[Asia Economy Reporter Park Byung-hee] Bloomberg reported on the 21st (local time) that the recent sharp decline in the dollar bond prices of China’s large private enterprise Fusheng Group has raised concerns that the liquidity crisis in China’s financial market, which began in the real estate sector, may be spreading to other industrial sectors.

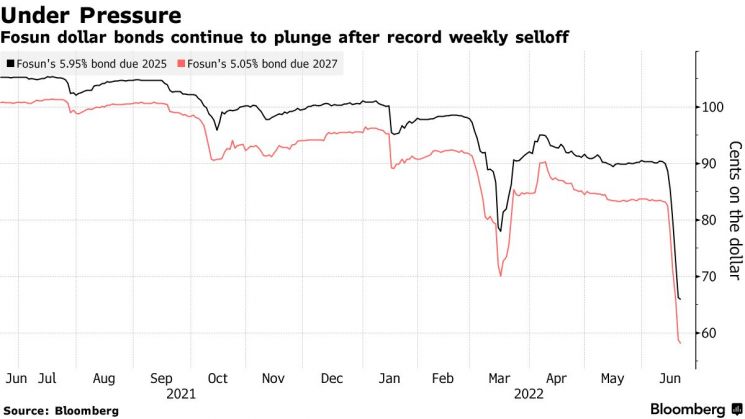

The dollar bond prices of Fusheng Group fell sharply by 21% last week. Among Chinese bonds included in the Bloomberg China High-Yield dollar bond index, it experienced the largest price drop. Fusheng Group has continued to decline further this week without any rebound.

Accordingly, the price of Fusheng Group’s dollar bonds maturing in 2025 has fallen below 70 cents per dollar, and the price of the 2027 maturity dollar bonds has dropped below 60 cents.

The announcement by credit rating agency Moody’s that it is considering downgrading Fusheng Group’s dollar bond credit rating became a negative factor.

Moody’s pointed out that Fusheng Group’s cash flow is not smooth. Moody’s analyzed, “Fusheng Group’s cash liquidity is very vulnerable as a holding company,” and “it is insufficient to cover short-term debt burdens within the next 12 months.”

Moody’s also noted that the downturn in China’s real estate market is a negative factor for Fusheng Group. Investors are reluctant to invest in companies exposed to the real estate sector, and since Fusheng Group is also related to the real estate sector, it is difficult to raise funds through bond issuance.

Fusheng Group, established in 1992, is a large private enterprise in China operating in various sectors such as pharmaceuticals, leisure, and insurance. It has also acquired famous overseas companies such as Club Med, a global resort operator from France, and Lanvin, a French luxury brand.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)