[Asia Economy Reporter Lee Seon-ae] Where does the domestic stock market stand now? How much has been reflected? When evaluating valuation considering profitability (ROE), it was diagnosed that the return on equity (ROE) embedded in the KOSPI valuation (PBR) is at about 7.9%, close to the historical lowest ROE. The only time KOSPI fell below an ROE of 8% since 2005 was around the COVID-19 shock in 2020.

On the 30th, Lee Jin-woo, head of the investment strategy team at Meritz Securities, said, "Although there are clear limitations to valuation in a highly uncertain market, it can help to understand the market position," adding, "The reason for the low ROE of KOSPI is partly due to the inefficiency of equity (excess capital), but the current index level largely reflects concerns about deteriorating profitability."

He continued, "If we apply the historically lowest ROE level of around 7%, the appropriate value of KOSPI is derived at the 2200 level," adding, "This is the margin of deterioration in profitability that can be assumed."

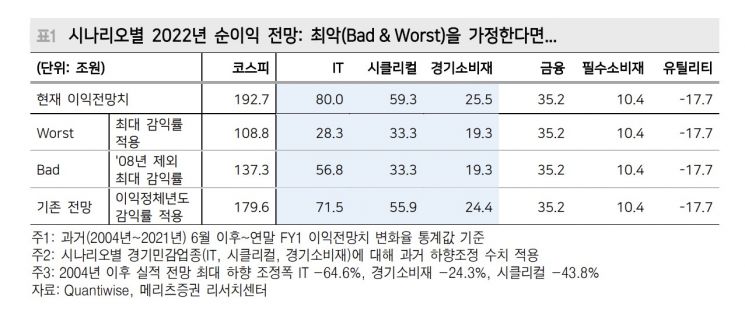

Even when viewed as an adjustment of expectations for earnings forecasts rather than profitability, the result is similar. This assumes a high likelihood of downward revisions in corporate earnings forecasts going forward. If earnings forecasts are revised downward to the historical maximum level (maximum by sector) over the next six months (excluding the 2008 financial crisis), the 2022 KOSPI net profit, currently formed at 193 trillion KRW, would be revised down to about 137 trillion KRW, implying a downward adjustment of about 55 trillion KRW in earnings.

Applying the maximum earnings reduction rate including the financial crisis level (excluding secondary shocks such as financial insolvency), earnings forecasts would be revised down to about 109 trillion KRW. This figure includes the assumption that earnings forecasts for the IT sector, including semiconductors, would plummet from the current 80 trillion KRW to 28 trillion KRW.

When inferring the KOSPI band according to the earnings level, a net profit level of about 137 trillion KRW is similar to 2017 (annual net profit of 143 trillion KRW), when KOSPI fluctuated between 2000 and 2500 points. The 109 trillion KRW net profit level is relatively similar to 2016 (annual net profit of 95 trillion KRW). The KOSPI trajectory in 2016 was in the mid-1800 to 2000 range. Assuming that the earnings level and KOSPI movement are linked (with similar valuation), the current KOSPI, hovering around 2300 points, is at the midpoint level of 2017 when earnings were about 143 trillion KRW. From an earnings perspective, it reflects a scenario applying the maximum earnings reduction rate excluding the financial crisis.

Lee said, "There is no definitive answer on whether bad news has been pre-reflected," but judged, "From a measurable scenario perspective, the current KOSPI reflects the lowest level of ROE (7.8%) in terms of ROE and a pessimistic earnings reduction scenario (maximum earnings reduction rate excluding the financial crisis) in terms of earnings."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)