[Asia Economy Reporter Changhwan Lee] It has been argued that domestic insurance companies should take a more active role in excluding coal-related industries and reducing carbon emission portfolios in line with the global coal phase-out trend.

According to the Insurance Research Institute's report titled "Current Status and Challenges of Coal Phase-Out in Insurance Companies" on the 26th, global warming caused by increased greenhouse gas emissions is triggering abnormal weather and natural disasters worldwide, thereby increasing related damages.

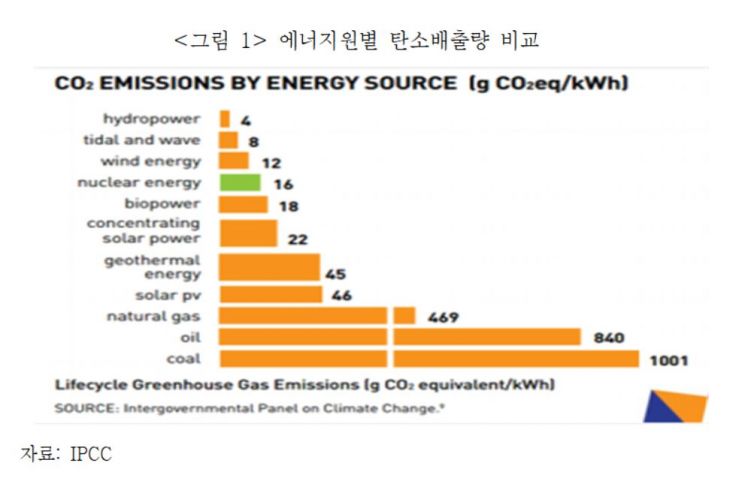

Among fossil fuels, coal has the highest carbon intensity compared to oil and natural gas, making the phase-out of coal-related industries, including coal power generation, an urgent task for the international community.

Through the Glasgow Climate Pact adopted at COP26 (United Nations Climate Change Conference) last November, the international community agreed to gradually reduce coal-fired power generation and phase out inefficient fossil fuel subsidies by 2030.

Coal Phase-Out by Insurance Companies is a Global Trend

Accordingly, the report emphasized that insurance companies should establish exclusion criteria for investments in all coal-related industries, including coal power generation.

In fact, from the underwriting perspective, at least 35 primary insurers and reinsurers worldwide had restricted or ceased underwriting risks related to coal-related businesses by 2021 as part of their company policies.

As of 2021, these insurance companies held a market share of 14.3% in the primary insurance market and 54.5% in the reinsurance market, both increases from 12.9% and 48.3% respectively in the previous year.

From the asset management perspective, as of the end of 2020, at least 65 insurance companies had stopped new investments or withdrawn existing investments in coal-related industries. The consolidated assets of these insurers amounted to $12 trillion, accounting for over 40% of the market share.

In Korea, in March 2021, 113 financial companies including subsidiaries of financial groups such as KB, Shinhan, Woori, NH Nonghyup, Hana, as well as financial subsidiaries of Samsung and Hanwha groups, participated in the "Climate Finance Support Declaration Ceremony for Achieving Carbon Neutrality by 2050." The assets under management (AUM) of these 113 financial companies at the end of last year reached approximately 5,563 trillion KRW.

In the insurance industry, except for a few companies, most life and non-life insurers have declared coal phase-out and are participating in coal phase-out efforts in underwriting and asset management.

Samsung Fire & Marine Insurance was the first Asian insurance company to stop underwriting new insurance for coal-fired power plants in 2020. This year, six financial companies of the Hanwha Group, including Hanwha Life Insurance, Hanwha General Insurance, and Carrot General Insurance, declared coal phase-out finance while joining sustainable management. DB Insurance, Hyundai Marine & Fire Insurance, Heungkuk Fire & Marine Insurance, and Lotte Insurance also declared the suspension of new coal-related businesses.

However, the report noted that although most domestic insurance companies have stopped new construction, operation, and new investments in coal power generation, efforts to exclude coal-related industries and reduce portfolios are still needed.

Seungjun Lee, a research fellow at the Insurance Research Institute, said, "Coal phase-out management by insurance companies is becoming increasingly important in terms of climate risk management. Therefore, it is necessary to establish and implement plans to gradually reduce the proportion of underwriting and asset management related to coal industries in the future." He added, "Along with coal phase-out, it is necessary to consider participation in renewable energy-related businesses, which are reported to have already begun to outperform coal power generation in terms of profitability, from the perspectives of profitability improvement and reputation management."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.