Construction Industry Research Institute, Second Half Construction and Real Estate Market Outlook

"Economic Conditions Worsen in Second Half... Possible Price Inflection Point"

"Price Declines Expected to Start in Areas with Poor Transportation"

As the real estate transaction freeze and house price adjustment movements have appeared this year, there is a growing outlook that the second half of the year will face an even more difficult situation than the first half.

On the 27th, the Korea Construction Industry Research Institute forecasted at the '2022 Second Half Construction and Real Estate Market Outlook Seminar' held at the Construction Hall in Gangnam-gu, Seoul, that nationwide housing sale prices will fall by 0.7% due to the worsening economic situation in the second half of this year.

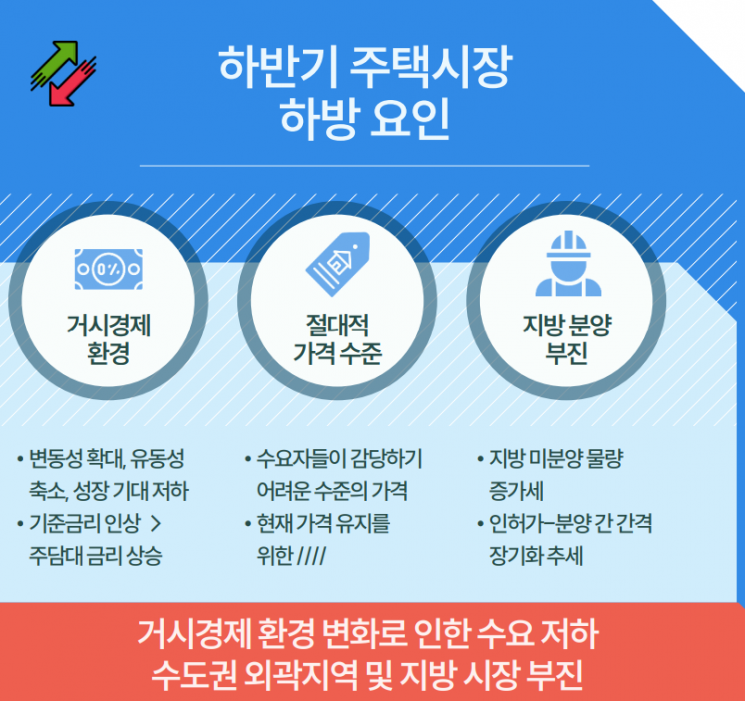

Kim Seong-hwan, associate researcher who presented the housing and real estate market outlook, said, "Despite expectations for revitalization of the housing market such as the inauguration of the new government in the first half of this year, the rise in house prices was limited to 0.2% nationwide due to the macroeconomic downturn," adding, "It is highly likely that a price inflection point will appear as the economic situation is expected to worsen further in the second half."

Considering the house price increase in the first half of this year, Associate Researcher Kim predicted an annual decline of 0.5%.

He also forecasted that housing prices in the metropolitan area will remain flat in the first half and fall by 0.5% in the second half, resulting in an annual decline of 0.5%.

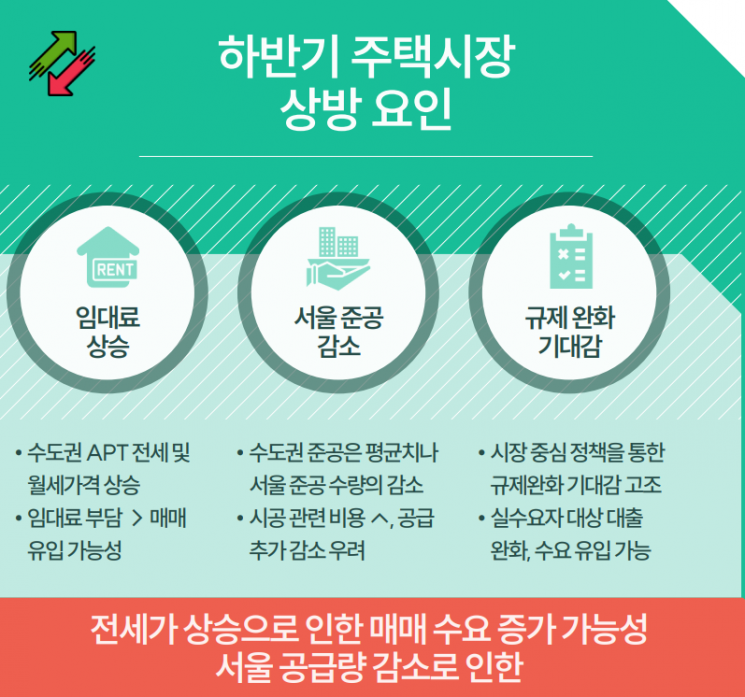

Although there are factors for price increases such as the reform of the price ceiling system for pre-sale prices and rising construction costs, as well as increases in monthly rent and jeonse (long-term deposit lease) prices that could affect house price rises, it was analyzed that the impact will not be significant due to passive market participation by demanders.

Kim said, "Preferences for areas convenient for commuting remain strong, so price declines will start in areas excluded from this, and market differentiation will appear."

Jeonse prices are expected to rise by 2.5% in the second half, following a 0.1% increase in the first half. This amounts to a 2.6% increase annually.

The research institute analyzed that the reason jeonse prices did not rise significantly in the first half was that tenants burdened by jeonse prices often chose monthly rent or half-jeonse types.

Kim predicted, "Even when renewing contracts in the second half, many tenants are expected to choose monthly rent or half-jeonse due to the heavy burden of jeonse price increases. However, the reduced supply in major areas in the second half will act as pressure for jeonse price increases."

He emphasized, "According to the lease market supplement plan announced on the 21st, the government's will to ease upward pressure in the lease market appears strong, but the burden on tenants who have to find a house every two or four years is considerable. It is necessary to respond sensitively to signals from the lease market after August, when the right to request contract renewal expires."

Kim Seonghwan, Associate Research Fellow at the Construction Industry Research Institute, is forecasting and analyzing the housing market for the second half of the year at the 2022 Second Half Construction and Real Estate Market Outlook Seminar held on the 27th at the Construction Hall in Gangnam-gu, Seoul.

Kim Seonghwan, Associate Research Fellow at the Construction Industry Research Institute, is forecasting and analyzing the housing market for the second half of the year at the 2022 Second Half Construction and Real Estate Market Outlook Seminar held on the 27th at the Construction Hall in Gangnam-gu, Seoul.

The construction industry is also expected to contract somewhat. Domestic construction orders this year are forecasted to decrease by 3.7% in the second half, resulting in a 0.5% year-on-year decline to 210.9 trillion won, and construction investment is expected to decrease by 1.8%.

Park Cheol-han, research fellow who presented the construction market outlook, said, "In the first half, orders were favorable due to expectations of deregulation from the regime change and the issuance of large civil engineering projects, but in the second half, orders are expected to be sluggish due to government spending restructuring and interest rate hikes."

Regarding construction investment, it was expected to decrease by 4.0% in the first half due to increased disputes and strikes caused by soaring material prices and construction costs. Even if there is a slight recovery in the second half, it will be difficult to turn annual construction investment positive (+), and thus construction investment is predicted to decrease by 1.8% this year.

Park said, "The government should ensure that housing supply is not disrupted due to increased material prices and financial costs," adding, "Since the number of deficit sites is greatly increasing this year due to cost increases, it is worth considering temporarily lowering taxes for small and medium construction companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)