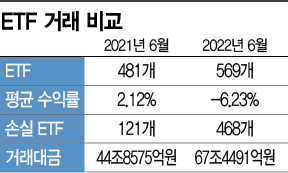

[Asia Economy Reporter Ji Yeon-jin] It has been revealed that about 80% of domestic Exchange-Traded Funds (ETFs) listed in Korea recorded negative returns this month. Individual investors who suffered losses investing in stocks during last year's stagnant market have shifted to ETFs this year, but even this could not avoid losses.

According to the Korea Exchange on the 30th, out of 569 domestic listed ETFs, 468 recorded losses. The average return was -9.52%. During this period, the 'TIGER KOSDAQ150 Leverage ETF' fell by 28.09%, marking the lowest returns among leverage ETFs based on the KOSDAQ150 index. On the other hand, 101 ETFs recorded positive returns during the same period, with the 'TIGER China Electric Vehicle SOLACTIVE ETF,' based on Chinese electric vehicle-related stocks, achieving the highest return of 32.33%.

Additionally, ETFs betting on the rise of Chinese companies and indices, including 'KINDEX China Mainland CSI300 Leverage (Synthetic)' (29.02%), posted solid returns exceeding 10%. Inverse ETFs, which expect profits when indices such as KOSPI200 and KOSDAQ150 fall, also showed positive returns.

Individual investors, having suffered losses from stock investments during last year's prolonged stagnant market, massively moved into the ETF market this year. In June last year, the domestic ETF trading volume slightly exceeded 44 trillion KRW, but it grew to 67 trillion KRW within a year. This reflects the expectation that ETFs, which diversify investments across multiple stocks, can significantly reduce losses.

However, with the U.S. interest rate hikes fully underway this year, the sell-off by foreign investors focused on large-cap stocks intensified the decline, causing related ETF returns to plummet. The KOSPI index, the underlying asset of ETFs, fell 10.57% this month up to the previous day, and the KOSDAQ index dropped 14.45%. The KOSDAQ150 index and KOSPI200 index also fell 14.13% and 10.74%, respectively. Park Seung-jin, a researcher at Hana Financial Investment, said, "Even if the stock market rebounds, the main background is the expectation of easing tightening caused by fundamental concerns, so it is difficult to expect an immediate market direction change," adding, "From a return defense perspective, portfolios should be maintained focusing on high-dividend ETFs, Chinese internet and large-cap Chinese stocks, and large technology stocks where investment and share buybacks can continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.