KEF BSI 92.6... Manufacturing (90.4) & Non-Manufacturing (95.1) Both Sluggish for Two Consecutive Months

[Asia Economy Reporter Moon Chaeseok] An analysis has emerged predicting a downturn in the overall business climate of South Korea's industrial sector due to disruptions in raw material supply. The business environment is expected to remain unfavorable for the time being due to the 'three highs' phenomenon of elevated exchange rates, inflation, and interest rates, with concerns growing as the manufacturing sector's slump appears to be spreading to the non-manufacturing sector.

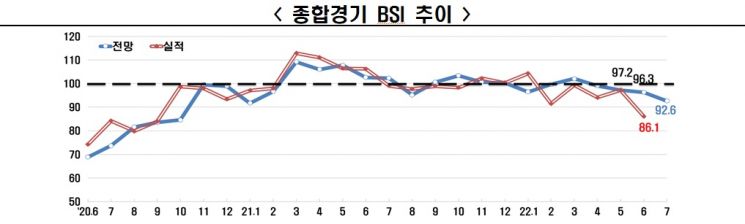

The Federation of Korean Industries (FKI) announced on the 29th that its Business Survey Index (BSI) for the top 600 companies by sales recorded a forecast of 92.6 for July. This is the lowest level in one and a half years since January last year, when it was 91.7. After recording 99.1 in April, the index has remained below 100 for four consecutive months. The actual BSI for June also fell to 86.1, the lowest in one year and nine months since September 2020's 84. A BSI above the baseline of 100 indicates a positive outlook compared to the previous month, while below 100 indicates a negative outlook.

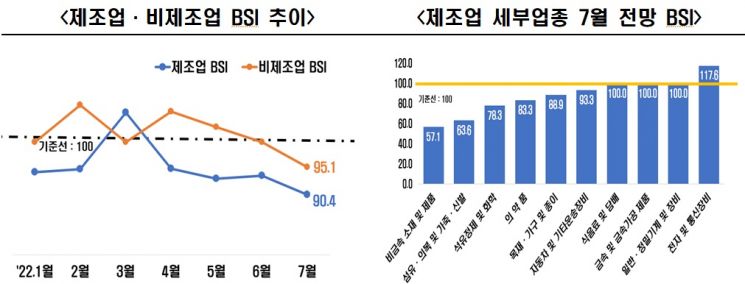

The FKI analyzed that the manufacturing sector's downturn caused by raw material supply disruptions has extended to the non-manufacturing sector. Moreover, due to the 'three highs' phenomenon, corporate investment and consumption are expected to continue deteriorating, indicating that economic recovery will be difficult in the near term. The July BSI forecast showed both manufacturing (90.4) and non-manufacturing (95.1) sectors performing poorly. Both sectors have been expected to underperform for two consecutive months since June. Among detailed industries, non-metallic materials and products in manufacturing recorded the lowest at 57.1, suffering from supply chain damage and the prolonged Ukraine crisis causing raw material supply disruptions. In the non-manufacturing sector, electricity, gas, and water supply, affected by seasonal factors such as decreased demand for city gas, showed the weakest performance at 78.6.

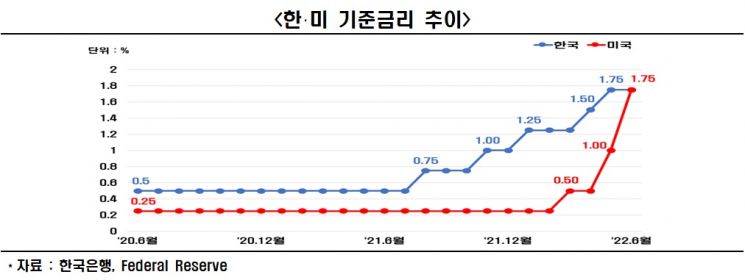

Looking at the forecasts by sector, all major indicators except employment (103.9) fell below 100. Investment (99.7), exports (99.0), financial conditions (97.1), profitability (95.8), domestic demand (95.8), and inventory (103.6) all fell short of the baseline. Since higher inventory levels are detrimental to companies, an inventory index above 100 indicates a negative outlook. The poor outlook for both exports and domestic demand is due to major institutions lowering their global economic growth forecasts (World Bank from 4.1% at the start of the year to 2.9% this month, OECD from 4.5% to 3%) combined with domestic and international interest rate hikes, raising concerns over purchasing power contraction. Investment (99.7) also fell below the baseline of 100 for the first time in 15 months since April last year (99.4), reflecting worsening domestic and international economic conditions and deepening negative economic outlook.

Financial conditions (97.1) and profitability (95.8) have remained below 100 for four consecutive months since recording 96.8 and 97.4 respectively in April. The rise in corporate bond yields due to interest rate hikes and a sluggish stock market have worsened companies' financing conditions, compounded by rising manufacturing costs from sharp exchange rate increases and weak product sales. This situation inevitably leads to deteriorating corporate profitability.

Given that South Korea's industry is in a 'comprehensive crisis,' the FKI believes the government must actively support businesses. It is difficult to overcome the economic crisis through government policy alone, as expansionary fiscal policies to stimulate the economy may drive up inflation, while contractionary monetary policies to curb inflation could dampen economic activity. Ultimately, corporate management revival must proceed in parallel.

Choo Kwang-ho, head of the FKI Economic Headquarters, stated, "Due to the limitations of government policies caused by stagflation and high inflation, the role of companies is more important now than ever," adding, "It is necessary to reform regulations that hinder corporate activities, reduce tax burdens to invigorate business management, and fundamentally improve international raw material supply through measures such as revitalizing overseas resource development."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.