Renewable Energy Generation in 2030 Must Surpass Nuclear Power

Renewable Energy Industry Virtually Wiped Out by China

Large Corporations Withdraw, SMEs Import and Sell Chinese Products

[Asia Economy Reporter Oh Hyung-gil] Woongjin Energy, the only domestic company producing solar ingots and wafers, is facing bankruptcy next month. Despite filing for corporate rehabilitation in 2019 due to difficulties caused by the onslaught of Chinese solar products, the situation has worsened.

LG Electronics will cease its solar module business at the Gumi plant on the 30th of this month. There are concerns that the added value amounting to 4.3412 trillion KRW in the Daegu-Gyeongbuk region, including related industries, will disappear.

Some companies cannot help but lament as the Yoon Seok-yeol administration focuses on fostering the nuclear power industry under the ‘nuclear phase-out’ policy. These are companies related to renewable energy such as solar and wind power. Once spotlighted as the main players of ‘low-carbon green growth,’ they complain that they have been sidelined compared to the nuclear power plants that the new government dreams of reviving.

President Yoon plans to hold bilateral talks on nuclear exports with the Czech Republic, Poland, and the Netherlands during the NATO summit in Madrid, Spain, on the 27th. The new government is putting its weight behind ‘reviving nuclear power,’ to the extent that President Yoon has pledged to “run all out for nuclear power sales.”

The government plans to urgently place orders worth more than 1 trillion KRW by 2025 to resume construction of Shin Hanul Units 3 and 4, invest 670 billion KRW in nuclear research and development (R&D) this year, and more than 3 trillion KRW by 2025, along with bold financial support. The strategy is to develop the nuclear power industry to create a balanced energy mix in an era of energy resource supply crises.

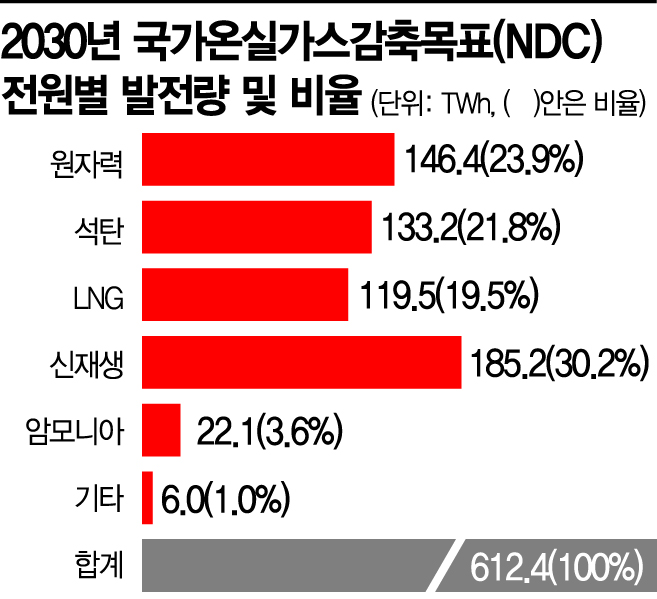

However, there are criticisms that government support is excessively skewed toward nuclear power. According to the nationally determined contribution (NDC) confirmed last year, South Korea’s renewable energy power generation is expected to reach 185.2 TWh by 2030, accounting for nearly 30.2% of the energy mix. This generation scale is larger than nuclear power’s 146.4 TWh and 23.9% share.

More investment should be made, but the reality is the opposite. Renewable energy generation was only 43 TWh in 2021, accounting for 7.5% of the total. This means it must increase more than fourfold over the next nine years. Meanwhile, nuclear power generation exceeded the target last year with 158 TWh.

Renewable Energy Generation Must Increase More Than Fourfold by 2030

The government plans to reduce fossil fuel use and increase the share of nuclear and renewable energy to achieve carbon neutrality, but there is no concrete investment plan. The government will set specific targets for expanding the nuclear power share when preparing the power supply plan by the end of the year.

Last month, at the opening ceremony of the 28th World Gas Conference (WGC) held in Daegu, President Yoon stated, “We will fulfill our responsibilities and roles in the international community’s efforts to achieve carbon neutrality,” and emphasized, “We must reasonably mix nuclear power, renewable energy, and natural gas.”

Another problem is that the renewable energy industry is practically decimated. Except for Hanwha Chemical (solar) and Doosan Enerbility (wind power), most large corporations have withdrawn from solar power generation, and small and medium-sized companies are limited to importing Chinese products and reprocessing them for sale.

There are concerns that the renewable energy value chain may be dominated by China. According to the Federation of Korean Industries, China accounts for 63% of the global polysilicon market, 95% of the ingot market, 97% of the wafer market, and 79% of the solar cell market. Additionally, six of the top ten global wind turbine manufacturers are Chinese companies.

In the domestic market, the share of Chinese modules increased from 21.6% in 2019 to 35.8% in 2020. The share of Chinese solar cells approached 70% in 2020. Although domestic module manufacturers held a 67.4% market share in 2020, most cells are made by importing Chinese products.

Industry insiders appeal for active government support from an energy security perspective. A solar power industry official said, “It is necessary to increase tax incentives for investment in renewable energy, simplify licensing procedures, and implement nurturing and protective measures for the renewable energy industry.”

On the 18th, a solar power control program was demonstrated at the '2022 International Electric Power Exhibition' held at COEX in Gangnam-gu, Seoul. Photo by Jinhyung Kang aymsdream@

On the 18th, a solar power control program was demonstrated at the '2022 International Electric Power Exhibition' held at COEX in Gangnam-gu, Seoul. Photo by Jinhyung Kang aymsdream@

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)