Government Implements 'Tax Cuts' to Combat High Inflation

Fuel Tax Relief and More... Limited Impact on Price Decline and Perception

Political Circles Push for Additional Tax Cuts... Some Conflict with Sound Fiscal Policy

[Asia Economy Sejong=Reporter Kwon Haeyoung] As the government has pulled out the 'tax cut' card as a livelihood stabilization measure to cope with high inflation, it is estimated that the scale of tax revenue reduction due to this year's fuel tax and comprehensive real estate tax (종부세, Jongbu-se) relief will reach 9 trillion won. With inflation predicted to rise by over 6%, the ruling party and government, feeling the urgency, are highly likely to implement additional tax cuts in the future, making a clash with the previously emphasized 'sound fiscal policy' stance inevitable for the time being.

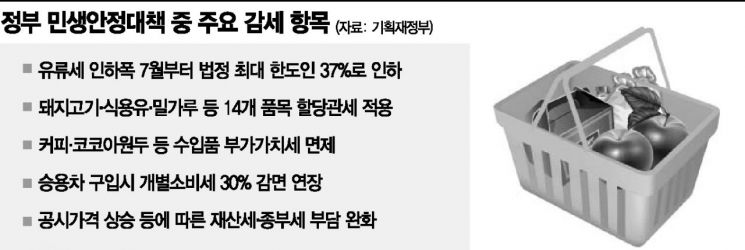

According to the Ministry of Economy and Finance on the 22nd, the recent expansion of the fuel tax reduction measure as part of the livelihood stabilization plan is expected to reduce tax revenue by about 5 trillion won in the second half of the year compared to before the fuel tax cut. On the 19th, the government decided to expand the fuel tax reduction rate from the current 30% to the legal maximum limit of 37% starting in July.

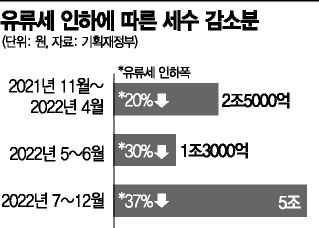

The fuel tax has been cut three times since November last year. The resulting tax revenue reduction is estimated as follows: 2.5 trillion won for the 20% reduction from November last year to April this year; 1.3 trillion won for the 30% reduction in May and June; and 5 trillion won for the 37% reduction from July to December. This amounts to roughly an 8 trillion won decrease in tax revenue this year alone.

Tax revenue related to property tax and Jongbu-se relief measures included in last month's government livelihood stabilization plan is also expected to decrease. The Ministry of Economy and Finance estimates that Jongbu-se revenue will decrease by about 1 trillion won this year compared to last year. Among this, Jongbu-se revenue from single-homeowners is estimated to decrease by about 200 billion won.

Tax revenue is also expected to decrease by about 8 billion won due to the government's additional domestic aviation fuel tariff reduction measure announced on the 19th.

Inside and outside the government, there is a strong voice that all means, including tax reductions, must be mobilized to stabilize livelihoods suffering from rapid inflation. However, this somewhat conflicts with the government's emphasized stance on sound fiscal policy. The government is also internally concerned that the price reduction and consumer perception effects from tax cuts are not very significant. In particular, regarding the fuel tax, the 20% reduction card was already used in November last year before the Ukraine war broke out in February this year, limiting policy room, and there are considerable concerns that the rapid rise in oil prices will make the additional reduction's perceptible effect minimal.

In this situation, legislative moves to enact additional tax cuts are active in the political arena. The People Power Party's Special Committee on Price and Livelihood Stabilization announced plans to push for a legal amendment to expand the fuel tax reduction rate to 50%. The Democratic Party of Korea is also advocating for lower fuel prices, so additional fuel tax cuts are expected. If prices rise further, cash support measures for livelihood stabilization may follow.

There are also concerns that this year's excess tax revenue may be lower than the government's initial expectations. Earlier, the government announced that it would utilize excess tax revenue expected to reach 53 trillion won when it formulated the largest supplementary budget of 62 trillion won in May, shortly after its inauguration. Although a 'tax revenue boom' is expected, with corporate tax revenue performing well and national tax revenue from January to April this year increasing by 34.5 trillion won compared to last year, the possibility of a rapid economic downturn in the second half cannot be completely ruled out. Tax cut measures, including the fuel tax reduction, are negative from the tax revenue perspective.

Regarding this, a Ministry of Economy and Finance official said, "The largest tax revenue reduction from the livelihood stabilization measures is from the fuel tax, and some of it has already been reflected in the tax revenue calculations from January to April this year," adding, "Overall tax revenue will not decrease due to tax cut measures for livelihood stabilization, including the fuel tax reduction."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)