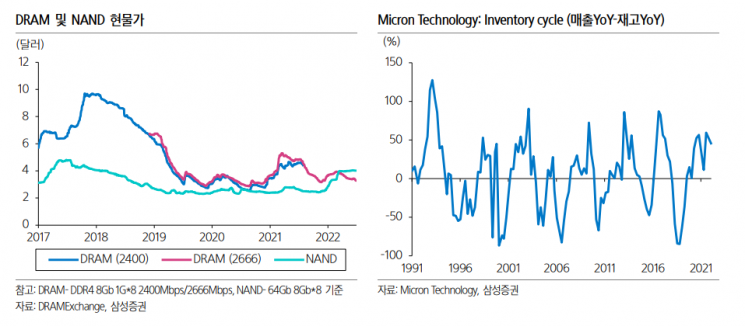

The company's guidance for the next quarter (June-August) projects revenue of $7.2 billion, below market expectations of $9.1 billion. This implies that the DRAM cycle may turn downward due to weakening consumer demand in PCs, mobile devices, and other areas. Typically, Q3, a peak season, sees growth slow down before demand sharply declines entering the year-end off-season; however, the current downturn appears to be arriving faster than expected.

The main reason is reduced consumption in the PC and mobile sectors. Although server end demand is expected to rise, sales are declining as customers deplete their inventories. Hyungtae Kim, a researcher at Shinhan Financial Investment, said, “While server demand from North American IDM companies is expected to remain solid, concerns remain due to recent server OEM (Dell, HP) order cuts and delays in Intel’s new CPU launch, which could prolong customer inventory depletion and delay the transition to DDR5 for servers.”

Hyungkeun Ryu, a researcher at Samsung Securities, said, “It appears that Korean companies’ Q2-end sales were also significantly affected, which will increase concerns about Q2 earnings. The sales decline cycle is expected to last 1 to 1.5 years, followed by a sales growth cycle after inventory is depleted.”

However, a notable point is the company’s determination to defend prices. The company plans to reduce capital expenditures in 2023. Researcher Ryu said, “They are adjusting factory utilization rates and prefer to hold inventory rather than aggressively sell it, intending to sell when conditions improve next year. If demand falls and supply adjustments happen faster than expected, recovery could also come sooner than in the past.”

Although the cycle will turn downward, excess free cash flow is still expected to be returned to shareholders through share buybacks and dividends. Researcher Hyungkeun Ryu analyzed, “Following this quarter, the next quarter is also expected to see share repurchases, and all remaining cash flow will be returned to shareholders. Setting return targets and adjusting investments to achieve free cash flow is a desirable strategy, and Korean companies should convey a similar message through profitability-focused management.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)