Market Size Grows 30% in One Year

Surpasses 300 Billion Won Last Year

Diverse Consumption Purposes Including Energy Recovery and Immunity Enhancement

[Asia Economy Reporter Eunmo Koo] The protein market is experiencing rapid growth as the purposes of protein intake diversify, ranging from younger generations focusing on increasing muscle mass to manage weight and body shape, to middle-aged and older adults aiming to supplement deficient nutrients for health management.

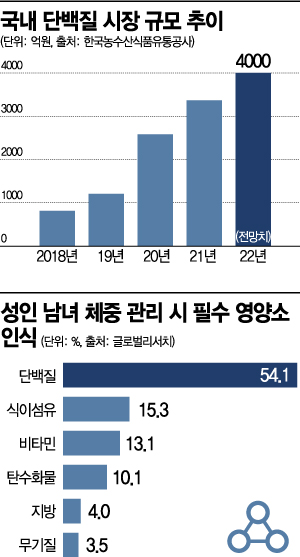

According to the Korea Agro-Fisheries & Food Trade Corporation on the 27th, the domestic protein market size was recorded at 336.4 billion KRW last year. This represents a 30.4% increase compared to the previous year (257.9 billion KRW). The domestic protein market was only 81.3 billion KRW in 2018 but surpassed 100 billion KRW the following year (120.6 billion KRW), and last year it exceeded 300 billion KRW, growing more than fourfold in the past three years.

The growth of the protein market has been driven by the heightened interest in weight management, to the extent that the phrase "dieting is a lifelong task" has emerged. Managing weight through exercise, controlling food intake, and diet management has become a daily routine. Among nutrients, protein is considered the most important for weight management. In the past, protein products were perceived as health supplements mainly for preventing muscle loss or increasing muscle mass during intense workouts or bodybuilding, but recently, the purposes of intake have diversified to include weight management, fatigue recovery, stress management, and immune enhancement.

In November 2018, Maeil Dairies launched the protein health functional food "Selex," stimulating consumer interest and demand for health and immunity. In February 2020, the latecomer Ildong Foodis released "Hi-Mune," igniting market growth. Since then, related products such as Lotte Foods Pasteur's "Dr. Active," Daesang Wellife's "My Meal," Harim's "P Plus," and Seoul Milk's "Click U" have been launched consecutively.

The weight management market, commonly referred to as dieting, is broadly divided into weight control formulated foods and diet health functional foods. Weight control formulated foods are products with added specific nutrients or controlled calories designed to be consumed as meals or snacks for weight control, available in various forms such as shakes, cereals, and bars.

The industry is diversifying packaging into PET bottles, sticks, pouches, etc., to enhance portability and ease of consumption, and expanding flavor options to satisfy consumer preferences and tastes. Recently, products have been launched that differentiate themselves by enhancing nutrients such as protein, vitamins, minerals, and dietary fiber while reducing fat, cholesterol, and calories.

Additionally, demand for protein health functional foods that not only reduce weight but also decrease body fat and increase muscle mass is another driving force behind market growth. The industry is responding to market demand by consecutively launching protein health functional foods containing functional ingredients effective for muscle health and body fat reduction, such as Garcinia Cambogia and green tea extract.

The industry expects the domestic protein market to continue its steady growth, reaching 400 billion KRW this year. The Korea Health Supplements Association evaluated in its "Health Functional Food Industry Survey" that although protein supplements account for less than 2% of the total health functional food market, their growth rate approaches 30%, showing a steeper growth trend compared to other functional ingredients.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.