First Half Trade Deficit Hits Record $10.3 Billion

Concerns Over Export Slowdown Amid Three Consecutive Months of Trade Deficits

Prolonged Global Dollar Strength Increases High Exchange Rate Burden

Market Watches for Possible 'Big Step' Rate Hike by Monetary Policy Committee This Month

[Asia Economy Reporter Seo So-jeong] South Korea's trade deficit in the first half of this year reached a record high of $10.3 billion, triggering alarm bells for the Korean economy, which is highly dependent on exports. Amid a situation where import values exceed export values due to a sharp rise in international raw material prices, economic agents are facing increased difficulties compounded by high inflation, high exchange rates, and high interest rates.

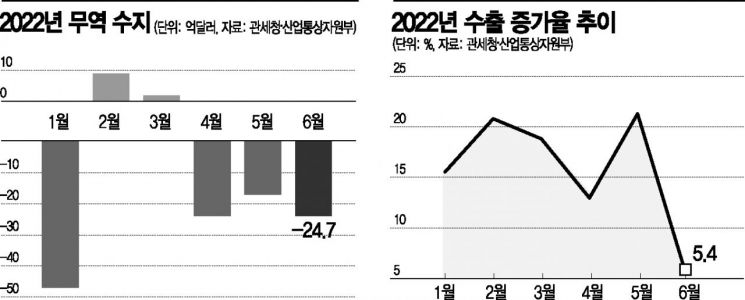

According to the Ministry of Trade, Industry and Energy on the 1st, the trade deficit for the first half of this year was $10.3 billion (approximately 13 trillion KRW), marking the largest deficit for the first half of any year on record. The trade balance in June showed a deficit of $2.47 billion, continuing a three-month streak of deficits since April. This is the first time in 14 years since the global financial crisis in 2008 (June to September) that the trade balance has recorded deficits for three consecutive months.

◆Government: "Export conditions in the second half are also challenging"= Exports in the first half performed well at $350.3 billion, up 15.6% from the same period last year, but imports increased by 26.2% to $360.6 billion, surpassing exports and resulting in a trade deficit of $10.3 billion.

As concerns over export slowdown grew with three consecutive months of trade deficits, the government began preparing countermeasures. At a meeting with export company representatives, Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho said, "Export companies are facing considerable difficulties due to rising raw material prices, supply chain instability, and exchange rate fluctuations," adding, "Considering that most of these difficulties are external factors unlikely to improve in the short term, export conditions in the second half are expected to remain challenging." He emphasized, "We will carefully review the difficulties and suggestions from the export sector and actively reflect them in future policies to revitalize exports."

Bang Ki-sun, First Vice Minister of the Ministry of Economy and Finance, presided over an emergency economic vice-ministerial meeting and said, "We are reviewing support measures that need to be implemented immediately to resolve export difficulties and activate exports in the second half," adding, "We will also actively seek mid- to long-term policy directions to fundamentally and structurally enhance export competitiveness so that exports can continue to serve as the engine of our economic growth."

The government's proactive stance on countermeasures stems from the fact that if exports, which support the Korean economy, falter, it could be interpreted as a signal of economic recession. Particularly, the trade deficit caused by the sharp rise in energy and raw material prices is unlikely to be resolved in the short term, heightening the sense of crisis. Additionally, the exchange rate fluctuating around the 1,300 KRW level is increasing uncertainty. So far, the won-dollar exchange rate has exceeded 1,300 KRW only three times: during the 1997 foreign exchange crisis, the 2001 dot-com bubble burst, and shortly after the 2009 financial crisis.

According to the Seoul foreign exchange market on the day, the won-dollar exchange rate opened at 1,290.0 KRW, down 8.4 KRW from the previous day, but gradually increased, approaching the 1,300 KRW level. The exchange rate, which had surged to a new high of 1,303.7 KRW during the previous day's session, declined overnight as the U.S. Personal Consumption Expenditures (PCE) price index showed a slower increase, reigniting speculation about a peak in inflation. However, experts predict that the global dollar strength trend will continue for the long term, maintaining a high exchange rate situation for the time being, and suggest keeping the upper limit of the exchange rate open up to 1,350 KRW.

Bank of Korea Governor Lee Chang-yong holds a briefing on the status of price stability target operations at the Bank of Korea press room in Jung-gu, Seoul, on the 21st. Photo by Moon Ho-nam munonam@

Bank of Korea Governor Lee Chang-yong holds a briefing on the status of price stability target operations at the Bank of Korea press room in Jung-gu, Seoul, on the 21st. Photo by Moon Ho-nam munonam@

◆Bank of Korea's 'Big Step' dilemma... Household debt ticking time bomb= As domestic and international conditions surrounding the Korean economy worsen, difficulties in monetary policy management are increasing. Market attention is focused on whether the Bank of Korea's Monetary Policy Committee will take the unprecedented 'big step' (a 0.5 percentage point interest rate hike at once) at its meeting on the 13th. Some predict that with inflation rates soon reaching the 6% range, the Monetary Policy Committee will take a big step to curb high inflation. The high-intensity tightening by the U.S. Federal Reserve (Fed) to control inflation, along with concerns about capital outflows due to interest rate inversion between Korea and the U.S., also support the possibility of a big step.

Kim Han-soo of the Korea Capital Market Institute said, "The recent situation is one where uncertainties such as the possibility of stagflation?characterized by rising inflation accompanied by economic recession?and global liquidity contraction due to accelerated quantitative tightening by major countries are increasing simultaneously," adding, "Based on past experience, optimistic forecasts that the impact of U.S. interest rate hikes will be limited are difficult to maintain."

However, household loans amounting to 1,752.7 trillion KRW as of the end of March this year remain a variable. With a high proportion of variable interest rates, rapid interest rate hikes could directly impact borrowers, acting as a burden. Bank of Korea Governor Lee Chang-yong said on the 21st of last month, "The big step is not decided solely based on inflation. We also need to consider the impact on our economy and exchange rates when inflation rises," adding, "Since Korea has many variable-rate bonds, we need to comprehensively consider household interest burdens and create an appropriate combination with Monetary Policy Committee members."

Regarding this, Professor Sung Tae-yoon of Yonsei University's Department of Economics said, "Considering the scale of U.S. policy rate hikes, an increase in Korea's base rate is inevitable," adding, "The continued high inflation situation and the soon-to-be-realized interest rate inversion between Korea and the U.S. could burden financial markets, and the depreciation of the won due to interest rate inversion could further stimulate inflation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)