Yuanta Securities Report

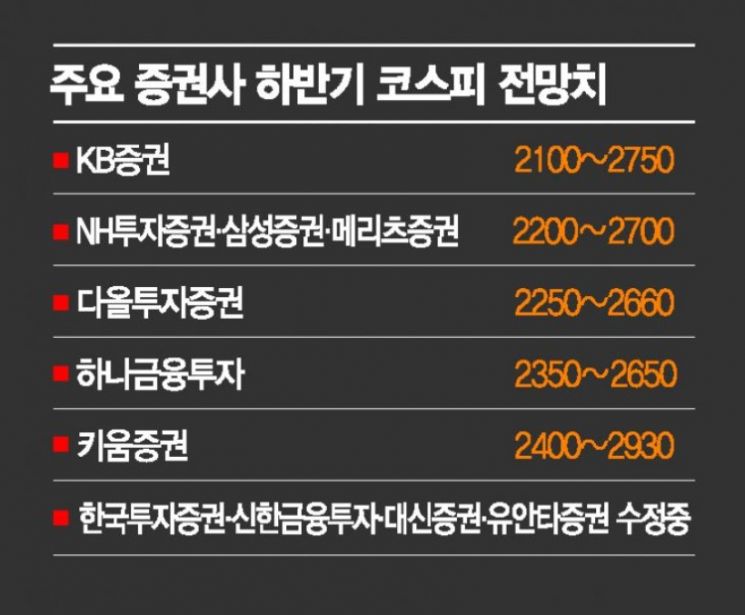

[Asia Economy Reporter Lee Myunghwan] As the domestic stock market enters the second half of the year, securities firms have analyzed that the decline in the stock market during the first half was excessive. There is also a forecast that the market could rebound with the upcoming earnings season in the second half.

According to Yuanta Securities on the 3rd, the KOSPI fell 13.2% last month, marking the largest monthly drop in 3 years and 8 months since the 13.4% decline in October 2018. For the first half of the year, it dropped 21.7%, the largest decline since the 2000s. Yuanta Securities explained that this indicates the recent market conditions are not conducive to positive expectations.

They also pointed out that volatility remains high. The intraday volatility of the KOSPI has exceeded 3%, reaching the highest level since the end of January. However, even after the KOSPI stopped its sharp decline, forced liquidation volumes are still being absorbed, which is expected to ease concerns about internal supply and demand factors. These internal factors have been the cause of the relative weakness of the domestic market compared to global markets.

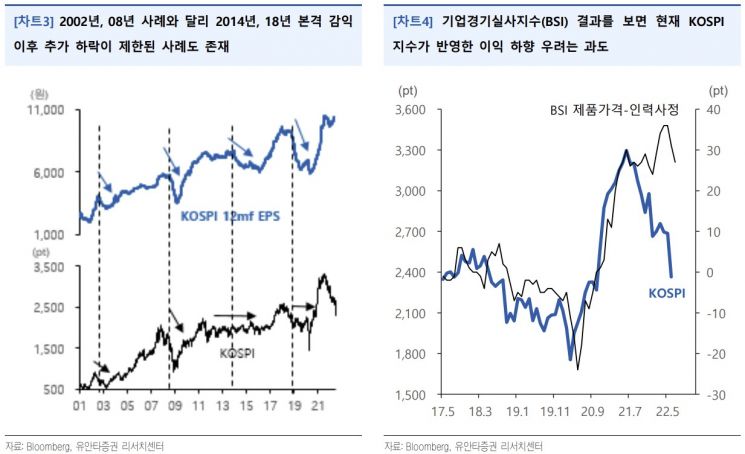

The upcoming Q2 earnings season this month is considered crucial. Yuanta Securities explained that the market is concerned about weakening trust in corporate earnings market forecasts. They noted that since mid-last month, earnings estimates by securities analysts have been trending downward. Since Q2 has just ended and the full earnings season has yet to begin, Yuanta Securities expects the possibility of further downward revisions spreading.

They also explained that companies themselves are feeling the economic downturn. According to the Bank of Korea’s Business Survey Index (BSI) released on the 30th of last month, the business outlook perceived by companies is also deteriorating, Yuanta Securities said.

However, when looking at the BSI and the KOSPI, the concerns reflected in the index about earnings downgrades are considered excessive. Yuanta Securities analyst Kang Daeseok said, "Currently, corporate earnings calculated through valuation and KOSPI prices are about 10% lower than the consensus level," adding, "If concerns reflected in the earnings season do not exceed this level, it could serve as a catalyst for a rebound."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.