[Asia Economy Reporter Changhwan Lee] Since the pandemic, non-face-to-face financial management via mobile has gained popularity. Demand for new financial management methods such as fractional investment has increased, and platforms that allow users to generate income from home through activities like translation or SNS (social network service) promotion have also grown. Recently, there has been attention on ways to do app tech through insurance companies.

Managing Health While Walking? Managing Points After Walking!

A representative example is the pedometer service. Through apps provided by insurance companies, users check their step count measured by their smartphones, and the insurance companies provide corresponding benefits.

Depending on the operation method, conditions such as achieving 6,000 or 10,000 steps, points, or insurance premium discounts vary by insurance company. However, beyond the traditional insurance perception of "receiving insurance money when sick," they share a preventive approach of "receiving benefits by walking more and maintaining healthy habits."

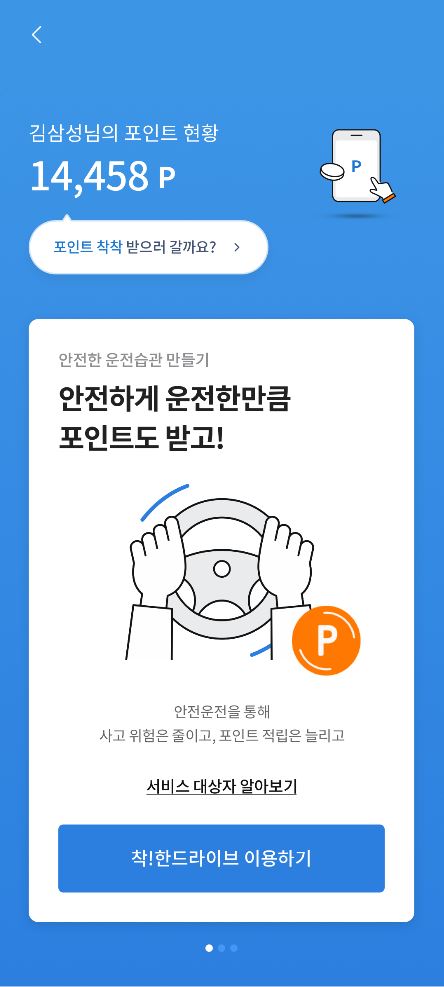

Point Benefits for the Best Drivers

In addition to health-related point rewards, benefits for safe driving are also provided.

Currently, driving-related app services offered by insurance companies assign higher scores the safer the driving. This allows users to check detailed feedback on their driving records through the app.

When using safe driving services, practical benefits such as point accumulation are also available based on driving and scores. Unlike the previous method of receiving some benefits on insurance premiums for safe driving, users can now enjoy immediate and tangible benefits like points.

Available to Anyone Without Insurance Subscription

When it comes to digital services provided by insurance companies, it is easy to think that "services are only available if you subscribe to insurance." However, recently released digital services are gradually expanding the range of users. In other words, users can accumulate points by using the service alone without subscribing to insurance with the company.

In the case of Samsung Fire & Marine Insurance Direct's 'Chak,' after launching the new brand last year, 'Chak! Han Walking' and 'Chak! Han Drive' were released in May, and these are free services available to anyone who logs in regardless of insurance subscription status.

A representative from Samsung Fire & Marine Insurance Direct 'Chak' stated, "In the era of one smartphone per person, apps are an important channel that can form a close relationship with consumers," adding, "We plan to increase efficient touchpoints to meet customers by providing content they need through the app."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)