[Asia Economy Reporter Lee Seon-ae] What does Samsung Electronics' price-to-book ratio (PBR) below 1 signify? What does it mean that the KOSPI is currently trading below its 250-week moving average? Investment advice has been raised to interpret these technical bottom indicators.

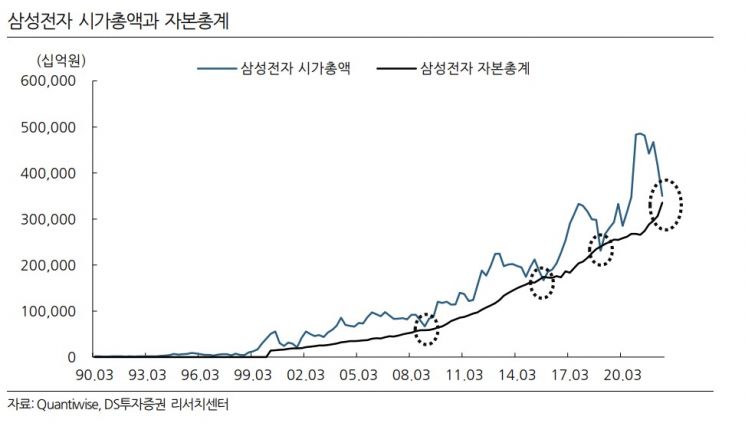

On the 29th, Yang Hae-jung, a researcher at DS Investment & Securities, said, "Samsung Electronics is characterized as a company that grows in the long term but shows cyclical traits depending on the economic flow, sometimes acting as a growth stock and sometimes as a value stock," adding, "From experience, the time when Samsung Electronics enters the value stock category has been a buying opportunity." He emphasized, "A PBR below 1 is the criterion for classifying Samsung Electronics as a value stock."

The consensus among securities firms is that Samsung Electronics' PBR below 1 represents a historical low point. Samsung Electronics accounts for about 19% of the market capitalization. The future trend of the KOSPI could change depending on Samsung Electronics' direction.

So, how much correction has the KOSPI undergone currently? Researcher Yang stated, "If we consider the 2020 COVID-19 pandemic recession as a temporary phase, the economy has maintained an expansion phase since mid-2019," adding, "As economic concerns have increased, the stock index has also experienced a correction and is technically trading below the 250-week moving average." He continued, "At present, from an investment horizon of about five years, it can be seen as reflecting the lower end of the economic cycle," and added, "As long as the reasonable assumption that the economy is still growing is not broken, it is judged that the stock index has already reflected some degree of economic downturn."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)