[Asia Economy Reporter Buaeri] It has been confirmed that the number of subscribers surpassed 30 million just five years after the launch of internet-only banks in 2017.

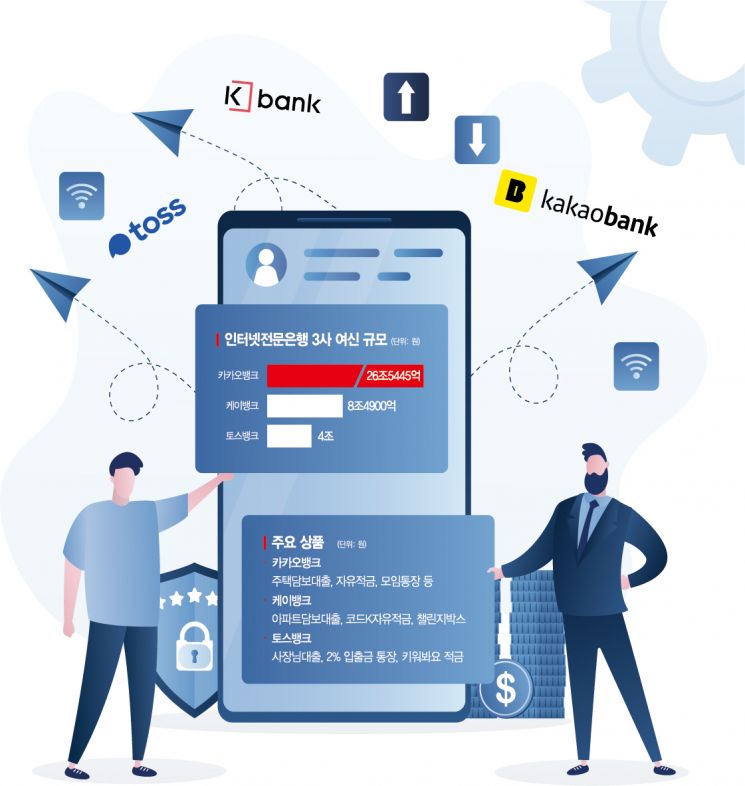

According to the three internet-only banks on the 2nd, the total number of subscribers is 30.53 million. Kakao Bank has 19.13 million subscribers, K Bank has 7.8 million, and Toss Bank has 3.6 million (as of June).

Internet-only banks are aggressively attracting users by targeting the MZ generation (Millennials + Generation Z) and expanding their reach to middle-aged and older customers. Looking at the age distribution of Toss Bank customers, which opened the latest in October last year, 20s (25.1%) and 30s (25.4%) are as many as 40s (23.8%) and 50s and older (19.2%). For Kakao Bank and K Bank, the proportion of customers aged 50 and over (as of May) reached 18% and 17%, respectively.

Loan amounts are also rapidly increasing, approaching a total of 40 trillion won. As of the end of May, Kakao Bank recorded 26.5445 trillion won, K Bank 8.49 trillion won, and Toss Bank surpassed 4 trillion won this month.

Internet-only banks are growing by reinterpreting existing commercial bank products. In the case of mortgage loans, a traditional counter sales product of commercial banks, Kakao Bank targeted users with a dramatically more convenient non-face-to-face method. The non-face-to-face mortgage loan launched by Kakao Bank in February features a ‘conversational’ interface similar to chatting on KakaoTalk. The average time to check loan eligibility and interest rates is 3 minutes and 29 seconds. The accumulated contract amount has exceeded 262 billion won. The proportion of customers in their 40s and 50s also reaches 43%.

In addition, Kakao Bank has captivated not only young customers but also senior customers with ideas that reinterpret existing products, such as free savings accounts without fixed payment dates or installments, group accounts, and piggy banks that collect balances. In particular, the group account has a 38.2% ratio of customers in their 40s to 60s.

Toss Bank is also chasing the two leading banks with a similar strategy. Toss Bank is prominently displayed at the top of the Toss platform, which has 22 million subscribers. It also attracted users by launching a deposit and withdrawal account with an annual interest rate in the 2% range. Toss Bank is also preparing to launch a ‘group account.’

Unlike Kakao and Toss, K Bank, which finds it difficult to expect platform effects, increased subscribers through an active partnership strategy. In June 2020, during the coin craze, K Bank raised its awareness by partnering with Upbit and increased its subscribers by nearly 5 million in 2021 alone. Since then, K Bank has maintained a ‘lock-in effect’ by offering the best interest rates in the industry. K Bank offers unconditional fixed deposits with an annual interest rate in the 3% range and savings accounts with rates in the 5% range.

However, long-term growth strategies remain a challenge. Seo Ji-yong, a professor at Sangmyung University’s Department of Business Administration, advised, "The profit models of internet-only banks are similar to those of commercial banks. They need to expand non-interest income and diversify fee income models by popularizing trust services."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)