Meritz Asset Management Sets Up Fund in P2P Company Invested by CEO John Lee's Spouse

Capital Markets Act Article 84 Includes Spouses in Stakeholder Scope

Fund Falls Under Exception Clause but May Violate Financial Company Conflict of Interest Management

"Potential Conflicts of Interest Must Be Disclosed to Investors"

Financial Supervisory Service Focuses on Conflict of Interest Management to Protect Meritz Investors

[Asia Economy Reporter Ji Yeon-jin] John Lee, CEO of Meritz Asset Management and a pioneer of the Donghak Ant Movement, was investigated by the Financial Supervisory Service (FSS) over allegations of illegal investment, with the core issue being a ‘conflict of interest.’ Whether Meritz Asset Management’s investment through its fund in a company operated by an acquaintance of CEO Lee and in which his spouse is a shareholder constitutes a conflict of interest will determine the legality of the case.

According to the financial investment industry on the 20th, CEO Lee’s spouse invested 200 million KRW (6.57% stake) in P Company, an online real estate peer-to-peer (P2P) lending firm established in 2016. In 2018, Meritz Asset Management set up the ‘Meritz Marketplace Landing Specialized Private Investment Trust’ fund and invested the entire 6 billion KRW fund amount into P Company’s real estate P2P products.

Article 44 of the Financial Investment Services and Capital Markets Act (Capital Markets Act) requires financial investment businesses to identify and assess potential conflicts of interest between specific investors and other investors, and to manage them according to internal control standards and procedures.

Furthermore, if it is recognized that a conflict of interest is likely to occur after identification and assessment, the fact must be disclosed to the relevant investor in advance, and the potential conflict must be reduced to a level that does not harm investor protection according to the internal control standards before conducting trades or other transactions.

The regulation also states that if a financial investment business deems it difficult to reduce the likelihood of a conflict of interest, it must not engage in trades or other transactions.

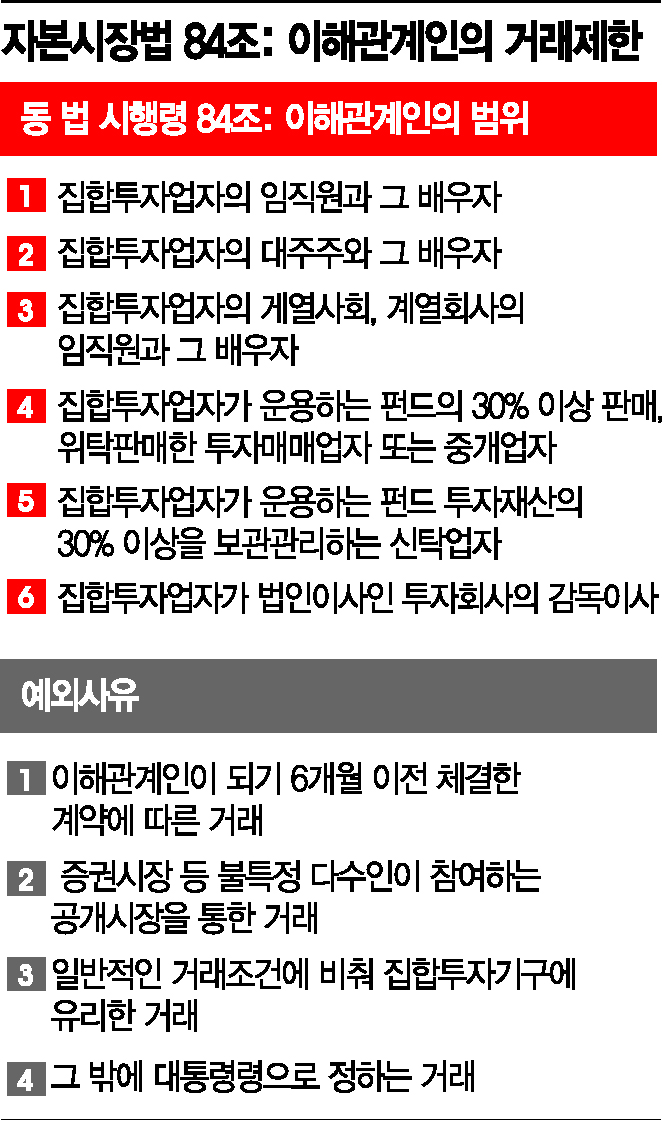

Article 84 of the same law stipulates that collective investment managers (such as asset management companies) operating fund products must not engage in transactions with interested parties when managing funds. Interested parties defined in the enforcement decree of this law include employees and spouses of the fund management company, major shareholders of the fund management company and their spouses, affiliates of the fund company and their employees, and their spouses.

According to this provision, since CEO Lee’s spouse qualifies as an interested party, it constitutes a violation of the Capital Markets Act. However, the law includes exceptions (legal exemption reasons) allowing transactions with interested parties, such as △transactions based on contracts concluded more than six months before becoming an interested party △transactions through public markets like securities markets where unspecified many participate △transactions favorable to the collective investment scheme compared to general transaction conditions.

Since CEO Lee’s spouse invested in P Company more than six months (two years) before Meritz Asset Management’s investment, and the fund managed by Meritz Asset Management yielded an annual return of about 12%, which is favorable to the company, there is a possibility that the legal exemption applies. Industry insiders believe that the focus will be less on the ‘conflict of interest between the P2P company and CEO Lee’ and more on whether ‘CEO Lee invested in a company owned by an acquaintance through his spouse’s name and then injected fund money to gain profits.’ If, as CEO Lee explained, the amount was about 10 million KRW over five years, or about 2 million KRW annually, the exemption is likely to be recognized.

However, under Article 44 of the Capital Markets Act concerning conflict of interest management, the asset management industry has established internal control regulations to prevent conflicts of interest, including requiring employees to report all stock trading transactions in advance and restricting private investments. Therefore, the FSS is expected to focus on whether Meritz Asset Management has managed conflict of interest prevention through internal control standards.

A conflict of interest refers to a situation where an ‘individual’s personal interest’ conflicts with the ‘organization’s interest’ through fair work, meaning that when performing duties, private interests related to the job may hinder fair execution. An asset management industry official said, "Employees investing can cause misunderstandings, and compliance is complicated, so there is a tendency not to do it."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)