Real Estate R114 Survey of Over 2,200 Home Buyers

4 out of 10 Predict Price Decline... Only 24% Expect Increase, Halved

Reasons for Decline: 'Economic Downturn and Interest Rate Hikes'

[Asia Economy Reporter Kim Hyemin] The outlook for falling house prices has surpassed the outlook for rising prices for the first time in three years. This is the result of a survey conducted on more than 2,200 actual homebuyers.

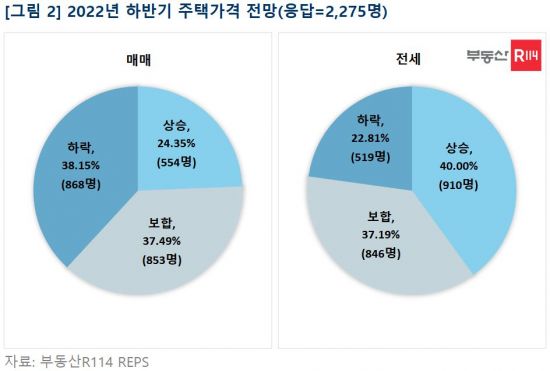

Real Estate R114 announced on the 30th that, based on a survey conducted from the 7th to the 20th over 14 days targeting 2,275 people nationwide on the '2022 Second Half Housing Market Outlook,' 4 out of 10 respondents expected housing transaction prices to fall. This is the first time in about three years since the first half of 2019 that the outlook for a decline has overtaken the outlook for an increase.

Compared to the previous survey six months ago, the proportion of respondents expecting a decline expanded from 14% to 38%, while those expecting an increase shrank from 48% to 24%. The outlook for stability was 37.5%, showing little change from the previous survey (37.5%).

Among those who predicted a decline, 34.56% cited the possibility of an economic recession as the main reason. Responses attributing it to the possibility of loan interest rate hikes accounted for 33.76%. Real Estate R114 diagnosed, "While inflation is rising, economic growth is slowing, reducing consumer purchasing power. Interest rate hikes to curb inflation are accelerating, increasing interest burdens and causing demand to withdraw."

Following this, 'weakening buying demand due to loan regulations' accounted for 11.75%, 'lack of transaction volume due to price burden' was 10.83%, 'expectations for pre-sale and public housing supply' was 3%, and 'increase in listings from rental business operators and multi-homeowners' was 2.88% in order.

On the other hand, among respondents who predicted a rise, 27.8% pointed to 'rising apartment prices in central areas such as Seoul.' This was followed by 'balloon effect on less risen areas' at 14.62%, 'activation of the apartment pre-sale market' at 12.45%, 'rise in sales prices due to rising jeonse prices' at 11.9%, and 'activation of redevelopment and reconstruction maintenance projects' at 11.55%.

The outlook for jeonse prices still favored an increase (40%) over a decrease (22.81%). However, considering that the previous survey showed a 62.3% expectation for an increase, the proportion expecting a rise has somewhat decreased.

Among respondents who answered that jeonse prices would rise, 42.2% expected an increase in jeonse demand due to weakened buying sentiment. This means that buying sentiment, which has been dampened by price burdens, interest rate hikes, and loan regulations, could relatively increase demand in the jeonse market, heightening price instability concerns. Responses expecting a shortage of jeonse supply due to landlords' preference for monthly rent were also high at 18.9%. Other factors for the increase included ▲the impact of the implementation of the Lease 3 Act (13.52%), ▲shortage of move-in supply in some popular areas such as Seoul (12.31%), and ▲temporary increase in jeonse residence for subscription (pre-subscription) purposes (11.87%) in order.

Conversely, respondents who chose a decline in jeonse prices cited the recent sharp rise in jeonse prices over the past 2-3 years (28.7%) as the main reason. This was followed by ▲decrease in jeonse demand due to conversion to existing home sales (22.54%), ▲increase in jeonse listings due to gap investment (18.88%), ▲effectiveness of government measures to stabilize the lease market (17.15%), and ▲landlords' risk of returning jeonse deposits (11.75%) as reasons for the decline in jeonse prices.

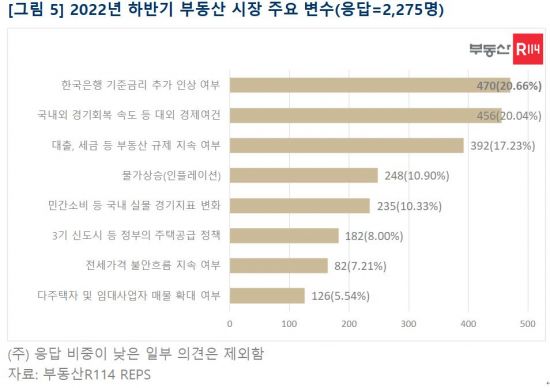

Among all respondents, 4 out of 10 selected 'whether the Bank of Korea will raise the base interest rate further (20.66%)' and 'external economic conditions such as the speed of domestic and international economic recovery (20.04%)' as the key variables in the real estate market in the second half of this year. This was followed by ▲whether real estate regulations such as loans and taxes will continue (17.23%), ▲inflation (10.90%), ▲changes in domestic real economy indicators such as private consumption (10.33%), ▲government housing supply policies such as the 3rd New Town (8.00%), and ▲whether the unstable trend in jeonse prices will continue (7.21%).

Meanwhile, Real Estate R114 has been conducting the housing market outlook survey twice a year since 2008. The survey's sampling error is ±2.05 percentage points at a 95% confidence level.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)