Weakening Export Competitiveness and Supply Chain Disruptions Due to Rising Raw Material Prices

[Asia Economy Reporter Park Sun-mi] Due to the global raw material supply shortage and supply chain disruptions, it is forecasted that South Korea's export growth will significantly slow down in the second half of this year.

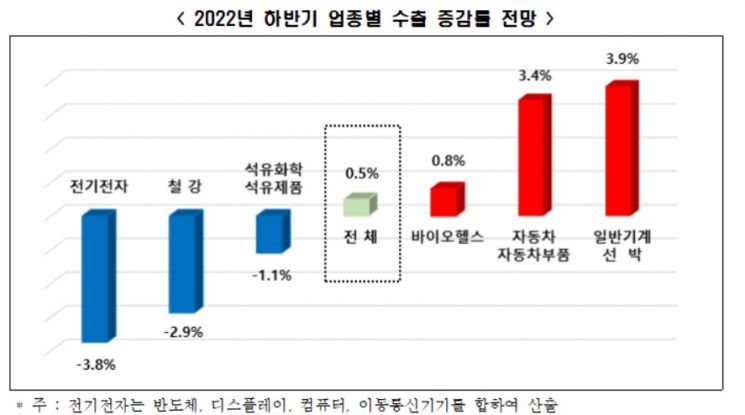

On the 1st, the Federation of Korean Industries (FKI) commissioned market research firm Monoresearch to conduct the "2022 Second Half Export Outlook Survey" targeting 12 major export industries among the top 1,000 companies by sales. The results showed that companies on average expect exports in the second half of this year to increase by only 0.5% compared to the same period last year.

Industries such as ▲Electrical and Electronics (-3.8%), ▲Steel (-2.9%), and ▲Petrochemicals and Petroleum Products (-1.1%) are expected to see a decline in exports compared to the same period last year. Conversely, ▲Biohealth (+0.8%), ▲Automobiles and Auto Parts (+3.4%), and ▲General Machinery and Shipbuilding (+3.9%) are expected to experience export growth in the second half of this year.

Companies forecasting a decline in exports compared to the same period last year cited major factors such as ▲Weakened export competitiveness due to rising raw material prices (41.2%), ▲Supply chain difficulties including increased maritime and air logistics costs (21.9%), and ▲Deterioration of economic conditions in key export destinations (21.1%). On the other hand, companies expecting export growth pointed to ▲Easing of COVID-19 and revitalization of global trade (45.1%), ▲Increased price competitiveness due to a weaker Korean won (21.3%), and ▲Rising export unit prices due to inflation (16.4%) as key reasons.

42% of respondent companies answered that export profitability in the second half of this year will be similar to the same period last year, while 40% said it would worsen. Factors contributing to the decline in export profitability included ▲Rising prices of raw materials such as crude oil, minerals, and agricultural products (39.8%), ▲Increased logistics costs such as higher shipping rates (31.5%), and ▲Rising interest expenses due to interest rate hikes (15.7%).

Additionally, the appropriate KRW-USD exchange rate level for South Korean companies to maintain export profitability in the second half of this year was surveyed at 1,206.1 won. If the high exchange rate approaching 1,300 won persists, further deterioration in export profitability is inevitable.

Meanwhile, companies identified the government's policy priorities to strengthen export competitiveness as resolving raw material supply difficulties (35.2%), alleviating export logistics issues such as maritime transport (34.0%), and resolving diplomatic issues such as Korea-Japan relations and the US-China trade dispute (15.4%). To address raw material supply challenges, respondents said the government should expand support for raw material purchase funds (32.1%), abolish tariffs on crude oil and bunker C fuel oil (26.1%), and promote overseas resource development (17.9%).

Yoo Hwan-ik, head of the Industry Division at FKI, stated, “As export growth, a major pillar of our economy, is expected to slow down, the government needs to focus more on creating an environment to improve export performance by securing raw material supply chains and resolving export logistics difficulties.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)