The Moon Administration Advocated for Localization Against Japan... Yet Import Dependence Remains Absolute

Semiconductor Material Items Show Increasing Trend... Equipment Import Volume Recovers to Usual Levels

Conflicts Between the Two Countries Affect Many Industries... Consensus on the Need to Ease Export-Import Regulations

[Asia Economy Reporters Sunmi Park, Hyunjin Jung, Chaeseok Moon] "We have achieved self-reliance in materials, parts, and equipment (SoBuJang) in response to Japan's surprise attack." (Remarks by President Moon Jae-in at the SoBuJang Performance Report Meeting in July 2021)

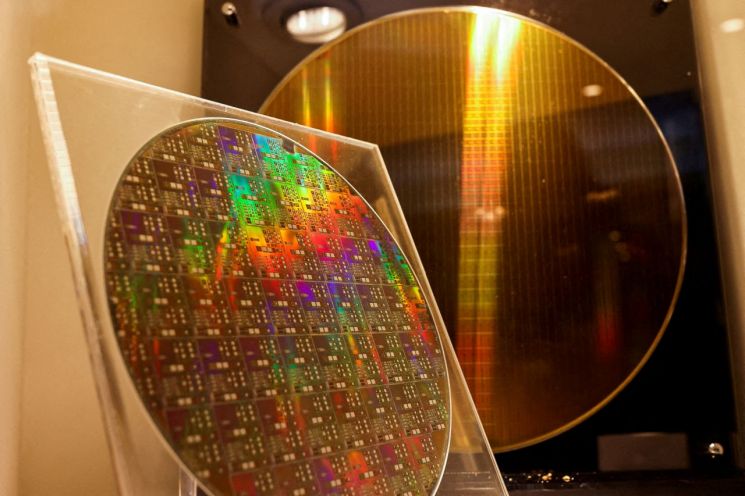

Japan imposed economic retaliation measures by tightening export regulations on three key semiconductor and display materials to South Korea in July 2019. In response, the Moon Jae-in administration declared the localization of SoBuJang and announced a large-scale corporate development plan. Last year, it boasted that it had achieved independence in SoBuJang against Japan's attack. However, three years later, it has been revealed that South Korea still heavily depends on Japan for SoBuJang-related materials.

◇ Japan's Dependence Remains Absolute

According to the Korea International Trade Association on the 29th, South Korea imports a significant portion of three semiconductor materials?photoresist, high-purity hydrogen fluoride (etching gas), and polyimide fluoride?from Japan. Although Japan imposed export restrictions on these three semiconductor materials in July 2019, the reduction was only temporary that year, and three years later, South Korea still heavily relies on Japanese products. In the case of photoresist, imports from Japan reached $367.23 million last year, an 11.9% increase compared to the previous year. The growth rate dropped to -10.2% in 2019, the year of export restrictions, indicating some impact, but it rebounded to $328.29 million in 2020, surpassing the pre-restriction level of 2018, and has shown an increasing trend every year since.

Hydrogen fluoride imports from Japan amounted to $12.52 million last year, with a growth rate of 33.5%. Due to Japan's strengthened export restrictions, South Korea's import growth rates plummeted by -45.7% in 2019 and -74.2% in 2020 but have shifted to an increasing trend last year and this year. Polyimide fluoride imports are still declining, but the decrease is not significant. Imports fell by 10.3% each in 2019 and 2020, but the decline narrowed to around 5% last year and from January to May this year.

As a result of Japan's export restrictions and the deterioration of Korea-Japan relations, South Korea's imports of Japanese equipment also temporarily slowed. However, this was also a short-lived effect. South Korea's imports of Japanese semiconductor manufacturing equipment reached $6.326 billion last year, a 44.4% increase from the previous year. This is double the $3.296 billion in 2019 when Korea-Japan relations were strained due to export restrictions, recovering to the 2018 level.

Regarding this, Japan evaluated South Korea's efforts to localize semiconductor materials as "stagnant." The Nihon Keizai Shimbun stated, "South Korea has promoted localization of related semiconductor materials and manufacturing equipment, but imports from Japan have started to increase again," and claimed, "The Korea-Japan semiconductor supply chain is maintaining its continuity (despite export restrictions)." Industry insiders agree that because it is a high-tech industry where the quality level of SoBuJang is crucial, it is not easy to replace the strong Japanese products.

◇ Loosening Korea-Japan Regulations Amid Global Supply Chain Issues

Ultimately, after Japan's export restrictions on SoBuJang to South Korea, Korea's dependence on Japanese SoBuJang remained, and the fallout spread to unrelated industries, causing a decline in bilateral trade. Moreover, both countries recognize the need to restore economic relations through easing regulations amid global supply chain issues.

Reflecting this, the Federation of Korean Industries is likely to propose easing mutual export restrictions to Japan at the Korea-Japan Business Council meeting, resuming after three years next month, aiming to secure a stable supply chain. The Federation has maintained the position that Japan's strengthened export restrictions on semiconductor and display core materials are "ineffective regulations."

However, Japan is closely monitoring the fact that the existing export restrictions have affected trust between Korean and Japanese companies, and that leading Korean semiconductor companies such as Samsung Electronics and SK Hynix are striving to support capital and share technology to replace Japanese SoBuJang, which could change future supply chain dynamics. Considering that Samsung Electronics is a key customer of Japanese companies, there are concerns that Japanese companies may be affected in the long term by the localization of SoBuJang by Korean companies.

In fact, Japan is paying close attention to whether there will be changes in Japanese policy with the launch of the Yoon Suk-yeol administration. On the 16th, Nihon Keizai highlighted that the Yoon administration's economic policy direction did not include phrases that would provoke Japan, such as "de-Japanization" or "localization," but emphasized the likelihood that the semiconductor materials and manufacturing equipment localization movement initiated by the Moon Jae-in administration would not be halted.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)