Samsung Electronics Slips for 5 Consecutive Trading Days

Records New 52-Week Low Daily

[Asia Economy Reporter Park Sun-mi] The Korean semiconductor industry, led by the 'two giants' Samsung Electronics and SK Hynix, has fallen into a 'gray' quagmire amid a rapidly changing market environment despite strong government support. Although plans have been made to increase facility investments to expand semiconductor production, the extended equipment lead times (the time from order to delivery) are threatening to disrupt the execution of these plans. With global IT device demand declining due to inflation and reduced consumer spending, there is a prevailing forecast that semiconductor prices will drop in the second half of the year. Amid these bleak predictions, the stock prices of Samsung Electronics and SK Hynix, the leading semiconductor companies, have struggled to recover.

◆ Equipment lead times extended by 18 to 30 months... Semiconductor production expansion 'disrupted' = On the 23rd, market research firm TrendForce diagnosed that semiconductor equipment lead times have extended from 18 months up to a maximum of 30 months. Compared to the pre-COVID-19 period when lead times were only 3 to 6 months, this represents an increase of more than five times at the maximum duration. TrendForce attributes this to prolonged COVID-19 disruptions hindering cross-border logistics, inflation caused by the Russia-Ukraine war, and rising raw material prices, all of which have caused supply chain issues.

As semiconductor equipment lead times continue to lengthen, immediate disruptions have occurred in production expansions by foundry companies such as Samsung Electronics and TSMC. TrendForce predicts that the annual production capacity growth rate of foundry companies will fall from the previous 10-13% to around 8%. Additionally, the execution speed of production capacity expansion plans already established by foundry companies is expected to be delayed by approximately 2 to 9 months due to equipment shortages.

In Korea, the impact on Samsung Electronics and SK Hynix, which are expanding semiconductor production facilities, is inevitable. Samsung Electronics, aiming to become the number one system semiconductor company by 2030, is currently undertaking large-scale facility investments. Starting in the second half of the year, the operation of the third line (P3) at the Pyeongtaek semiconductor plant will begin, followed by the construction of the fourth line (P4). In Texas, USA, construction has commenced on a foundry plant targeting operation in 2024. SK Hynix is also expected to hold a groundbreaking ceremony next month for the Yongin Semiconductor Cluster, where it plans to invest 120 trillion won to build a total of four semiconductor production fabs.

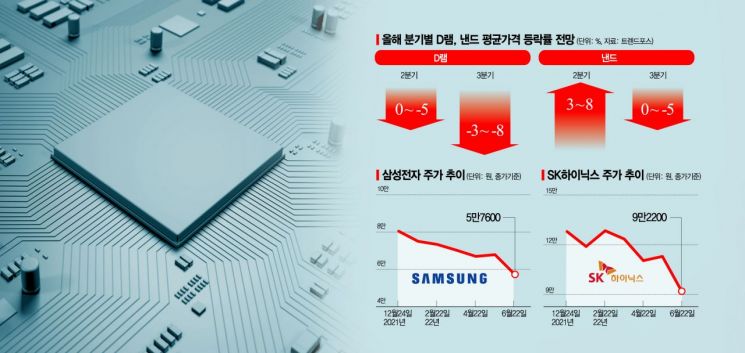

◆ Gloomy atmosphere drags down earnings and stock price forecasts = Negative outlooks on the semiconductor sector have caused the stock prices of Samsung Electronics and SK Hynix to continue their downward trend. As of 10 a.m. on the day, Samsung Electronics' stock price was down 0.17% from the previous day at 57,500 won, and SK Hynix was down 0.54% at 91,700 won. Samsung Electronics, which has been sliding for five consecutive trading days, recorded a new 52-week low again on this day. SK Hynix's stock price, which was over 130,000 won two months ago, has fallen by about 30%. Securities firms have lowered their annual operating profit forecasts for both Samsung Electronics and SK Hynix.

In an environment where semiconductor production is inevitably disrupted, the slowdown in IT device demand presents another challenge. Due to global inflation and economic uncertainty, consumer electronics such as smartphones, PCs, and home appliances have seen reduced consumption, shaking semiconductor demand. This demand slowdown leads to price declines, negatively impacting earnings.

The semiconductor industry forecasts an oversupply of NAND flash in the third quarter of this year, with average prices expected to fall by 0 to 5%. In particular, consumer SSDs are expected to see prices drop by 3 to 8% in the third quarter due to a sharp increase in inventory caused by sluggish PC and laptop demand. This is a complete reversal from the second quarter, when consumer SSD prices were expected to rise by 3 to 8% just three months ago.

Prices for 3D NAND wafers are expected to fall by 5 to 10%, and DRAM prices are also projected to drop by an average of 3 to 8% in the third quarter. PC DRAM prices are forecasted to decline by 3 to 8% for DDR4 and 0 to 5% for DDR5. Mobile DRAM is also estimated to fall by 3 to 8% due to decreased smartphone sales. DRAM is a sector where Korean memory semiconductor companies hold more than 70% market share, making price declines a significant negative factor for corporate earnings.

Kim Young-woo, an analyst at SK Securities, stated, "This year's DRAM demand composition is expected to be 13.2% PC, 34.6% server, 38.5% mobile, 5.4% graphics, and 8.2% others. There are concerns about sales volume declines compared to initial expectations, with PC, including laptops, down more than 10%, and mobile down 4% on a set basis." He added, "The only reliable segment is servers, but even Intel's new server CPU launch has been delayed, reducing visibility for a semiconductor market recovery."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)