[Asia Economy Sejong=Reporter Son Seon-hee] There has been a call to ease the current four-tier progressive corporate tax structure based on the size of corporate income. It is pointed out that the system is excessively complex and does not align with international standards, as most major advanced countries adopt a single corporate tax rate or a two-tier system.

The Korea Institute of Public Finance (KIPF), a government-funded research institute, held a "Public Hearing on the Direction of Corporate Tax System Reform" on the 22nd at the Bankers Hall in Jung-gu, Seoul. Kim Bitmaro, head of the Tax and Fiscal Outlook Center at KIPF, reviewed the necessity of reforming Korea's corporate tax rate system, focusing on policy trends in major overseas countries during the "Adjustment of Corporate Tax Rates and Tax Base Brackets" session.

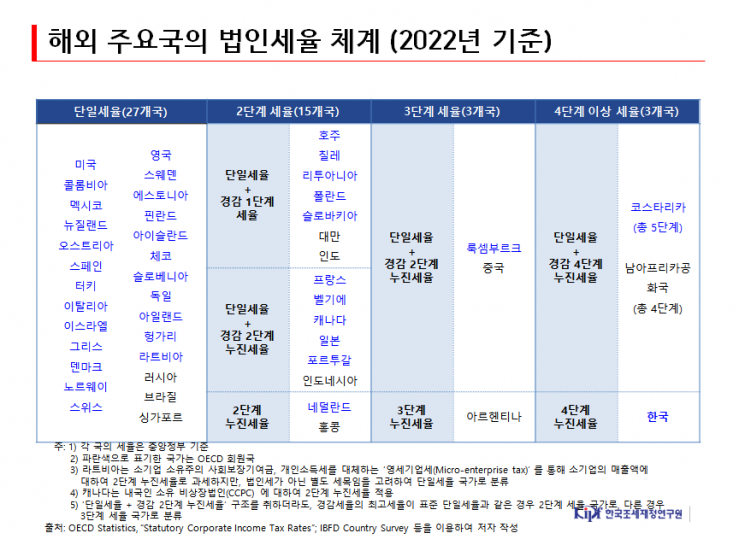

Center Director Kim pointed out, "The current four-tier progressive tax rate structure hinders corporate growth incentives and may induce abnormal behaviors such as corporate splitting for tax avoidance purposes. Most OECD countries have a single or two-tier tax rate structure, so our tax rate structure does not align with international standards."

The corporate tax applied to domestic profit-making corporations is currently divided into four tiers based on the tax base: ▲10% for up to 2 billion KRW ▲20% for 2 billion to 20 billion KRW ▲22% for 20 billion to 300 billion KRW ▲25% for over 300 billion KRW. The tax rate increases progressively as the tax base rises.

Previously, the Ministry of Economy and Finance, the tax authority, announced a plan to lower the highest corporate tax rate from 25% to 22%. However, while there is a need to simplify the four-tier tax base system as well as reduce the top rate, no specific measures have been disclosed.

According to KIPF, among OECD member countries including major advanced nations such as the United States, the United Kingdom, and Germany, 24 countries apply a single corporate tax rate. This means that companies pay taxes at the same rate on profits regardless of their size.

Eleven countries, including Australia and France, apply a two-tier tax rate. Only Luxembourg (three tiers), Costa Rica (five tiers), and Korea (four tiers) apply three or more progressive tax rates.

Center Director Kim noted that regarding tax policies that vary rates by company size, "the majority of past research cases hold a negative view." He cited examples where tax neutrality was undermined and companies artificially distorted growth decisions to benefit from lower tax rates.

Regarding corporate tax rates, Kim said, "Korea's highest corporate tax rate exceeds the OECD average and runs counter to major countries' policy trends, so it is necessary to consider lowering the rate. Korea's corporate tax burden is relatively high, partly due to institutional factors such as the tax rate system, and major countries like the United States, Japan, the United Kingdom, and France have recently reduced their corporate tax rates." However, he added, "Sufficient consideration is needed for the short-term revenue decline resulting from the rate reduction."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)