40-Year Maturity Bogeumjari Loan Repayment Method Also Switching to Graduated Repayment

Jugeumgong "Easing Burden on Low-Income and Actual Demand Borrowers"

Korea Housing Finance Corporation Headquarters Exterior (Provided by Korea Housing Finance Corporation)

Korea Housing Finance Corporation Headquarters Exterior (Provided by Korea Housing Finance Corporation)

[Asia Economy Reporter Minwoo Lee] Korea Housing Finance Corporation (HF) is lowering early repayment fees and introducing a graduated repayment method for 40-year maturity Bogeumjari Loans to reduce the repayment burden on financial consumers.

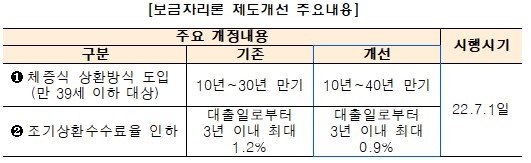

HF announced on the 28th that starting next month, it will reduce the early repayment fee rate for Bogeumjari Loans and Qualified Loans from the current maximum of 1.2% to 0.9%, a decrease of 0.3 percentage points (P), and introduce a graduated repayment method for 40-year maturity Bogeumjari Loans. This follows the "New Government Household Loan Management Direction and Gradual Normalization of Regulations" announced by the Financial Services Commission on the 16th.

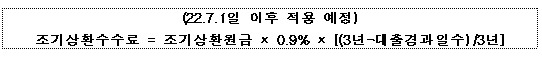

The early repayment fee rate will be reduced starting from repayments executed on the 1st of next month. For early repayments made within three years from the date of receiving Bogeumjari Loans or Qualified Loans, the early repayment fee rate, which is applied in a way that gradually decreases according to the elapsed days on the early repayment principal, will be lowered from a maximum of 1.2% to 0.9%.

Accordingly, customers using policy mortgages (Bogeumjari Loans and Qualified Loans) can save up to 900,000 KRW in costs when repaying a loan principal of 300 million KRW early. The 70% reduction in early repayment fees for Bogeumjari Loans, which has been in effect since October last year, is expected to end at the end of this month. As of the end of April, the total amount of support for early repayment fee reductions was approximately 3.1 billion KRW.

In addition, a graduated repayment method will be introduced for 40-year maturity Bogeumjari Loans. This is intended to help reduce the initial repayment burden for young borrowers with relatively lower income.

The graduated repayment method involves lower repayment amounts initially, with the principal repayment amount increasing over time. It targets customers aged 39 or younger who are expected to have income growth in the future. For example, with a 40-year loan maturity, a loan amount of 300 million KRW, and an interest rate of 4.6%, using the equal principal and interest repayment method results in a monthly repayment of about 1.37 million KRW, which remains the same until maturity. However, using the graduated repayment method, the first repayment amount is about 1.17 million KRW, which is 200,000 KRW less than the equal principal and interest method, and the 60th repayment amount is about 1.24 million KRW, which is 130,000 KRW less.

Choi Junwoo, President of HF, said, "This is a measure to actively respond to the government's policy direction for stabilizing people’s livelihoods and to alleviate the financial cost burden on low-income and real demand borrowers." He added, "We will speedily promote various institutional improvements so that the public can feel the relief in repayment burdens for financial consumers during the period of rising interest rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.