National Tax Service Releases Q2 National Tax Statistics

[Asia Economy Sejong=Reporter Kim Hyewon] The scale of inherited and gifted assets exceeded 100 trillion won for the first time ever last year.

Although the inheritance of the late Samsung Chairman Lee Kun-hee, who passed away in October 2020 and whose inheritance tax was reported last year, accounted for a large portion, the rise in stock and real estate prices as well as gifts of apartments and villas also had an impact.

Due to the rise in publicly announced land prices, the number of people paying comprehensive real estate holding tax (종부세) and the amount of tax paid increased significantly. The number of corporations filing corporate tax was 906,000, with a total tax burden of 60.2 trillion won.

According to the second quarter national tax statistics released by the National Tax Service on the 30th, the total value of reported inherited and gifted assets last year was 116.5 trillion won, an increase of 64.1% compared to the previous year. This is the largest scale ever recorded.

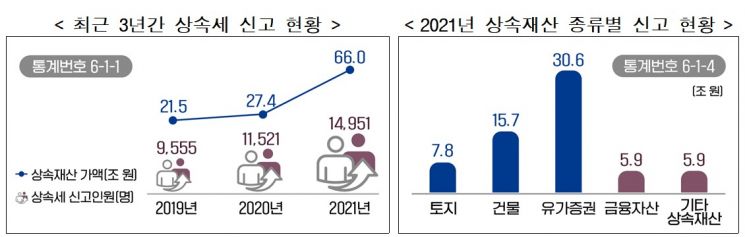

The value of inherited assets was 66 trillion won, a 140.9% increase from 2020. Securities (30.6 trillion won) accounted for the largest portion of inherited assets, followed by buildings (15.7 trillion won) and land (7.8 trillion won). The significant increase in inherited assets last year is believed to be due to the inheritance tax filing by the family of the late Chairman Lee Kun-hee.

The number of inheritance tax filers also increased by 29.8% to 14,951 compared to the previous year. The National Tax Service analyzed that the increase in the number of filers was due to the rise in asset prices such as real estate and stocks, which expanded the scope of inheritance tax reporting.

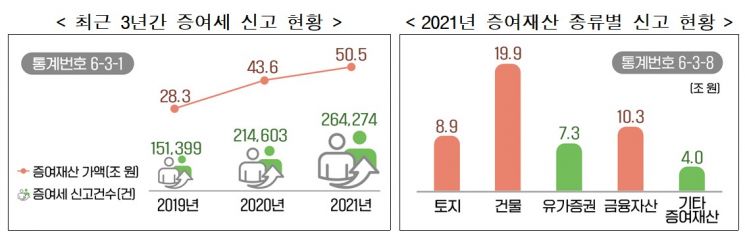

The value of gifted assets last year was 50.5 trillion won, up 15.8% from 2020. Gifted assets were mostly buildings (19.9 trillion won), followed by financial assets (10.3 trillion won) and land (8.9 trillion won). The number of gift tax filings was 264,000, an increase of 22.8% from 2020. The increase in gifted assets and gift tax filings is attributed to the increased burden of holding taxes, which led to more gifts of houses including apartments.

Due to the rise in publicly announced land prices, the number of people paying comprehensive real estate holding tax and the amount of tax paid increased significantly last year. The decided tax amount for 종부세 was 7.3 trillion won, an 87.2% increase from 2020. The number of people subject to 종부세 also increased by 36.7% to 1,017,000. This is the first time the number of people subject to 종부세 exceeded one million. Seoul (474,000) and Gyeonggi (234,000) accounted for 76.0% of the number of people subject to 종부세 on housing last year.

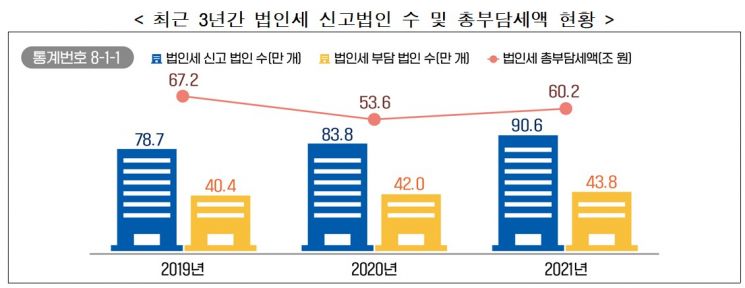

The number of corporations filing corporate tax last year was 906,000, with a total tax burden of 60.2 trillion won. There is a difference compared to the government’s corporate tax revenue of 70.4 trillion won in the fiscal year settlement, because the fiscal year settlement corporate tax revenue includes the finalized 2020 tax returns and the mid-term prepayments for the first half of 2021, whereas the total tax burden mostly reflects the 2020 tax year.

The number of corporations filing corporate tax increased by 8.1% compared to 2020, and the total tax burden increased by 12.3%. The increase in total tax burden is analyzed to be due to increased operating profits from cost-cutting efforts, despite corporate sales not increasing significantly due to the COVID-19 pandemic.

Among corporations filing corporate tax, 48.3% (438,000) actually paid corporate tax. This means that more than half either reported losses or received tax credits and did not pay corporate tax.

The number of filing corporations was highest in the service sector (200,000), but the total tax burden was highest in manufacturing (20.3 trillion won), followed by finance and insurance (14 trillion won), and construction (6.6 trillion won).

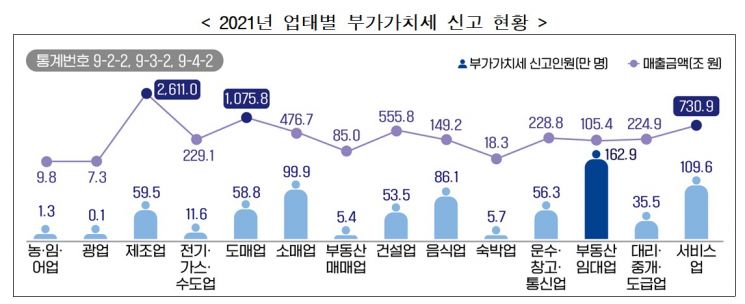

The number of value-added tax (VAT) filers last year was 7,464,000, an increase of 5.0% from the previous year. The real estate rental business had the highest number of filers at 1,629,000.

The payable amounts for consumption taxes were 9.4 trillion won for individual consumption tax, 3.1 trillion won for liquor tax, 15.5 trillion won for transportation, energy, and environment tax, 9.9 trillion won for securities transaction tax, and 1 trillion won for stamp tax.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.