[Asia Economy Reporter Song Hwajeong] As internet banks strive to increase the proportion of loans to medium- and low-credit borrowers, concerns are emerging that such loans may be a factor slowing the growth rate of internet banks.

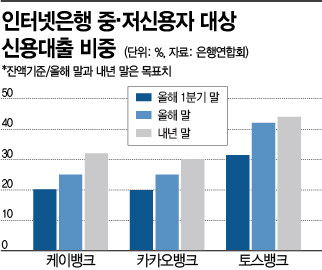

According to the Korea Federation of Banks on the 1st, the target proportion of medium- and low-credit loans by the end of this year is 25% each for KakaoBank and K Bank, and 42% for Toss Bank. By the end of next year, the plan is to raise this proportion to 30% for KakaoBank, 32% for K Bank, and 44% for Toss Bank.

Contrary to the founding purpose of internet banks to activate the supply of loans to medium- and low-credit borrowers, there were criticisms that they were operating mainly for high-credit borrowers. In response, financial authorities demanded improvements last year, and each internet bank submitted plans to the authorities to raise the proportion of medium- and low-credit loans to over 30%. Internet banks had agreed to increase the proportion of medium- and low-credit loans by the end of last year to 20.8% for KakaoBank, 21.5% for K Bank, and 34.9% for Toss Bank, but except for Toss Bank, they failed to meet the targets. Accordingly, in the first quarter of this year, they actively expanded the proportion, achieving 20.2% for K Bank, 19.9% for KakaoBank, and 31.4% for Toss Bank as of the first quarter.

The problem is that this expansion of medium- and low-credit loan supply could cause a slowdown in the growth of internet banks. Since medium- and low-credit loans have short maturities, it is difficult to increase the outstanding balance, and to raise the proportion based on the balance, the outstanding balance of the main product, credit loans, decreases, which can act to slow the growth rate. Lee Byung-geon, a researcher at DB Financial Investment, analyzed, "Medium- and low-credit loans generally have to have short maturities, so internet banks have recently launched new loans with maturities of over five years, but most are still executed with maturities around one year, so to increase the balance, there is the burden of reprocessing existing loans." In the case of KakaoBank, until the first half of last year, the difference between the amount of medium- and low-credit loans handled and the increase in balance was not large, but for the whole of last year, the amount of medium- and low-credit loans handled was 1.7 trillion won, but the balance increased by only 1 trillion won.

Due to the goal of achieving medium- and low-credit loan targets this year, growth expectations are also expected to be lowered. Kim Hyunki, a researcher at Hi Investment & Securities, said, "Even if the medium- and low-credit targets are achieved during the year, the growth rate of high-credit loans will be adjusted to some extent to maintain the proportion," adding, "Since the interest rate level for borrowers is also burdensome, growth expectations for this year should be somewhat lowered."

The increasing credit risk due to the rise in medium- and low-credit loans is another risk factor. Since the credit risk of medium- and low-credit borrowers is naturally higher than that of high-credit borrowers, the soundness of medium- and low-credit loans is relatively lower. Moreover, the rising interest rates are also a burdensome situation. Researcher Kim pointed out, "In a low-interest-rate environment, the interest rate level itself is low, so the burden on medium- and low-credit loan borrowers is relatively low, but in the current phase of rising interest rates, the interest burden increases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.