6 Consecutive Months of Increase... Approaching 4%

Interest Rate Level Outlook Index Hits All-Time High

Consumer Sentiment Index Falls Below 100 for the First Time in 16 Months

Concerns Over Economic Recession Grow

As the prospect of a 6% inflation rate materializing for the first time in 24 years emerges, the worries of ordinary people are deepening. Along with the soaring prices of essential daily items such as fuel, the cost of food on the table has been rising sharply every day, and with public utility charges also increasing, the burden of inflation has grown even heavier. The photo shows a traditional market in Seoul on the 28th. Photo by Kim Hyun-min kimhyun81@

As the prospect of a 6% inflation rate materializing for the first time in 24 years emerges, the worries of ordinary people are deepening. Along with the soaring prices of essential daily items such as fuel, the cost of food on the table has been rising sharply every day, and with public utility charges also increasing, the burden of inflation has grown even heavier. The photo shows a traditional market in Seoul on the 28th. Photo by Kim Hyun-min kimhyun81@

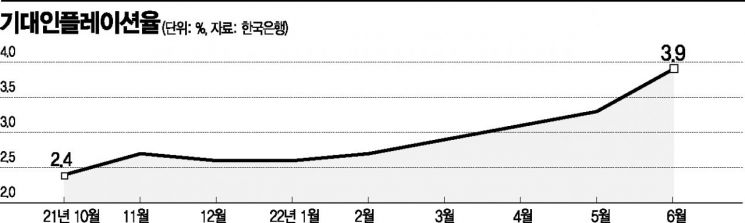

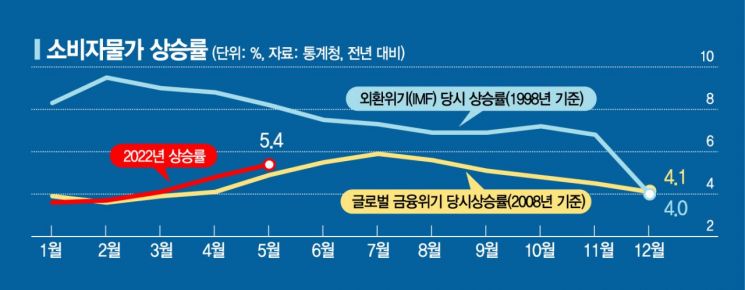

[Asia Economy Reporter Seo So-jeong] As the inflation rate is about to enter the 6% range for the first time in 24 years, the expected inflation rate, which is the consumer price inflation rate anticipated by consumers for the next year, surged by 0.6 percentage points in just one month, approaching the 4% range. The interest rate level expectation index also reached an all-time high due to the U.S. interest rate hikes and expectations of further base rate increases.

According to the "June Consumer Sentiment Survey Results" released by the Bank of Korea on the 29th, the expected inflation rate this month rose by 0.6 percentage points from the previous month to 3.9%, marking the highest level in 10 years and 2 months since April 2012 (3.9%).

The expected inflation rate has been on the rise for six consecutive months since January (2.6%). After entering the 3% range in April (3.1%) and rising to 3.3% in May, it surged to nearly 4%. Notably, the 0.6 percentage point increase is the largest since related statistics began in 2008. The inflation perception index, which reflects consumers' judgment on the inflation rate over the past year, also rose by 0.6 percentage points from the previous month, showing the largest increase on record.

Hwang Hee-jin, head of the Statistics Survey Team at the Bank of Korea’s Economic Statistics Bureau, stated, "Although the expected inflation rate reflects price expectations for the next year, it also continuously reflects current price trends, which is why it appeared high. The biggest factors are overseas influences such as rising international oil and food prices and supply chain disruptions. Additionally, high living costs and perceived inflation, including dining out and personal service fees, seem to have significantly driven up the expected inflation rate." The expected inflation rate had surged to 4.6% in October 2008 during a period of rapid price increases and rose to the 4% range again in April 2011, reaching 4.3% in October before declining.

The interest rate level expectation index (149) also rose by 3 points from the previous month, breaking the record. This index exceeds 100 when more people expect interest rates to rise in six months than those expecting a decline. The rapid pace of U.S. interest rate hikes and the anticipated additional base rate increases domestically are interpreted as reasons for reaching an all-time high.

However, the housing price expectation index (98) plunged by 13 points in one month due to rising interest rates and sluggish housing transactions. This is the largest drop since April 2020 (-16 points).

Amid ongoing high inflation and concerns over economic slowdown due to U.S. tightening, consumer sentiment is also deteriorating. The Consumer Confidence Index (CCSI) dropped 6.2 points from May (102.6) to 96.4. This is the first time the index has fallen below 100 in 1 year and 4 months since February 2021 (97.2), indicating a pessimistic turn in consumer sentiment. Compared to May, all six components of the CCSI (current living conditions, living conditions outlook, household income outlook, consumption expenditure outlook, current economic judgment, and future economic outlook) declined. In particular, the future economic outlook (69) plunged by 15 points in one month, and the current economic judgment (60) also fell by 14 points. The consumer confidence index typically leads private consumption by about one quarter.

While inflation expectation sentiment is spreading rapidly, economic outlooks are darkening, raising concerns that domestic demand may shrink. Usually, expected inflation rises when the economy is doing well, but recently, negative economic outlooks have increased alongside rising expected inflation. Next month, the Bank of Korea’s Monetary Policy Committee is weighing a 'big step' of raising the base rate by 0.5 percentage points at once to counter high inflation. However, rapid interest rate hikes could dampen consumer sentiment and deal a blow to the domestic economy, deepening concerns.

Regarding future prospects, Team Leader Hwang said, "If consumption increases significantly after the lifting of social distancing and domestic demand supports it, the decline in consumer confidence could be prevented. Government inflation measures such as fuel tax cuts may affect perceived inflation, and we need to observe how interest rate hikes psychologically impact sentiment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)