[Asia Economy Reporter Lee Jung-yoon] The Financial Services Commission (FSC) is set to revise regulations concerning the asset management companies (asset managers, business trustees) that actually perform tasks on behalf of Special Purpose Companies (SPCs) for securitization.

On the 27th, the FSC announced that it has prepared a plan to revise regulations on asset management companies of SPCs in response to calls for the need to improve oversight, and reported this plan to the 12th Securities and Futures Commission meeting.

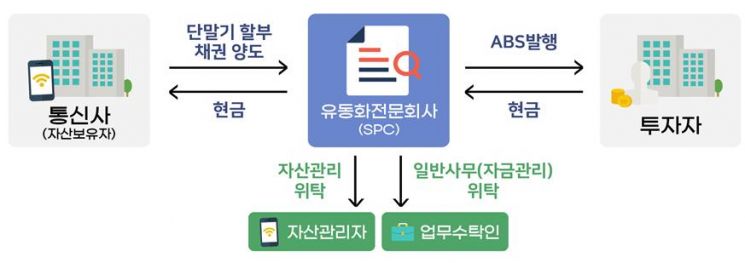

Asset holders transfer their assets to SPCs, which then issue securitization securities based on those assets. According to the Act on Asset Securitization, SPCs are nominal companies, so asset management and general administrative tasks must be entrusted to asset managers and business trustees, respectively. However, there have been cases where business trustees were falsely listed in securitization plans, and individuals not listed in the plans performed asset securitization tasks, investing surplus funds in risky assets and causing losses.

The improvement plan primarily includes clarifying standards for fund management and borrowing. Regarding fund management, funds must be deposited with financial institutions or managed through government bonds, etc., within a scope that does not hinder the repayment of securitization securities. For borrowing, it will only be permitted for purposes such as repaying securitization securities or covering costs necessary to execute the securitization plan.

Additionally, behavioral regulations for asset management companies will be established. These include prohibiting failure to perform entrusted tasks for more than six months without justifiable reasons and banning the re-entrustment of core tasks. Other ancillary tasks may be re-entrusted but must be reported to financial authorities afterward. Legal grounds will also be established to impose measures such as business improvement orders, suspension of operations, and fines if these regulations are violated.

Qualification requirements for business trustees will also be set. For general administrative tasks, the trustee must be a corporation with at least 500 million KRW in equity capital and at least three full-time employees. Fund management tasks can only be performed by financial institutions such as banks or securities firms licensed for trust business under the Capital Markets Act. However, an exception will be made allowing a single investor holding 100% of securitization securities to manage funds without a trust business license. Furthermore, requirements to establish conflict-of-interest prevention systems, such as separation of departments and personnel when concurrently serving as asset managers, have been introduced.

Moreover, the FSC will establish penalties for false or omitted entries in important matters on asset securitization plan registration applications. It will also require specific descriptions of assets eligible for surplus fund management in the securitization plan registration application to prevent excessive investment in risky assets in advance.

The FSC stated, "We expect this to encourage asset management companies to perform securitization tasks more responsibly and contribute to strengthening investor protection," adding, "We will strive to ensure these measures are reflected if the pending amendment to the Asset Securitization Act is discussed in the National Assembly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.