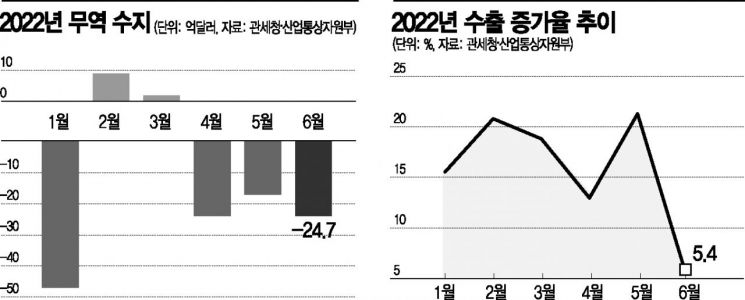

Last Month's Export Growth Rate 5.4%... Nearly Four Times Lower Than Previous Month

Energy Import Increase Leads to First Half Trade Deficit of $10.3 Billion

High Inflation, High Exchange Rates, High Interest Rates... Price Surge → Consumption Contraction → Economic Recession Concerns

[Asia Economy Sejong=Reporter Kwon Haeyoung, Sejong=Reporter Lee Junhyung] In the export-import statistics for the first half of this year, alongside the trade deficit exceeding 10 billion dollars, a noteworthy indicator is the export growth rate falling to single digits for the first time in 16 months. Given South Korea's economic structure that relies heavily on trade, a slowdown in exports is interpreted as a sign of a global economic downturn. Amid a 'complex crisis' where domestic and international adversities such as high inflation, high exchange rates, high interest rates, the Ukraine war, and supply chain instability have hit simultaneously, even the export sector, which has been a pillar of the economy, is cooling down. This has raised calls for the government and businesses to actively prepare for downside risks to the economy.

◆Declining Export Growth Rate=According to the Ministry of Trade, Industry and Energy on the 1st, the export growth rate last month was 5.4%, shrinking nearly fourfold compared to the previous month (21.3%). The export growth rate also showed a declining trend in March (18.8%) and April (12.9%). Although there was a brief increase in May, it was largely due to two additional working days. The fact that the export growth, which had set record highs last year, has faltered is increasing concerns about a global economic downturn. In fact, Samsung Electronics' inventory turnover days increased by two weeks compared to a year ago to 94 days, marking a record high, indicating signs of economic slowdown. Terms of trade are also worsening. According to the Bank of Korea, the net goods terms of trade index in May was 85.33, down 10.6% year-on-year. On the same day, Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho said at a meeting with export companies held at the Namdong National Industrial Complex in Incheon, "There are considerable difficulties faced by export companies due to rising raw material prices, supply chain instability, and exchange rate fluctuations," adding, "Considering that most of the difficulties faced by export companies are external factors that are not easily improved in the short term, export conditions in the second half of the year will not be easy."

Moreover, due to the ripple effects of supply chain instability causing energy prices to surge, the cumulative trade deficit for the first half of this year reached a record high of 10.3 billion dollars. The prices of the three major energy sources?crude oil (60%), gas (229%), and coal (223%)?have soared significantly over the past year as of the first half of this year. Consequently, energy import costs in the first half amounted to 87.9 billion dollars, nearly double the 46.9 billion dollars recorded in the same period last year. The problem is that the sharp rise in international oil and grain prices suggests that the trade deficit is likely to continue in the second half of the year. According to the Korea International Trade Association, there is an analysis that the annual trade balance this year could reach a deficit of 14.7 billion dollars, the largest since the 2008 financial crisis.

◆Arrival of a Complex Crisis... Recession to Intensify from the Second Half=The problem is not only with exports but also that various domestic and international adversities such as high inflation, high exchange rates, and high interest rates are occurring in rapid succession, interacting with each other and amplifying the crisis. Domestic consumer prices have surged due to massive liquidity released after COVID-19, demand recovery, and the impact of war, reaching 4.1% in March, 5.4% in May, and possibly surpassing 6% in June this year. There are considerable concerns that inflation could reach 7-8% in the second half. Recently, signs of 'wage-driven inflation' have become visible, where high prices stimulate wage increases, which in turn push prices higher. Rapid inflation suppresses consumption and ultimately leads the economy into recession.

Interest rate hikes are expected to continue until soaring inflation is controlled. If inflation hits the 6% range in June, the Bank of Korea is likely to implement a 'big step' (a 0.5 percentage point hike at once). Countries including the United States are also rapidly raising interest rates in the fight against inflation, and with the spread of global financial market instability, the won-dollar exchange rate is fluctuating above 1,300 won. Furthermore, the war and supply chain instability that have hit simultaneously are unlikely to be resolved in the short term.

Particularly, concerns are high because this crisis differs from past ones. In the past, economic crises had simple causes such as high inflation (1970s-1980s oil shocks), high exchange rates (1997 foreign exchange crisis), or financial soundness issues (2008 global financial crisis). This time, all adversities have occurred simultaneously, interacting in a chain reaction that worsens the situation. Now, the fear has shifted beyond 'S (stagflation: inflation during economic stagnation)' to 'R (recession: economic downturn)'.

Professor Kang Sungjin of the Department of Economics at Korea University said, "In the past, economic crises occurred due to a single cause, and the economy recovered once that cause was resolved, but in a complex crisis like now, it is difficult to resolve in the short term," adding, "The Bank of Korea should focus all its efforts on raising interest rates quickly to control inflation, and the government should concentrate on minimizing damage to ordinary citizens and vulnerable groups caused by high interest rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.