Outlook by US Giant Step:

Big Step Expected at July FOMC

High Inflation at Asian Financial Crisis Level

Additional Big Steps May Be Needed

[Asia Economy Reporter Seo So-jeong] Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho has warned that the consumer price inflation rate could exceed 6% as early as this month, prompting market expectations that the Bank of Korea's Monetary Policy Committee, which sets the base interest rate, may implement a big step (a 0.5 percentage point hike at once) for two consecutive times in July and August.

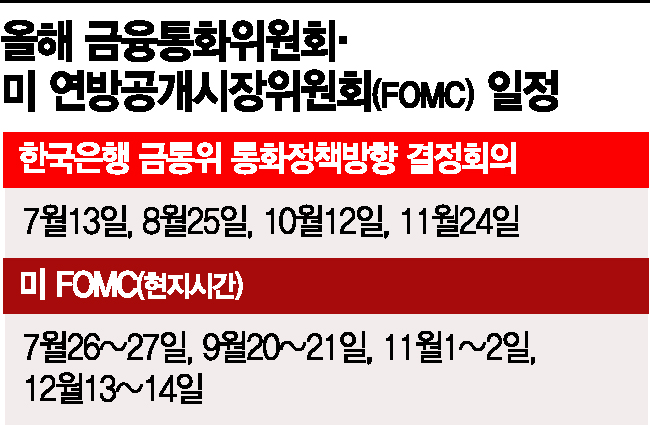

According to the Bank of Korea on the 27th, there are a total of four Monetary Policy Committee meetings scheduled for this year (July, August, October, and November), the same number as the U.S. Federal Open Market Committee (FOMC) meetings (July, September, November, December). With the next Monetary Policy Committee meeting set for August 13, about two weeks ahead of the U.S. FOMC, and the growing possibility of a giant step (a 0.75 percentage point hike) by the U.S. Federal Reserve (Fed) in July, combined with the domestic fear of inflation surpassing 6%, the prevailing view is that the Bank of Korea will take an unprecedented big step.

The issue lies in the magnitude of the interest rate hike in August. With the current upper limit of the interest rate at 1.75%, the same as the U.S., if the Fed takes a giant step next month, even if Korea implements a big step, the U.S. interest rate will be 0.25 percentage points higher than Korea's, marking the beginning of a full-scale interest rate inversion between Korea and the U.S. Considering that the next U.S. FOMC meeting is in September, the Bank of Korea, which meets a month earlier, has an opportunity in August to narrow the interest rate gap between the two countries and adjust the scale of future hikes.

As confirmation of the peak in U.S. inflation is delayed, the market sentiment has rapidly changed recently. Initially, the market expected that after the Monetary Policy Committee's big step in July, interest rates would continue to rise by 0.25 percentage points incrementally, reaching 2.75-3.00% by the end of the year. However, the Fed's tightening pace has been steeper than expected. The median of the Fed's dot plot (which shows interest rate projections as dots) has risen to 3.4%, and expectations for the upper limit continue to increase, leading to a growing consensus that Korea will not stop at just one big step.

Professor Kim Sang-bong of Hansung University’s Department of Economics said, "We need to comprehensively review upcoming U.S. data such as the May Personal Consumption Expenditures (PCE) price index, Consumer Price Index (CPI), and unemployment rate trends, but it is unlikely that the peak of U.S. inflation will be confirmed in the short term," adding, "Considering foreign capital outflows due to the interest rate inversion between Korea and the U.S., consecutive big steps in July and August are necessary."

In particular, with the recent won-dollar exchange rate entering the 1,300 won range for the first time in about 13 years, fueling inflation, and international oil prices expected to remain high for a considerable period, there is growing weight to the forecast that domestic consumer price inflation will form a peak in the second half of the year.

However, some view that it is still premature to decide on consecutive big steps. Park Seok-gil, Head of JP Morgan’s Financial Market Operations Department, said, "Although the Bank of Korea announced that it will operate monetary policy focused on inflation for the time being, rapid interest rate hikes could trigger an economic recession," adding, "Because the Bank of Korea must comprehensively consider the economic situation, exchange rates, and household interest burdens, its dilemma may deepen."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)