Patent Expiry Approaching for Macular Degeneration Treatment

Rising Demand for Expensive Cancer Drug Avastin

Samsung Bioepis Begins US Sales of Lucentis

Caregen Plans to Submit IND for Different Mechanism to FDA in Second Half

[Asia Economy Reporter Lee Chun-hee] As patents for wet age-related macular degeneration (AMD) treatments, one of the geriatric diseases, are approaching expiration, fierce competition is underway over the treatment and biosimilar (biopharmaceutical generic) market, which could reach up to 24 trillion KRW. Macular degeneration occurs when waste accumulates in the macula, the central part of the retina, causing dry AMD, which can worsen into wet AMD due to excessive blood vessel growth. If left untreated, it can lead to blindness, so treatment focuses on inhibiting blood vessel formation to slow disease progression. Antibody drugs such as 'Eylea' or 'Lucentis' are directly injected into the eye.

Unexpected 'Chemotherapy Drug' Use Due to High Prices

Although there is little difference in efficacy and side effects between the two products, Eylea, which was released a few years later, has a higher market share due to greater dosing convenience. Unlike Lucentis, which requires monthly injections, Eylea can be administered every two months after the initial three months. As a result, annual sales have diverged significantly, with Eylea generating approximately $9.4 billion (about 12 trillion KRW) and Lucentis about $3.6 billion (approximately 4.6818 trillion KRW). Especially with the global increase in the elderly population, data analytics firm GlobalData estimates that the wet AMD treatment market in nine major countries including the U.S., Germany, Japan, China, and Australia will reach $18.7 billion (about 24 trillion KRW) by 2028.

However, since neither drug's patent has expired yet, prices remain high, leading to frequent off-label use of the chemotherapy drug Avastin. Even in Korea, despite health insurance coverage for Eylea and Lucentis, the out-of-pocket cost for Avastin is similar to the non-reimbursed prices of the other two drugs. However, Avastin has no approved indication for eye diseases, and concerns about contamination during preparation and dilution processes have been raised.

Professor Jung Eun-ji of the National Health Insurance Ilsan Hospital estimated that 35% of domestic AMD patients were prescribed Avastin. Professor Jung stated, "Because treatments are expensive and require repeated injections, medical costs increase," adding, "We need to actively support the development and use of relatively affordable drugs as patents near expiration."

Samsung Bioepis: "Catching Both Rabbits"

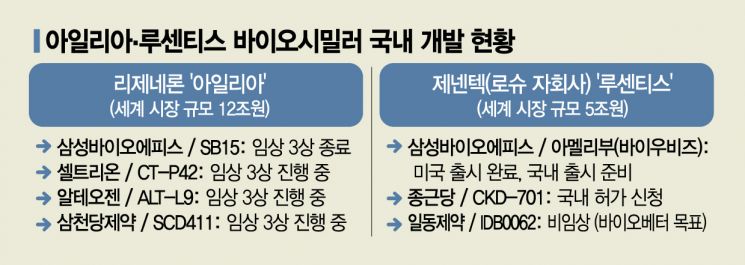

Consequently, competition to develop biosimilars for both drugs is intensifying. Among several domestic companies developing biosimilars, Samsung Bioepis is leading by targeting both Lucentis and Eylea simultaneously. A Samsung Bioepis representative explained, "From the perspective of providing patients with more diverse treatment options, we are developing biosimilars for both products," adding, "Following the earlier patent expiration of Lucentis, we are also accelerating development of Eylea."

The Lucentis biosimilar has already entered the market. After receiving FDA approval last September, it began sales in the U.S. this month under the name 'Byooviz.' It is entering the market at a wholesale price 40% lower than Lucentis. Domestically, Samsung Bioepis is coordinating the launch timing under the product name 'Amelibu' in partnership with Samil Pharmaceutical. The Eylea biosimilar under development, SB15, completed a Phase 3 comparative clinical trial with Eylea involving 449 patients last March. The company plans to analyze the data within this year and soon apply for marketing authorization.

Regarding patents, Lucentis' patents will expire in both the U.S. and Europe within this year, while Eylea's patents will expire in Europe in 2025 and in the U.S. in 2027, making market entry easier for Lucentis biosimilars. However, due to the large market size difference, domestic developers are focusing more on Eylea. Besides Chong Kun Dang Pharmaceutical, which completed Phase 3 clinical trials for the Lucentis biosimilar 'CKD-701' and applied for approval with the Ministry of Food and Drug Safety last July, Celltrion (CT-P42), Alteogen (ALT-L9), and Samchundang Pharmaceutical (SCD411) are all developing Eylea biosimilars. All are conducting global Phase 3 clinical trials. Some companies are developing AMD treatments with different mechanisms. Caregen, developing the 'P5 eye drops,' plans to submit an Investigational New Drug (IND) application to the FDA within the second half of the year. As an eye drop rather than an injection, it offers greater dosing convenience and shows efficacy in dry AMD, indicating significant market potential. Additionally, Curacle is developing the natural product oral drug 'CU03,' and Amicogen Pharma is developing 'AGP600,' an oral drug delivered via retinal vascular barrier permeation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.