On the 1st, a bank in downtown Seoul where financial authorities are implementing high-intensity loan regulations. Photo by Mun Ho-nam munonam@

On the 1st, a bank in downtown Seoul where financial authorities are implementing high-intensity loan regulations. Photo by Mun Ho-nam munonam@

[Asia Economy Reporter Song Seungseop] As the base interest rate rises, loan interest rates are soaring, leading to a rapid increase in interest in fixed interest rates. However, recently on social networking services (SNS) and internet communities, claims that ‘fixed interest rates can also rise depending on the national economy or the bank’s situation’ have been spreading. It is hard to readily understand that fixed interest rates, which mean rates that do not change at all, can be increased. We have looked into the facts.

To get straight to the point, it is true. Although very rare, fixed loan interest rates can increase depending on the situation.

How is it possible for fixed interest rates to rise? The household loan guides or individual credit loan and mortgage loan documents of the four major banks (KB Kookmin, Shinhan, Hana, and Woori Bank) do not contain such information. They only state that the fixed interest rate is ‘the rate decided at the time of loan execution and applied uniformly during the agreed period.’

However, the ‘Bank Loan Transaction Basic Terms and Conditions’ contain somewhat different content. The Bank Loan Transaction Basic Terms and Conditions are the most fundamental rules that banks and customers must follow when exchanging money. Since the loan documents are usually very extensive, many people overlook them, but these terms apply to almost all loans.

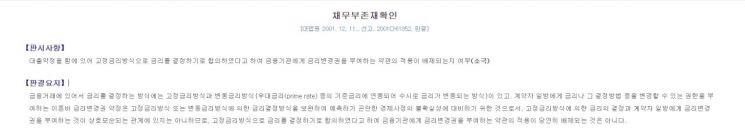

The content related to interest rates appears in Article 3, Paragraph 2, ‘Interest and Delayed Compensation.’ Two types of interest rate methods are presented: ‘the principle that the bank cannot change the rate until the debt is fully repaid (fixed interest rate)’ and ‘the bank can change the rate at any time until the debt is fully repaid (variable interest rate).’

However, an exception clause appears in Paragraph 3. Even if a fixed interest rate is chosen, ‘in cases of significant changes in circumstances that could not have been anticipated at the time of contract due to sudden changes in the national economy or financial conditions, the bank may increase or decrease the rate by individually notifying the debtor.’ In other words, fixed interest rates are only a ‘principle,’ and adjustments can be made if a serious crisis occurs.

Why does such a clause exist? From the bank’s perspective, fixed interest rates represent a kind of risk. It is virtually impossible to predict financial conditions decades later or crises such as war, natural disasters, or national default. If the low fixed interest rate could never be changed even in emergencies, banks could collapse during a financial crisis, which would lead to a greater national crisis. Therefore, this clause is established.

There has been an actual case. In 1997, Mr. Yoon borrowed 100 million KRW from Dongyang Card at a fixed interest rate of 15% per annum. The problem arose when the International Monetary Fund (IMF) crisis hit, worsening Dongyang Card’s financial situation. Dongyang Card notified Mr. Yoon that it would raise the interest rate to 24%, citing the rapid changes in the domestic financial market.

Mr. Yoon filed a lawsuit claiming the action was unfair, but in 2001, the Supreme Court ruled in favor of Dongyang Card. The Supreme Court stated, “There is no contradiction between determining the interest rate by a fixed interest rate method and granting the financial institution the right to change the interest rate unilaterally,” and “Agreeing to determine the interest rate by a fixed interest rate method does not exclude the application of terms granting the financial institution the right to change the interest rate.”

At first glance, this may seem like a clause that favors banks unilaterally, but that is not necessarily the case. Paragraph 8 guarantees the financial consumer’s right to choose. If the bank changes the fixed interest rate contract terms causing disadvantages, the borrower can terminate the contract. The borrower must notify the bank within one month from the time they are required to pay interest at the changed rate. The original fixed interest rate at the time of contract applies for the remaining period.

Also, the possibility of a bank’s ‘fixed interest rate change’ decision is extremely low. This right is exercised very restrictively only in unavoidable, severe crises. If a bank exercises this authority recklessly, it may become embroiled in legal disputes or lose consumer trust in the financial market.

Concerns that fixed-rate loans will rise soon are largely unfounded. Although the base interest rate has risen sharply and risks such as the Russia-Ukraine war persist, they are not enough to collapse the national economy. If you are considering fixed versus variable interest rates in practice, it is wiser to consider your current financial situation rather than a low-probability crisis in the distant future.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.